BDSwiss App

Download & start trading

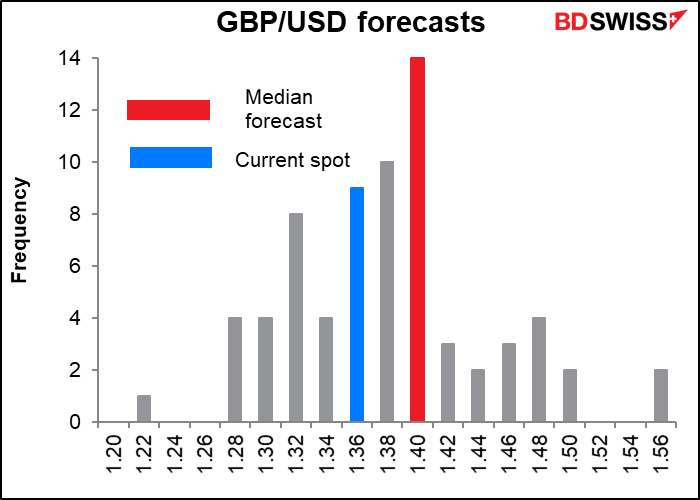

The point of this article isn’t to discuss the “why” of these forecasts. I can only speak for myself, not the market in general, so I cannot claim to be able to explain “why” the market thinks something (although I do know why I expect the dollar to decline: 1) Fed policy to remain on hold while other central banks start tapering; 2) declining real yields; 3) increasing use of the dollar as a funding currency; and 4) a widening deficit on the “basic balance” as the US economy recovers and imports surge, as usual. Plus the disastrous response to the pandemic, although I do hope President Biden can make some headway in dealing with the problem.

Instead of discussing “why” in this article, I’d like to discuss the “how.” How are consensus forecasts made and, most importantly,how realistic are they?

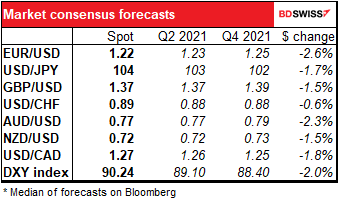

The forecasts that I use come from the Bloomberg news service. Bloomberg polls a large number of forecasters (mostly bank economists), assembles their forecasts, and calculates a “consensus” forecast by taking the median of the forecasts.

They use the median instead of the average because analysts sometimes publish an extreme forecast simply to get attention. The consensus helps to reduce the impact of such extreme forecasts as much as possible.

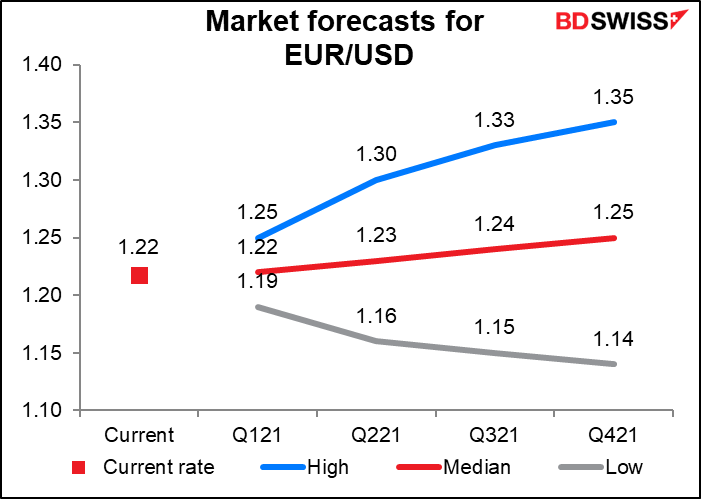

For example, let’s look at the data for EUR/USD.

Bloomberg has 79 valid forecasts for EUR/USD. Of these, in 27 forecasts the pair is moving lower, while in 52 forecasts it’s moving higher. Five are at the current spot rate (effectively 1.22 at the time of writing). The median, which is also the figure that got the most “votes,” is 1.25, while the average is 1.24.

The point of this article isn’t to discuss the “why” of these forecasts. I can only speak for myself, not the market in general, so I cannot claim to be able to explain “why” the market thinks something (although I do know why I expect the dollar to decline: 1) Fed policy to remain on hold while other central banks start tapering; 2) declining real yields; 3) increasing use of the dollar as a funding currency; and 4) a widening deficit on the “basic balance” as the US economy recovers and imports surge, as usual. Plus the disastrous response to the pandemic, although I do hope President Biden can make some headway in dealing with the problem.

Instead of discussing “why” in this article, I’d like to discuss the “how.” How are consensus forecasts made and, most importantly,how realistic are they?

The forecasts that I use come from the Bloomberg news service. Bloomberg polls a large number of forecasters (mostly bank economists), assembles their forecasts, and calculates a “consensus” forecast by taking the median of the forecasts.

They use the median instead of the average because analysts sometimes publish an extreme forecast simply to get attention. The consensus helps to reduce the impact of such extreme forecasts as much as possible.

For example, let’s look at the data for EUR/USD.

Bloomberg has 79 valid forecasts for EUR/USD. Of these, in 27 forecasts the pair is moving lower, while in 52 forecasts it’s moving higher. Five are at the current spot rate (effectively 1.22 at the time of writing). The median, which is also the figure that got the most “votes,” is 1.25, while the average is 1.24.

The question is, how much of a “consensus” is this when one-third of the forecasters disagree with the direction, much less the rate?

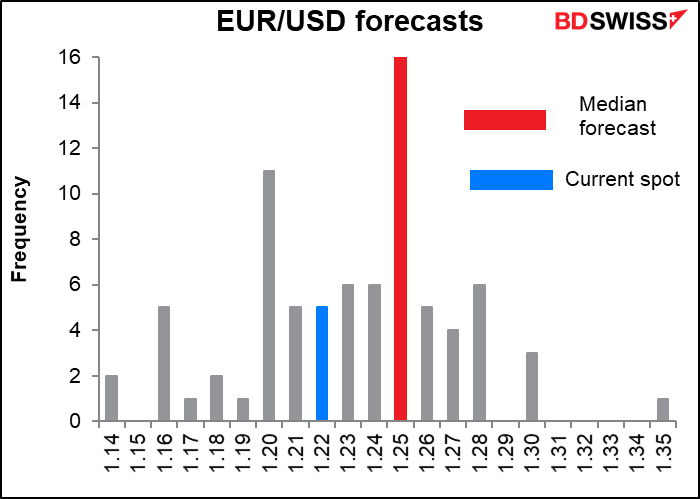

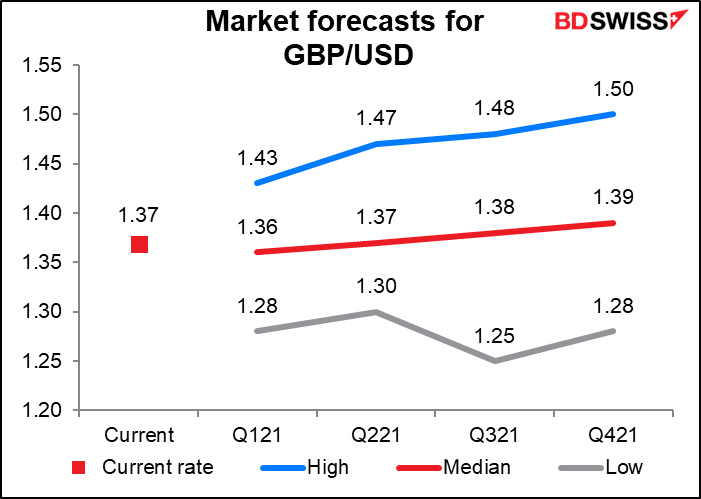

The situation is even worse for GBP/USD: it’s almost evenly split. Thirty forecasts are lower, 36 are higher, and four are at the current spot. So almost exactly as many firms think it will be unchanged or lower as think it will be higher. Although in both this case and in the EUR/USD, the “consensus” has the benefit of not only being the median but also being the level that got the most votes.

The question is, how much of a “consensus” is this when one-third of the forecasters disagree with the direction, much less the rate?

The situation is even worse for GBP/USD: it’s almost evenly split. Thirty forecasts are lower, 36 are higher, and four are at the current spot. So almost exactly as many firms think it will be unchanged or lower as think it will be higher. Although in both this case and in the EUR/USD, the “consensus” has the benefit of not only being the median but also being the level that got the most votes.

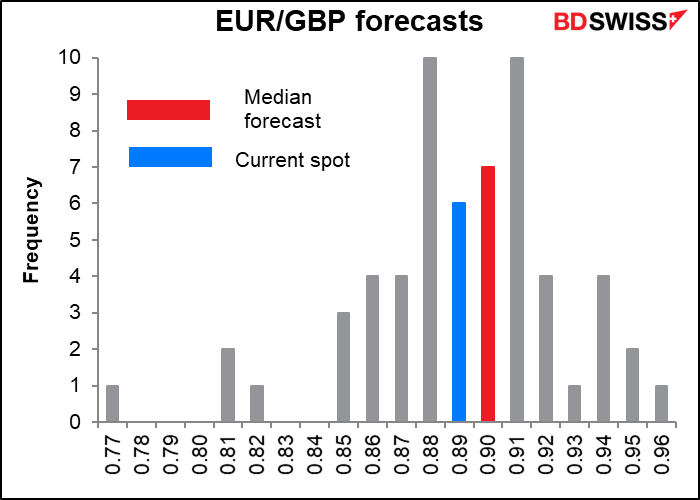

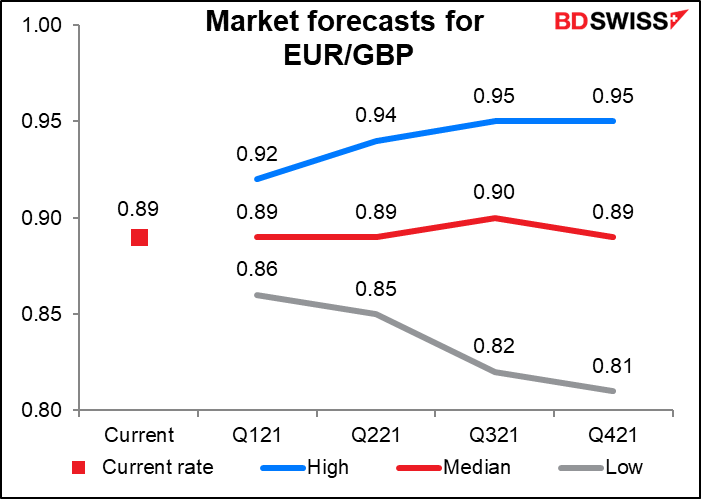

Not so for EUR/GBP: it was split similarly to GBP/USD, with 25 forecasts lower, six at the current spot rate, and 29 higher. To make matters worse, in this case, the median was not the forecast with the most “votes.” 0.88 and 0.90 both got more – and one is lower than today’s rate while the other is higher.

Not so for EUR/GBP: it was split similarly to GBP/USD, with 25 forecasts lower, six at the current spot rate, and 29 higher. To make matters worse, in this case, the median was not the forecast with the most “votes.” 0.88 and 0.90 both got more – and one is lower than today’s rate while the other is higher.

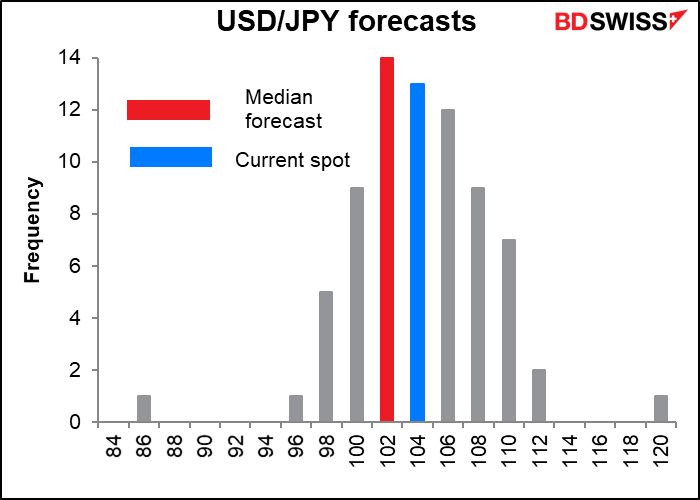

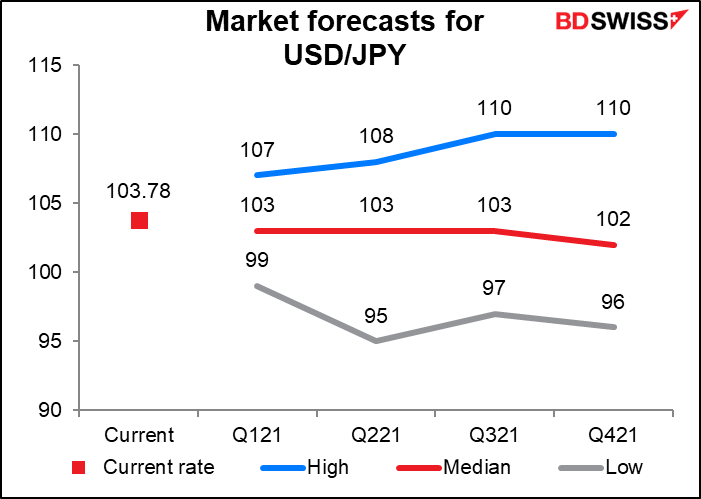

Views on USD/JPY are similarly evenly split: 35 forecasters see the pair declining, eight see it unchanged, and 31 see it moving higher.

Views on USD/JPY are similarly evenly split: 35 forecasters see the pair declining, eight see it unchanged, and 31 see it moving higher.

Looking at these forecasts, I’m loath to talk of a “consensus” forecast, because there is no actual consensus -- there is only a “median” of the forecasts. Unfortunately, I can’t think of a better explanation that also satisfies the need to have a single number. I agree with Bloomberg that, that’s the best guess we have – the forecast that the most number of people agree with. Or at least a forecast that has roughly an equal number of people who think it’s too low as those who think it’s too high.

Perhaps we could indicate a “confidence interval” around the consensus – for example expressing it in terms of the standard deviation of the forecasts. (Standard deviation being a measure of the dispersion of the forecasts – the range that most of the forecasts fall into.) So for the USD/JPY forecast above, we could express it as ¥102 ±¥5. But people want certainty, and saying that it will be anywhere from ¥97 to ¥107 doesn’t give us a whole lot more assurance than we could guess ourselves.

Another problem becomes evident when you compare these “consensus” forecasts to the average movement that we see in currencies during a year. The “consensus” usually predicts much less movement than we see during the average year.

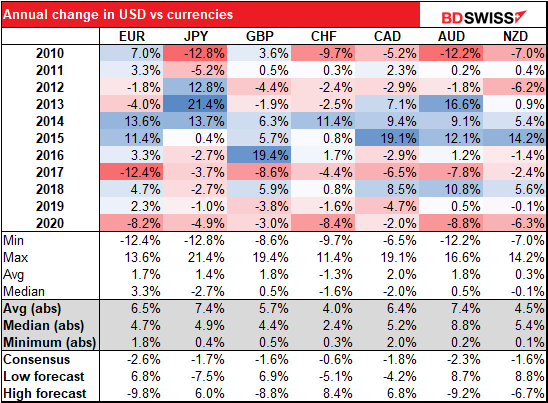

This table shows the change in the dollar vs each currency since the Global Financial Crisis. At the bottom, there’s the minimum, maximum, average, and median. However, the dollar went up, and sometimes it went down, so the average and median are going to be relatively small – the negative numbers cancelling out the positive numbers.

That’s why I re-ran those numbers using the absolute value of the change. If we take EUR/USD as an example, the average of the annual changes is 1.7%, but that’s an absurd number – there wasn’t one year with that little of an increase. The average of the absolute changes however gives us ±6.5% from one year to another, which is more reasonable. The median change would be ±4.7%, while the smallest change during a year was ±1.8%. In that respect,the market forecast for a decline in the dollar of 2.6% is not impossible, but not likely either. In actuality, 2.6% would be the third-smallest yearly change (after 1.8% in 2021 and 2.3% in 2019).

That’s a common problem. The “consensus” forecast for all the currencies is for a much smaller change in the dollar than we generally see(as expressed by the median of the absolute value of the changes). They aren’t possible, but they don’t seem so likely, either.

By comparison, the extreme forecasts – the “low” and the “high” forecasts – seem more in line with the historical experience. Although in many cases these extreme forecasts assume more volatility than is normal, in no case do they assume a bigger move than has happened during the past 11 years. In other words, they are well within the bounds of the possible

Looking at these forecasts, I’m loath to talk of a “consensus” forecast, because there is no actual consensus -- there is only a “median” of the forecasts. Unfortunately, I can’t think of a better explanation that also satisfies the need to have a single number. I agree with Bloomberg that, that’s the best guess we have – the forecast that the most number of people agree with. Or at least a forecast that has roughly an equal number of people who think it’s too low as those who think it’s too high.

Perhaps we could indicate a “confidence interval” around the consensus – for example expressing it in terms of the standard deviation of the forecasts. (Standard deviation being a measure of the dispersion of the forecasts – the range that most of the forecasts fall into.) So for the USD/JPY forecast above, we could express it as ¥102 ±¥5. But people want certainty, and saying that it will be anywhere from ¥97 to ¥107 doesn’t give us a whole lot more assurance than we could guess ourselves.

Another problem becomes evident when you compare these “consensus” forecasts to the average movement that we see in currencies during a year. The “consensus” usually predicts much less movement than we see during the average year.

This table shows the change in the dollar vs each currency since the Global Financial Crisis. At the bottom, there’s the minimum, maximum, average, and median. However, the dollar went up, and sometimes it went down, so the average and median are going to be relatively small – the negative numbers cancelling out the positive numbers.

That’s why I re-ran those numbers using the absolute value of the change. If we take EUR/USD as an example, the average of the annual changes is 1.7%, but that’s an absurd number – there wasn’t one year with that little of an increase. The average of the absolute changes however gives us ±6.5% from one year to another, which is more reasonable. The median change would be ±4.7%, while the smallest change during a year was ±1.8%. In that respect,the market forecast for a decline in the dollar of 2.6% is not impossible, but not likely either. In actuality, 2.6% would be the third-smallest yearly change (after 1.8% in 2021 and 2.3% in 2019).

That’s a common problem. The “consensus” forecast for all the currencies is for a much smaller change in the dollar than we generally see(as expressed by the median of the absolute value of the changes). They aren’t possible, but they don’t seem so likely, either.

By comparison, the extreme forecasts – the “low” and the “high” forecasts – seem more in line with the historical experience. Although in many cases these extreme forecasts assume more volatility than is normal, in no case do they assume a bigger move than has happened during the past 11 years. In other words, they are well within the bounds of the possible

Looking at the past volatility of the market,I think we are more likely to see the extreme currency forecasts come true than the consensus. Unfortunately, there’s no way to determine with 100% certainty ahead of time which of the extremes it’s going to be – the low or the high. So for better or worse, the median is probably the best we can do.

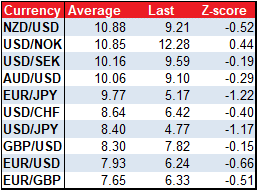

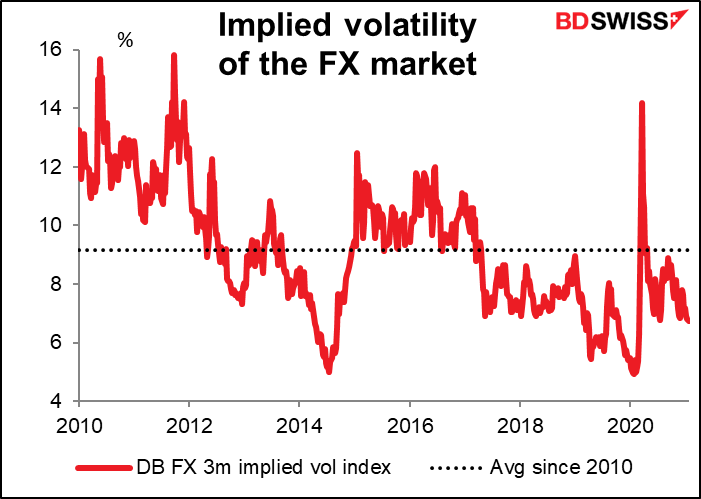

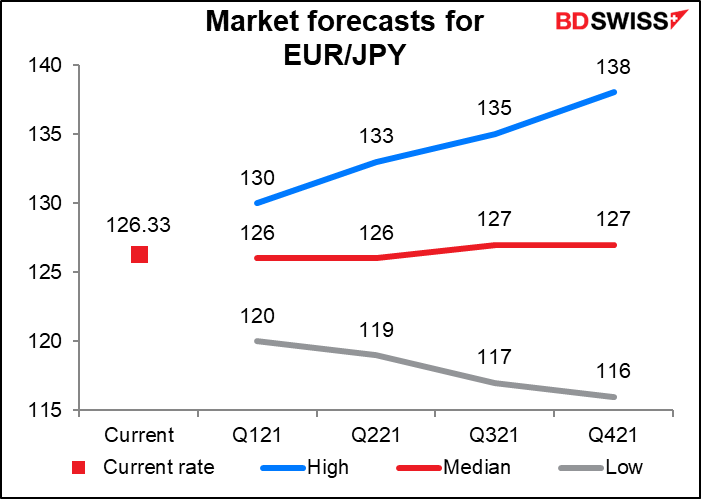

The market has recently been a little less volatile than normal, but not unusually so. Looking at the historical volatility for the last month, all the major currency pairs are well within their normal range, except USD/JPY and EUR/JPY. If the major central banks all keep their policies unchanged for the entire year then we may well see a volatility drought, but as we saw with CAD last week, there’s plenty of room for currencies to move simply on a hint of a shift of policy.

Looking at the past volatility of the market,I think we are more likely to see the extreme currency forecasts come true than the consensus. Unfortunately, there’s no way to determine with 100% certainty ahead of time which of the extremes it’s going to be – the low or the high. So for better or worse, the median is probably the best we can do.

The market has recently been a little less volatile than normal, but not unusually so. Looking at the historical volatility for the last month, all the major currency pairs are well within their normal range, except USD/JPY and EUR/JPY. If the major central banks all keep their policies unchanged for the entire year then we may well see a volatility drought, but as we saw with CAD last week, there’s plenty of room for currencies to move simply on a hint of a shift of policy.

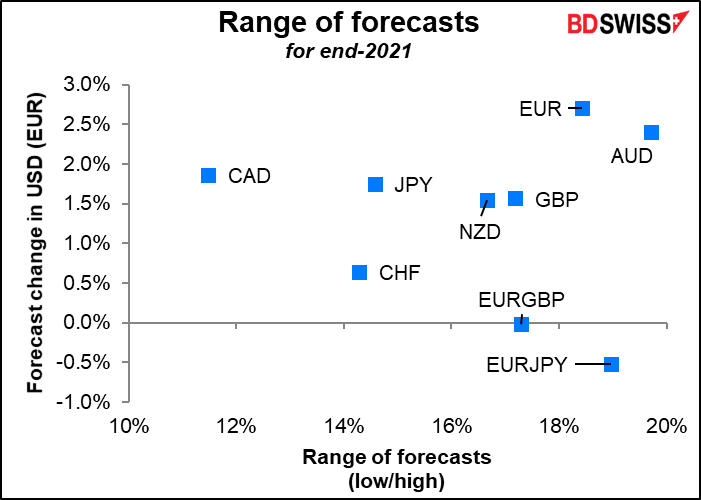

The change implied by the consensus forecast has no relation to the uncertainty surrounding that forecast< (as measured by the range of forecasts, i.e., the low forecast divided by the high). The median forecast for EUR/GBP, for example, is for it to end the year right where it is now, but that masks a wide range of forecasts – from 0.81 to 0.95.

The change implied by the consensus forecast has no relation to the uncertainty surrounding that forecast< (as measured by the range of forecasts, i.e., the low forecast divided by the high). The median forecast for EUR/GBP, for example, is for it to end the year right where it is now, but that masks a wide range of forecasts – from 0.81 to 0.95.

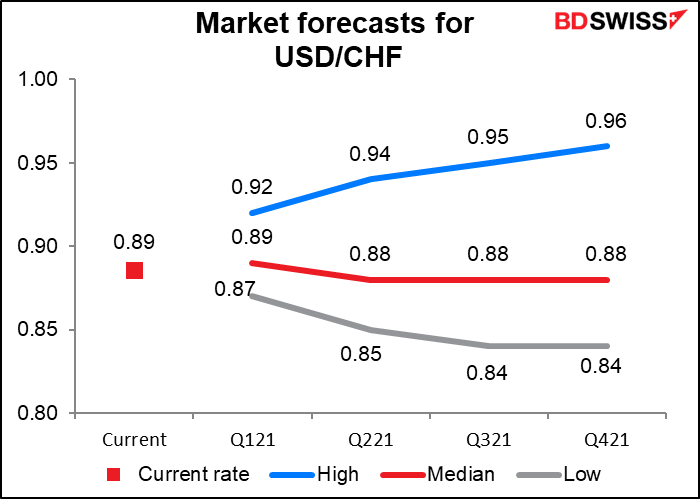

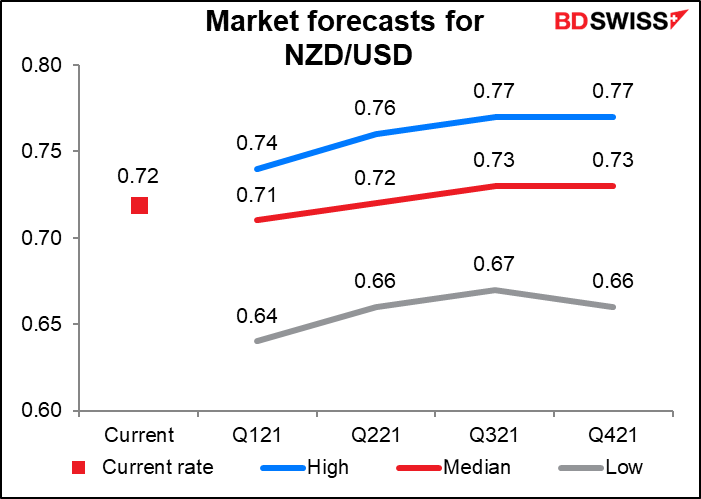

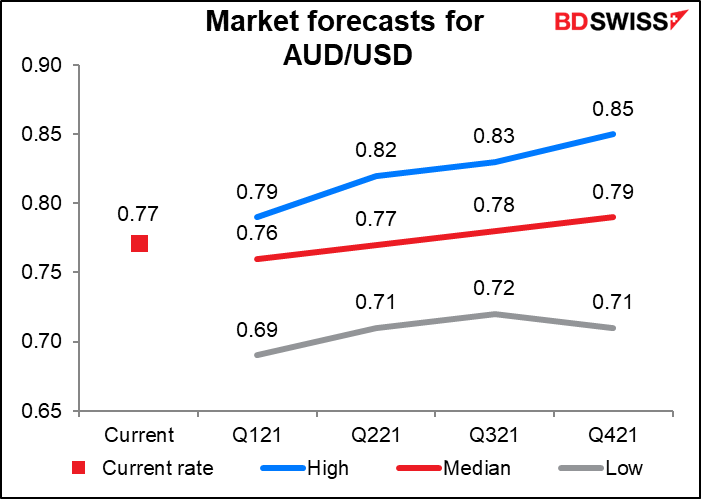

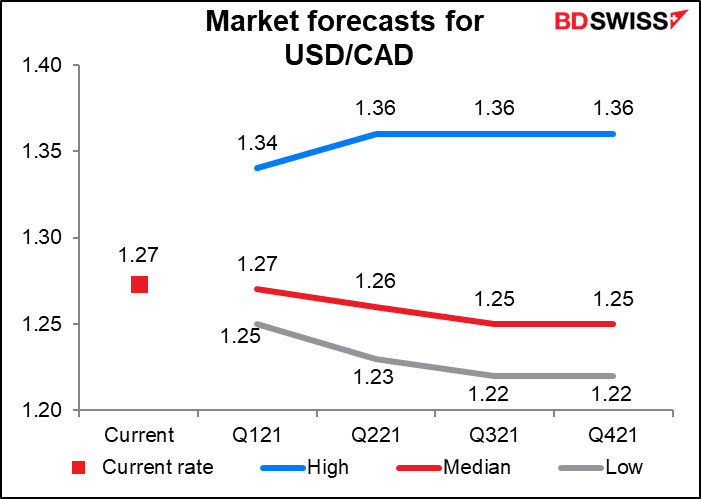

Here are the forecasts for the major currency pairs:

Here are the forecasts for the major currency pairs:

Not an existing member? Register an account in a few seconds, and gain unlimited access to exclusive research resources.

Access Leading Analysis, Market Briefs & Reports, Daily Live Webinars and much more!