Technical Analysis Post

Alibaba Group Holdings Ltd (NYSE: BABA) 2024 Q4 and Full Fiscal Year 2024 Results Release : Market Insights, Analyst Forecasts, and Technical Analysis

Today, May 14, 2024, from 11:30 AM to 1:00 PM, Alibaba Group Holdings Ltd. ( NYSE : BABA ) is scheduled to announce its 2024 Q4 and Full Fiscal Year 2024 results. Following this announcement, a conference call will take place on the same day at 7:30 a.m. U.S. Eastern Time (7:30 p.m. Hong Kong Time).

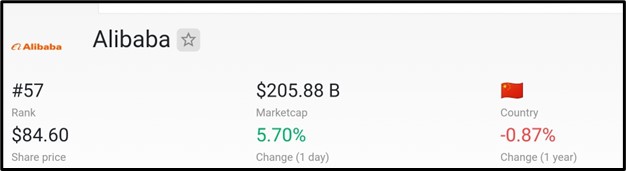

According to data from www.companiesmarketcap.com, as of May 2024, Alibaba’s market capitalization stands at $205.88 billion, making it the 57th most valuable company worldwide by market capitalization.

According to data from www.companiesmarketcap.com, as of May 2024, Alibaba’s market capitalization stands at $205.88 billion, making it the 57th most valuable company worldwide by market capitalization.

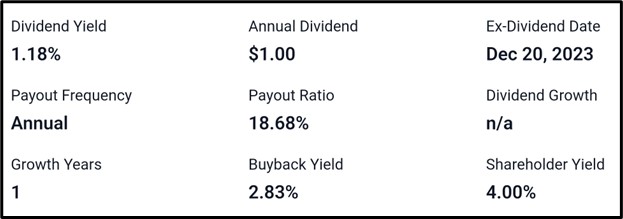

Alibaba Dividend Information

Alibaba’s dividend yield currently stands at 1.18%, with a payout of $1.00 per share in the previous year, paid out once annually, with the last ex-dividend date noted as December 20, 2023. The payout ratio is calculated at 18.68%, and the company has experienced one year of growth. Additionally, the buyback yield is reported at 2.83%, resulting in a shareholder yield of 4.00%. However, there is no available data regarding dividend growth.

Recent Development At Alibaba

Alibaba, the Chinese e-commerce and entertainment powerhouse, announced several significant developments:

- Alibaba commits HK$5 billion ($640 million) over five years to support the growth of Hong Kong’s film and TV industries.

- Alibaba.com unveils a new AI-powered feature at CES aimed at enhancing efficiency and fostering growth for SMEs and entrepreneurs in 2024.

- Alibaba Cloud introduces a new pricing strategy and expands service availability for its international customers.

- Alibaba invests in a $2.5 billion AI firm, marking its second major deal of 2024.

- Alibaba launches the latest iteration of its large language model to meet the increasing demand for robust AI solutions.

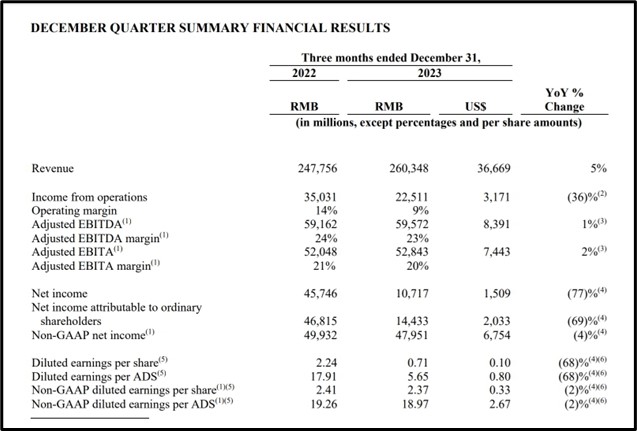

2024 Q3 Recap of Alibaba (NYSE: BABA) earnings release

In the 2024 Q3 financial report, Alibaba’s revenue reached $36,669 million, showing a year-over-year change of 5%. Operating margin stood at $3,171 million, marking a significant increase of 36% compared to the previous year. Net income also experienced substantial growth, reaching $1,509 million, with a remarkable year-over-year change of 77%. Diluted earnings per share reached $0.10, reflecting a notable increase of 68% compared to the previous year. It’s important to note that the company’s non-GAAP financial measures, including the sections on “Non-GAAP Financial Measures” and “Reconciliations of Non-GAAP Measures to the Nearest Comparable U.S. GAAP Measures,” provide further insights into these results. The year-over-year fluctuations mentioned in the report were primarily influenced by various factors, including revenue growth, operating efficiency improvements, impairment of certain assets, and investment increases. Each ADS represents eight ordinary shares, and while the year-over-year percentages are calculated based on the exact amounts, minor differences may occur due to rounding when calculated based on RMB amounts.

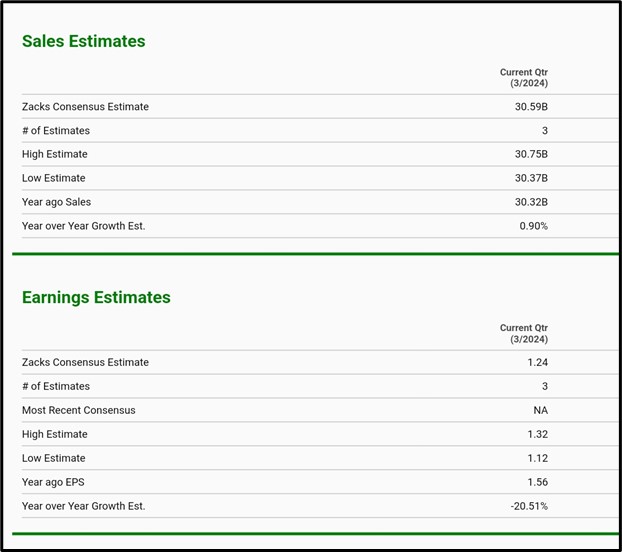

2024 Q4 Earnings Release Analyst Forecast

For the current quarter, Alibaba (NYSE: BABA) is projected to achieve sales estimates according to the Zacks Consensus Estimate, with a forecast of $30.59 billion derived from three estimates, ranging from a high estimate of $30.75 billion to a low estimate of $30.37 billion, compared to sales of $30.32 billion in the same period last year, reflecting a year-over-year growth estimate of 0.90%. Similarly, earnings estimates for the current quarter indicate a Zacks Consensus Estimate of $1.24, based on three estimates, with a high estimate of $1.32 and a low estimate of $1.12. This contrasts with earnings per share of $1.56 in the previous year’s corresponding quarter, representing a year-over-year growth estimate of -20.51%.

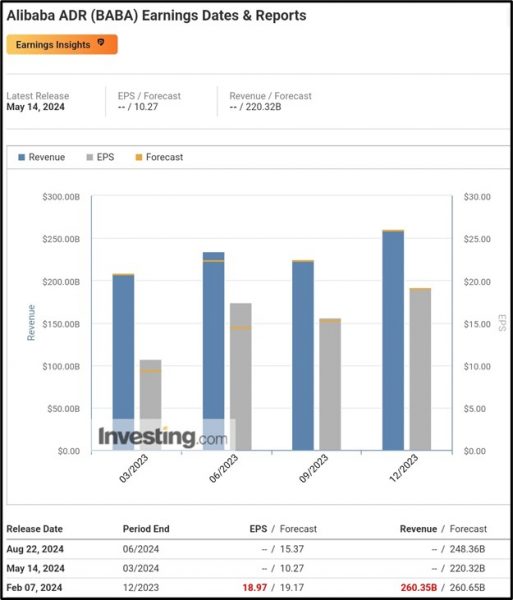

As per Investing.com’s prediction, Alibaba Group Holdings Ltd (NYSE: BABA) is projected to attain an earnings per share (EPS) of 10.27 RMB, equivalent to $1.42, along with an estimated revenue of 220.32 RMB, translating to $30.46 billion.

As per TradingView.com’s analysis, Alibaba Group Holdings Ltd (NYSE: BABA) is anticipated to attain an earnings per share (EPS) of $1.42, alongside an estimated revenue of $30.50 billion.

Technical Analysis

Based on technical analysis using the 4-hour chart of NYSE: BABA, it’s observed that the price has been in an uptrend since April 19, 2024, forming an ascending triangle pattern. An uptrendline originating from $68.17 resisted the price at $77.69 after it retraced from $82.39, which previously acted as resistance until it was breached to the upside, now serving as support with the current price at approximately $84.57.

If the upward breakout maintains its momentum, there’s a likelihood of further price appreciation. However, failure to sustain the upward breakout and a drop below the current support could indicate a potential downturn in price.

Conclusion

In conclusion, Alibaba Group is set to unveil its March Quarter 2024 and Full Fiscal Year 2024 results, with an anticipated conference call following shortly after. With a market capitalization of $205.88 billion as of May 2024, Alibaba continues to position itself as a significant player in the global market. Recent developments, including substantial investments in various sectors, showcase Alibaba’s commitment to growth and innovation. Additionally, the technical analysis suggests a potential uptrend continuation, contingent upon maintaining support levels. This comprehensive outlook underscores Alibaba’s resilience and strategic positioning in the market.

Sources:

https://www.alibabagroup.com/en-US/ir-events

https://companiesmarketcap.com/alibaba/marketcap/#google_vignette

https://stockanalysis.com/stocks/baba/dividend/

https://variety.com/2024/film/news/alibaba-hong-kong-film-tv-development-1235937900/amp/

https://www.alibabagroup.com/en-US/document-1691884451786653696

https://www.zacks.com/stock/quote/BABA/detailed-earning-estimates

https://www.investing.com/equities/alibaba-earnings