Position Sizing

Appropriate position sizing is closely related to effective Risk Management. To understand whether it is best to trade standard, mini or nano lots, the trader must consider several important factors:

- – Total capital base

- – Trade duration

- – Market dynamics and volatility

- – Risk appetite

Here’ a quick reminder of what different lot sizes mean:

1 Micro lot = 1,000 units of a currency

1 Mini lot = 10,000 units.

1 Standard lot = 100,000 units.

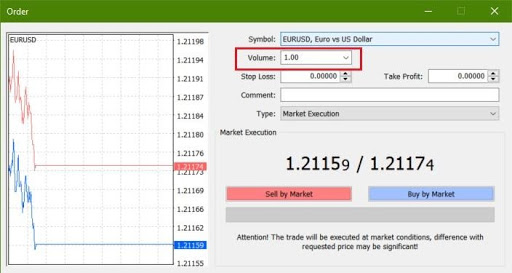

By selecting a different lot size, the trader can determine the amount of nominal currency they want to buy/sell, and thereby, select their desired risk exposure per pip.

A pip, which is short for “percentage in point” or “price interest point”. Effectively, it is the smallest increment by which a currency pair could change at any one time.

For most currency pairs, a pip is 0.0001, or one-hundredth of a percent. For pairs that include the Japanese yen (JPY), a pip is 0.01, or 1 percentage point.