Technical Analysis Post

Nike Inc (NYSE: NKE) FY2024 Q4 Earnings Release: Market Insights, Analyst Forecasts, and Technical Analysis

Today, June 27, 2024, around 1:15 p.m. PT, following the end of regular trading hours, NIKE, Inc. (NYSE: NKE) will release its fourth quarter fiscal 2024 financial results. Shortly after, at 2:00 p.m. PT, NIKE, Inc.’s management will hold a conference call to discuss the results.

Today, June 27, 2024, around 1:15 p.m. PT, following the end of regular trading hours, NIKE, Inc. (NYSE: NKE) will release its fourth quarter fiscal 2024 financial results. Shortly after, at 2:00 p.m. PT, NIKE, Inc.’s management will hold a conference call to discuss the results.

The live broadcast of the conference call will be available on the Internet at https://investors.nike.com/.

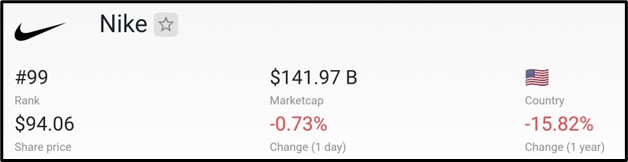

As of June 2024, with a market cap of $141.97 billion, Nike ranks as the world’s 99th most valuable company.

Dividend Information

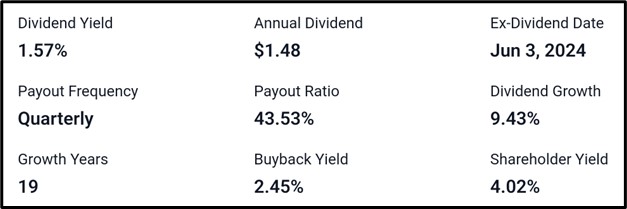

Nike offers a 1.57% dividend yield with an annual dividend of $1.48. With a payout ratio of 43.53% and quarterly payouts, Nike has seen 19 years of dividend growth, currently at 9.43%. The ex-dividend date is June 3, 2024, and it has a buyback yield of 2.45%, leading to a total shareholder yield of 4.02%.

Recent Development At Nike

Recent developments at Nike include:

– Nike and Hyperice launch tech-enabled boots and gilet for athlete warm-up and recovery.

– Nike Athlete Think Tank expands, adding elite coaches with its third cohort.

– Nike signs its first Refugee Olympic Team athlete, extending its work with the Refuge Foundation.

– Kylian Mbappé starts Nike’s Victory Mode tour to inspire youth in sports.

– Nike partners with Nala Track Club to support Kenya’s female runners.

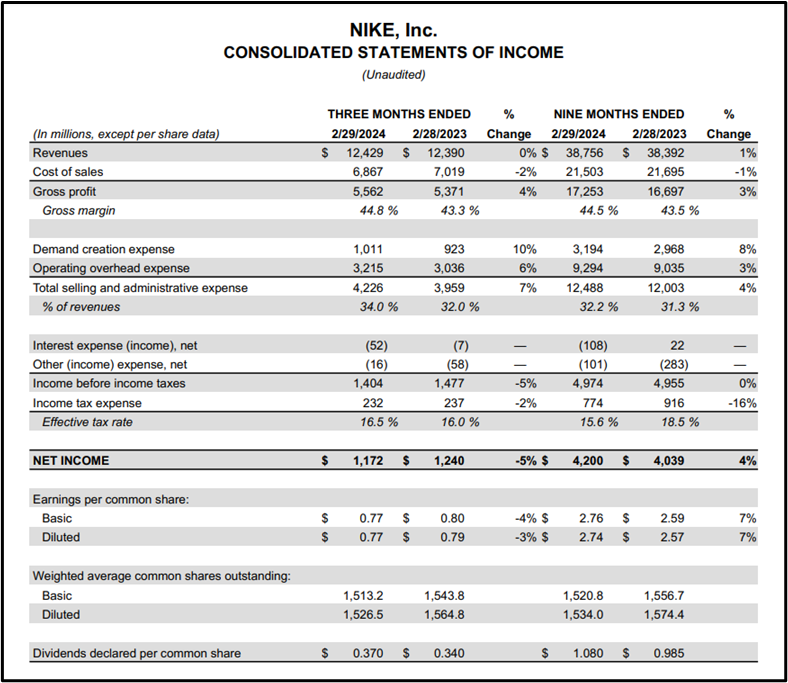

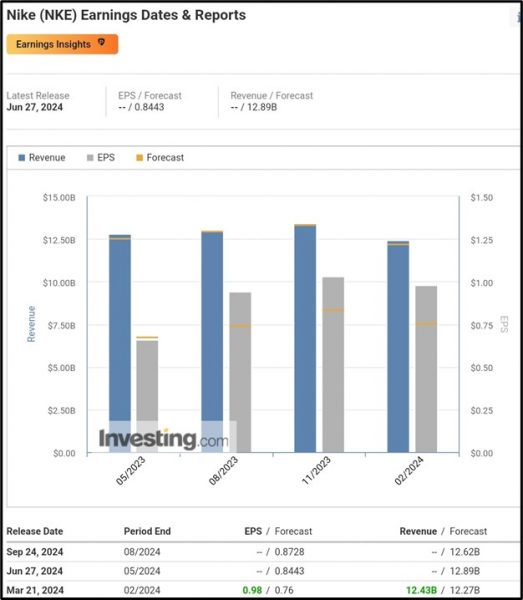

Q3 Recap of Nike Earnings Report  On February 29, 2024, NIKE, Inc. (NYSE: NKE) announced its fiscal 2024 third-quarter results. Revenues were slightly up to $12.4 billion, with NIKE Direct at $5.4 billion. NIKE Brand Digital sales dropped by 3% reported and 4% currency-neutral, while wholesale revenues increased by 3% to $6.6 billion. Gross margin rose to 44.8%, despite a 50-basis-point impact from restructuring charges. Selling and administrative expenses went up by 7% to $4.2 billion. Diluted EPS was $0.77, or $0.98 excluding restructuring charges.

On February 29, 2024, NIKE, Inc. (NYSE: NKE) announced its fiscal 2024 third-quarter results. Revenues were slightly up to $12.4 billion, with NIKE Direct at $5.4 billion. NIKE Brand Digital sales dropped by 3% reported and 4% currency-neutral, while wholesale revenues increased by 3% to $6.6 billion. Gross margin rose to 44.8%, despite a 50-basis-point impact from restructuring charges. Selling and administrative expenses went up by 7% to $4.2 billion. Diluted EPS was $0.77, or $0.98 excluding restructuring charges.

CEO John Donahoe highlighted strategic adjustments for growth, while CFO Matthew Friend focused on efficiency and innovation. The effective tax rate was 16.5%, net income was $1.2 billion, and diluted EPS decreased by 3%. Inventories fell by 13% to $7.7 billion, and cash holdings were $10.6 billion. NIKE returned $1.4 billion to shareholders through $562 million in dividends and $866 million in share repurchases.

Q4 FY2024 Forecast of Nike Earnings Report

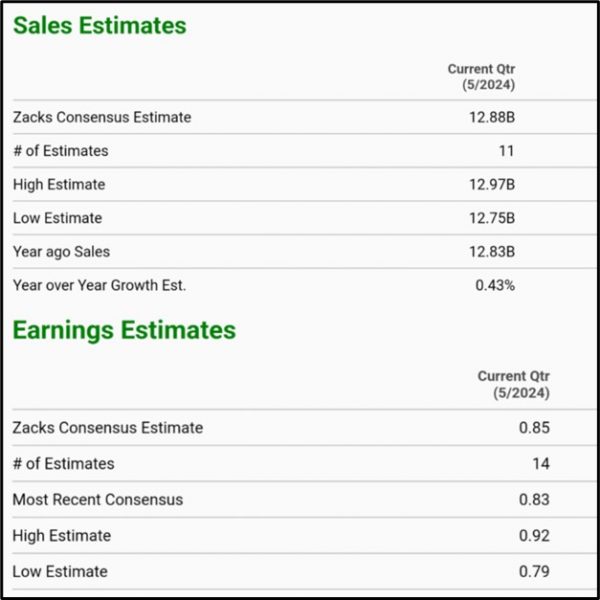

For the current quarter, the Zacks Consensus sales estimate is $12.88B, with 11 estimates ranging from $12.75B to $12.97B, reflecting a 0.43% year-over-year growth from last year’s $12.83B. The earnings estimate is $0.85 with 14 estimates, a recent consensus of $0.83, ranging from $0.79 to $0.92, representing a 28.79% year-over-year increase from last year’s $0.66.

Investing.com projects Nike Inc (NYSE: NKE) to have an EPS of $0.8443 and revenue of $12.89 billion.

Tradingview.com predicts Nike Inc (NYSE: NKE) EPS at $0.84 and revenue at $12.86 billion.

Tradingview.com predicts Nike Inc (NYSE: NKE) EPS at $0.84 and revenue at $12.86 billion.

Technical Analysis

– Identified a downtrend line rejection on the 4-hour chart of NIKE Inc (NYSE: NKE) around $97.76.

– If rejection holds, anticipate a potential decline to $90.91, with further downside potential to $82.19 upon breaking below $90.91.

– Conversely, if rejection fails, expect a possible move upwards to $103.15, with potential continuation to $107.39 upon breaking above $103.15.

Apply Risk Management

Conclusion

Despite challenges, NIKE, Inc. (NYSE: NKE) has demonstrated resilience and strategic agility in its fiscal year 2024. With robust fourth-quarter earnings anticipated, marked by projected revenue growth and improved earnings per share, NIKE continues to innovate and expand its global footprint. The company’s commitment to shareholder value through dividends and buybacks underscores its financial health and long-term vision. Moving forward, NIKE’s focus on efficiency, innovation, and strategic partnerships positions it well for sustained growth in the dynamic sportswear market.

Sources:

https://companiesmarketcap.com/nike/marketcap/

https://stockanalysis.com/stocks/nke/dividend/

https://investors.nike.com/investors/news-events-and-reports/default.aspx

https://www.zacks.com/stock/quote/NKE/detailed-earning-estimates

https://www.investing.com/equities/nike-earnings

https://www.tradingview.com/symbols/NYSE-NKE/forecast/

https://www.tradingview.com/chart/NKE/lDifKiYe-NIKE-Downtrend-Line-Rejection-At-97-76-27-06-2024/