Weekly Outlook

“Least Regrets” approach may lead to weaker USD

We’re seeing much the same approach to monetary policy around the world. The Reserve Bank of New Zealand (RBNZ), which has been threatening to go “full Switzerland” and start intervening in the FX market along with negative rates, briefed reporters on their possible additional policy measures. They made it clear that they’re preparing to do more. “We have a least regrets approach to thinking how much stimulus to deliver,” RBNZ Chief Economist Yuong Ha said. “We’d rather do too much too soon than too little too late.”

We heard the same line Tuesday from Fed Chair Powell. “At this early stage, I would argue that the risks of policy intervention are still asymmetric. Too little support would lead to a weak recovery…By contrast, the risks of overdoing it seem, for now, to be smaller.”

That statement can help us to understand one of the key lines in the minutes from the September meeting of the Federal Open Market Committee (FOMC), the US central bank’s rate-setting policy board. The minutes said, “many participants noted that their economic outlook assumed additional fiscal support and that if future fiscal support was significantly smaller or arrived significantly later than they expected, the pace of the recovery could be slower than anticipated.”

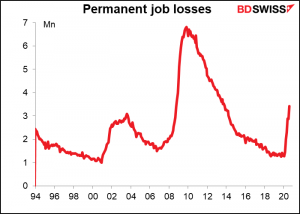

The phrase “significantly later than expected” is important, as it indicates the Fed views stimulus now as qualitatively different than stimulus in three months, when former VP Joe Biden will (we assume) be president. “The pace of economic improvement has moderated since the outsize gains of May and June,” Powell noted. “…a prolonged slowing in the pace of improvement over time could trigger typical recessionary dynamics, as weakness feeds on weakness.” Weak demand triggers bankruptcies and job losses, which causes demand to weaken further in a downward spiral that’s hard to break. It’s much harder to resuscitate someone once they’re dead and it’s much harder to create jobs when companies have gone bust.

The Fed is on hold for now while the indicators continue to improve and it waits to see what (if anything) the government will come up with. But once the data start to show the recovery stalling, it’s likely to move fairly quickly to ease further if they see that the fiscal authorities are incapable of action. That could put further downward pressure on the dollar.

What might the Fed do? It’s pretty much ruled out negative interest rates, which aren’t appropriate for the US — $4.4tn in money market funds makes it impractical to impose negative rates. A more aggressive quantitative easing (QE) might be the first option. “I can imagine wanting to shift to longer-term Treasuries, as we did during the Great Recession, if we needed more accommodation,” said Cleveland Fed President Mester (V) Monday in an interview with Bloomberg News. That would be a “soft” version of “yield curve control,” a policy that Japan and Australia have implemented. At the least, the Fed should provide “further detailed guidance on the Committee’s intentions regarding these purchases,” according to Kansas City Fed President George ((NV) on Thursday.

Yield curve control helps support the economy in two ways: the portfolio balance effect and the interest rate effect. As Reserve Bank of Australia Deputy Gov. Debelle said on 22 September:

Bond purchases have a portfolio balance effect in addition to the interest rate effect. When a central bank buys government bonds, it is exchanging a shorter duration asset (cash) for longer duration one (the bond). This incentivises investors to switch into other assets, including potentially foreign assets, to get that duration exposure. This lowers interest rates on other financial assets and also can contribute to a lower exchange rate. (emphasis added)

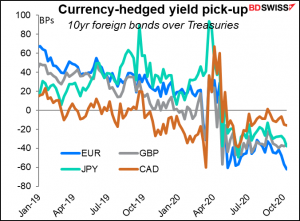

Currently, US Treasuries are an attractive investment for foreign fund managers. After taking hedging costs into account, they yield significantly more than bonds in other major currencies (or looked at the other way, foreign bonds yield a lot less than a currency-hedged Treasury). Lowering the yield of Treasuries would reduce their attractiveness to foreign investors while increasing the attractiveness of foreign bonds for domestic US investors. Result? A lower dollar (in theory).

This is one reason why I think Trump’s ridiculous move to stop negotiations on CARES Act 2.0 – negotiations that weren’t going anywhere, but let’s put that aside – is negative for the dollar. It makes further easing by the Fed more likely, which is negative for the dollar.

There’s another reason, too. By reducing more people to poverty, it makes VP Biden’s election more likely. That’s negative for the dollar, because it would engender a “risk-on” mood that would probably reduce “safe-haven” flows into the US.

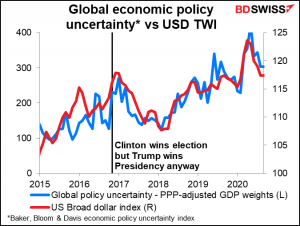

Don’t believe me? Maybe you’ll believe the European Central Bank (ECB). This is what they had to say this week in the minutes from their latest meeting (emphasis added):

…model-based analysis identified two main drivers behind the recent shifts in exchange rates. The first and most important one was the substantial improvement in global risk sentiment, i.e. the reversal of previous safe-haven flows into the United States. The decisive policy actions taken by euro area governments to fight the crisis had likely contributed to the improvement in risk sentiment. A second driver was likely related to monetary policies implemented in the United States and the euro area, in part reflecting differences in conventional policy space before the pandemic.

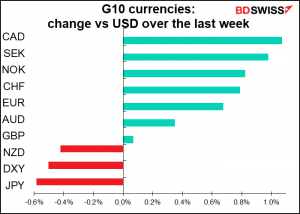

The data certainly demonstrate the “first and most important one,” as the graph shows.

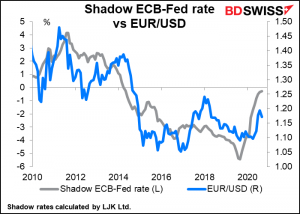

As for the latter, we can see that factor in play when we look at the difference between the “shadow rates” for the ECB and the Fed — the policy rates adjusted to take into account the effect of quantitative easing and other unconventional monetary policies. Adjusted for such measures, the gains in EUR/USD clearly follow the Fed’s recent easing, which narrowed the gap between the ECB and the Fed’s “shadow rates.”

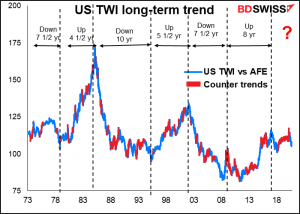

I think we are still in the beginning of a multi-year downtrend for the dollar that is just getting under way. With Trump doing his best to sabotage the US economy and the Fed therefore likely to ease further, it’s got much further to run, in my view.

Next week: Trump’s health, EC Summit, US retail sales, UK employment

This past week was relatively devoid of US data. As a result, next week will have more data than usual for the third week of the month. No major central bank meetings or minutes, though.

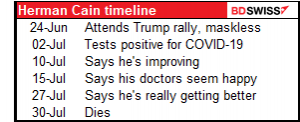

The key to the markets this coming week will not be found in the indicators. Trump’s health will be a constant source of concern. While he claims to be over his illness, reasonable people can have their doubts. I present again the timeline of Herman Cain, one of Trump’s many opponents for president in 2016 who later became a major supporter:

The spread of the virus among other US politicians, government officials, and members of the administration, including the Joint Chiefs of Staff, several Senators, the White House press secretary and the head of the Republican National Committee, may also have unexpected effects on the US government. We of course eagerly await the next deranged tweet from Trump meddling in the negotiations about the CARES Act 2.0, which in any event I don’t expect to see bear fruit regardless.

The polls are showing more and more support for former VP Biden. Unusually, the Democrats are being seen as the preferred party of Wall Street this election cycle. None other than Goldman, Sachs chief economist Jan Hatzius recently told the firm’s clients that a “blue sweep,” with Democrats controlling Congress and the White House, “would likely prompt us to upgrade our (growth) forecasts,” as it would increase the likelihood of a $2tn fiscal stimulus package shortly after the inauguration (20 January) “followed by longer-term spending increases on infrastructure, climate, health care and education that would at least match the long-term tax increases on corporations and upper-income earners.” More polls showing Biden increasing his lead should be supportive for stocks and therefore negative for the dollar.

We’ll also have to see how House Speaker Pelosi’s attempt to have Trump removed from office under the 25th Amendment goes. I doubt whether it’ll succeed, but it should be some dynamite theater!

The European Council (EC) summit Thursday and Friday was going to be the key event of October, but it looks to be just another meeting now. Leaders will meet in Brussels to discuss the pandemic, relations with the UK, climate change and relations with Africa. This meeting had been billed as the “last chance” for the EU and the UK to make a deal in time for all the EU countries to ratify it, but it looks like discussions are going to continue down to the wire. Nonetheless, the leaders “will take stock of the implementation of the withdrawal agreement and review the state of the negotiations on the future EU-UK partnership. Leaders will discuss preparatory work for all scenarios after 1 January 2021.”

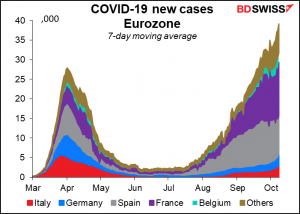

I suspect that with Brexit negotiations continuing, they may spend more time discussing the pandemic, which is now worse than it was back when it was really bad (although deaths have not risen in line with new cases). The ECB minutes noted that the Governing Cuncil’s baseline scenario “assumed that the virus was largely under control.” That’s clearly outdated already. European officials may have to focus more on virus protection, which could mean lockdowns or restrictions on economic activity, which would in turn probably elicit further easing from the ECB – EUR-negative.

Main indicators out during the week

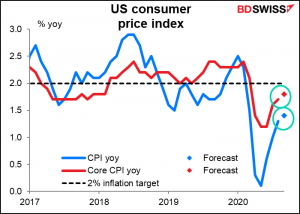

The US consumer price index (CPI), out Tuesday, is expected to rise somewhat. Nobody in their right mind expects that to affect Fed thinking however. The result would then be a reduction in real interest rates, not a greater likelihood of rising rates. It should therefore be a negative for the dollar as long as the Fed is keeping rates suppressed.

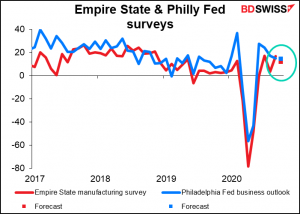

Unusually, the Empire State and Philly Fed indices are coming out on the same day (Thursday). The Empire State index is expected to be down a bit and the Philly Fed virtually unchanged. Since their current level is consistent with modest expansion, this should be taken as a good indication for the US – hence good for stocks and probably negative for the dollar, again according to the upside-down logic of today’s market.

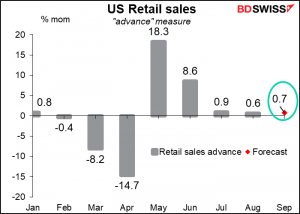

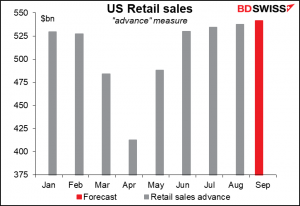

After a couple of months of outsized losses & gains, US retail sales have settled back into the normal range of month-on-month changes.

Even so, that would leave sales 2.4% above the pre-pandemic level, which is quite healthy, all things considered. It’s when incomes start to fall, or precautionary savings start to rise, and sales fall below pre-pandemic levels that we have to worry about the downward spiral that Powell warned of.

The US will also announce industrial production for September and the U of Michigan consumer sentiment index for October on Friday.

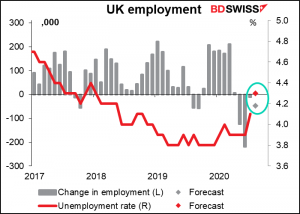

The UK will of course be buffeted by any talk about a Brexit deal coming closer, further, rejected, accepted, sounding fishy, etc. Aside from that though, the employment data on Tuesday is the only major UK economic indicator. The unemployment rate is expected to increase by 0.2 ppt as various schemes to keep people on payrolls start to expire. More people are expected to lose their jobs than did last month, but still nowhere near the level of May or June. In short the figures should be relatively reassuring. However the ones that the market apparently pays more attention to – the claimant count rate and the jobless claims change – don’t have any forecasts.

There are also several Bank of England speakers out during the week: Monetary Policy Committee member Haske and BoE Gov. Baily both speak on Monday, while CoE Chief Economist Haldane will lecture some people on Wednesday. They’ve all spoken recently though so I wouldn’t expect anything new.

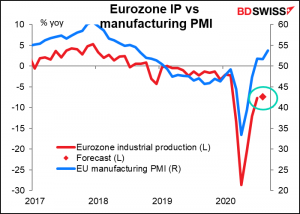

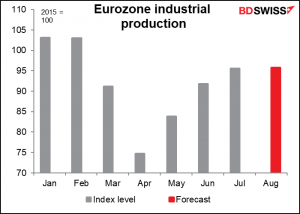

In addition to the summit during the week, the EU will announce industrial production on Wednesday. It’s expected to fall back to a more normal rate of month-on-month increase.

It seems to be far behind the improvement in the manufacturing purchasing managers’ index (PMI).

Production seems to have stalled at around 7% below pre-pandemic levels. That’s not good. I think this could be negative for the euro.

Finally, China releases its inflation data on Thursday. The market expects a continuation of the recent convergence trend: slowing inflation at the retail level and slowing deflation at the producer level. Slowing PPI deflation is a tailwind for central banks around the world as China’s PPI has a big influence on their import prices.