Market Analysis Review

BOE Interest Rate reduced and NFP projected at 175K

Previous Trading Day’s Events (01.08.2024)

Australia Balance of Trade: Australia’s trade surplus expanded to AUD 5.59 billion in June 2024, exceeding the AUD 5 billion forecast, with exports increasing 1.7% to AUD 43.77 billion.

Euro Area Unemployment Rate: Euro Area unemployment rose to 6.5% in June 2024, up from 6.4% in May.

United Kingdom Interest Rate: BOE cut the Bank Rate by 25bps to 5% in August.

United States ISM Manufacturing PMI: US ISM Manufacturing PMI dropped to 46.6 in July, missing the 48.8 estimate, while jobless claims increased to 249,000, surpassing the 236,000 forecast.

Apple Earnings (NASDAQ: AAPL): Apple reported EPS of $1.40 and revenue of $85.78 billion, with iPhone revenue at $39.30 billion, all exceeding estimates.

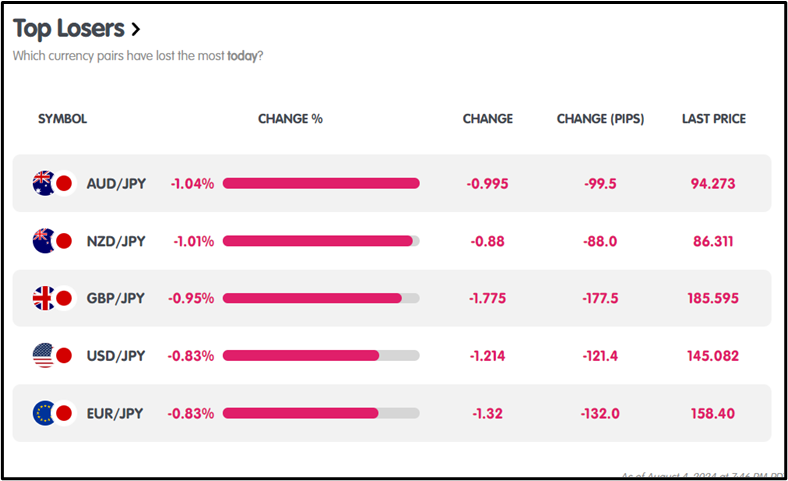

Winners and Losers

On August 1st, 2024, EUR/GBP was the top performer, gaining 0.60% (+0.50 pips), while GBP/CHF was the biggest loser, dropping 1.43% (-161.2 pips).

On August 1st, 2024, EUR/GBP was the top performer, gaining 0.60% (+0.50 pips), while GBP/CHF was the biggest loser, dropping 1.43% (-161.2 pips).

News Reports Monitor – Previous Trading Day (01.08.2024)

Server Time / Timezone EEST (UTC+03:00)

1. Tokyo Session:

2. London Session:

3. New York Session:

General Verdict

FOREX MARKETS MONITOR

EURUSD (01.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

EUR/USD was bearish, opening at 1.08218 and closing at 1.07900, with a high of 1.08349 and a low of 1.07762.

CRYPTO MARKETS MONITOR

CRYPTO MARKETS MONITOR

BTCUSD (01.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

BTC/USD was bullish, opening at $64,543.11 and closing at $64,674.86, with a high of $65,092.05 and a low of $62,215.58.

STOCKS MARKETS MONITOR

STOCKS MARKETS MONITOR

APPLE (01.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Apple was bearish, opening at $224.05 and closing at $218.39, with a high of $225.78 and a low of $216.95.

EQUITY MARKETS MONITOR

EQUITY MARKETS MONITOR

SP500 15 minutes Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

S&P 500 was bearish, opening at $5,550.37 and closing at $5,426.40, with a high of $5,569.21 and a low of $5,426.40.

COMMODITIES MARKETS MONITOR

COMMODITIES MARKETS MONITOR

GOLD 15 minutes Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

XAU/USD was bearish, opening at $2,447.91 and closing at $2,445.56, with a high of $2,461.98 and a low of $2,429.93.

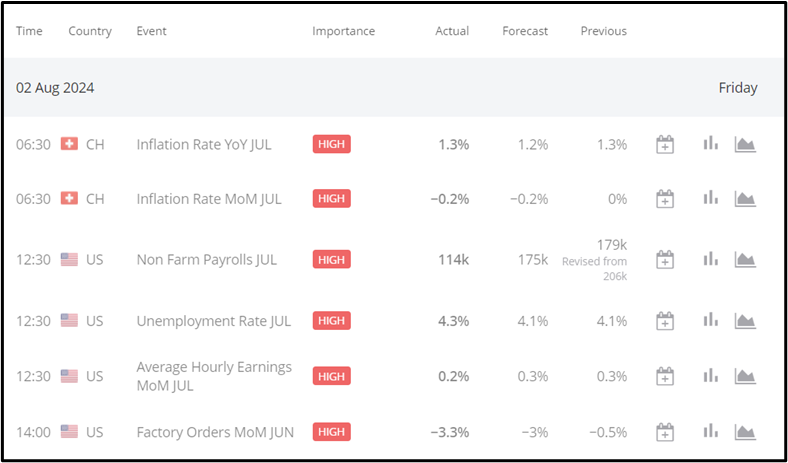

News Reports Monitor – Today Trading Day (02.08.2024)

News Reports Monitor – Today Trading Day (02.08.2024)

1. Tokyo Session:

Australia’s producer prices rose 4.80% YoY in Q2 2024, up from 4.30% in Q1. Bullish at 1:30 AM GMT.

2. London Session:

Switzerland’s CPI fell 0.20% MoM in July 2024. Bullish at 6:30 AM GMT.

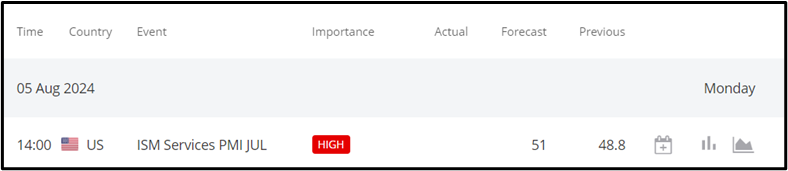

3. New York Session:

The US is expected to add 175K jobs in July 2024 with an unemployment rate steady at 4.1%, the highest since November 2021.

General Verdict

Source

https://ec.europa.eu/eurostat/

https://www.bankofengland.co.uk/

https://www.investing.com/equities/apple-computer-inc-earnings

https://marketmilk.babypips.com/

Metatrader 4 ( MT4 )