Market Analysis Review

Daily Market Report: Expert Technical & Fundamental Insights – 29.04.2025

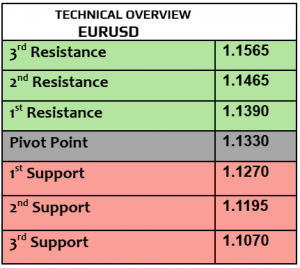

EURUSD

EURUSD fell today & traded at $1.1391 after USD index increased by 0.20% to 99.19 . EUR is still up by more than 5% vs USD in a month, such a strength in EUR reflects the loss of trust in Greenback due to economic & political chaos that caused by Trump’s last tariffs. EZ Business climate, consumer confidence & service sentiments will be released later today . Amid low volatility, 1H RSI is trading sideways today. 1H trend index was somehow bearish ; today’s loss confirms this bearish attitude. $1.1315 is support, $1.1420 is the next resistance.

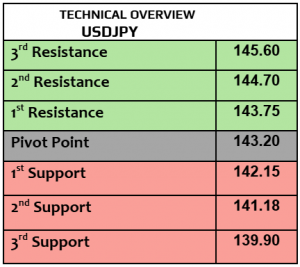

USDJPY

USD gained & traded higher vs Yen today at 142.64 . While the trade tensions remained serious, BoJ is likely to keep watching the consequences of trade war on Japan’s exports, and damages that may happen to consumer spending as well. Japan’s retail trade, large retailers sales & industrial production will be due later today.

Hourly trend index remained bullish, heading higher to 143.10 . 142 is support , then 141.60. 1H RSI is still trading near an oversold level ( at 38 RSI) which may support further advance.

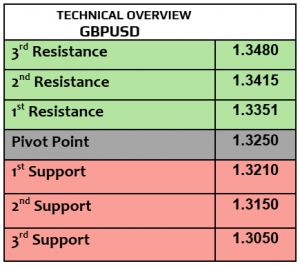

GBPUSD

GBPUSD traded weaker today & fell to $1.3408. As UK calendar has no major releases for today, the focus is likely to remain on US side of data & technical indicators for day traders. EY Club in the UK forecasts a slowdown in economic growth , lowering GDP growth projection in 2025 to 0.8% from 1% . If China & US work together to deescalate the trade obstacles, risk appetite will gain momentum.

1H RSI started falling after hitting an overbought level, targeting $1.3365. $1.3445 is the next resistance. Even if correction continues ( downside) , it is likely to remain short-lived due to markets’ behavior.

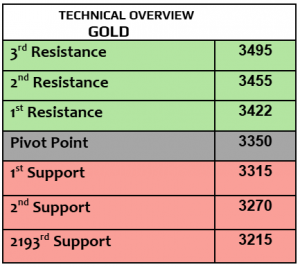

GOLD

Gold fell today & traded at $3314 per ounce. Today’s loss in gold happened after USD index increased & positive comments from Bessent, US Treasury Secretary about possible deal with China. Markets’ focus will shift to more macroeconomic from the US this week that include Q1 GDP growth , PCE numbers & April’s nonfarm payrolls on Friday. The stronger the US economic numbers, the weaker the demand for gold is likely to happen.

Technical diagram shows possible advance to $3340 before falling again to $3290 ( support). Hourly & daily trend index remained bearish amid bearish forecasts by the traders.

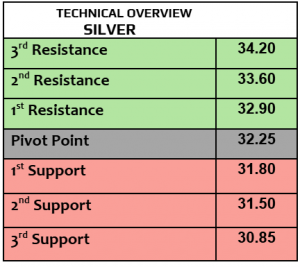

SILVER

On the second consecutive day of positive performance, silver gained today & traded higher at $33.33 per ounce. Silver is likely to remain highly correlated to the trade tensions & disruption ( if happens) more than gold. If China & America work together on easing the trade tensions & lowering the tariffs, silver may gain momentum.

While volatility remains low, 1H trend index is still bullish. $33.50 will be the next target ( approaching) . $32.50 is support. 1H RSI is showing slow improvement as well.

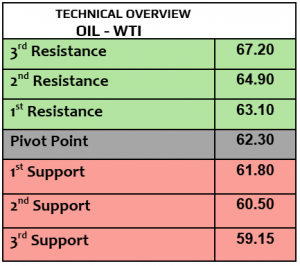

Oil-WTI

Crude oil prices fell today by more than -1%, WTI $61.30PB, Brent $64.95PB. Barclays cut its 2025 Brent forecast by $4 to $70 PB. In the meantime, OPEC+ members are expected to suggest an increase in oil output in the next meeting on May 5th /2025. US weekly crude oil inventories will be released later today by API, it fell by 4.5 million barrels two weeks earlier.

1H RSI is falling & approaching from support level ( re-entry ); however, markets’ behavior is still showing bearish trend index in 1H & targeting $60.40 . $62 is the next resistance ( target).

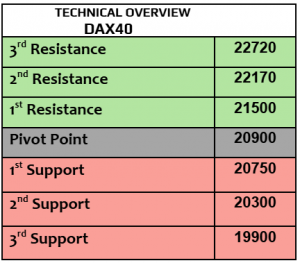

DAX40

Another 1% of the strong performance, DAX gained today & advanced to 22488, the highest since early April 2025. German consumer confidence improved in May to the highest in six months. Adidas announced 155% jump in Q1 profits, but Porsche dropped by more than 7% after disappointing first-quarter results. Germany’s largest lender Deutsche Bank gained more than 2% after posting higher than expected profits in Q1.

Hourly & daily trend index remained bullish with uptrend chart that is still heading higher, supported by bullish behavior. 21800 is support, 22600 is the next resistance ( approaching today).

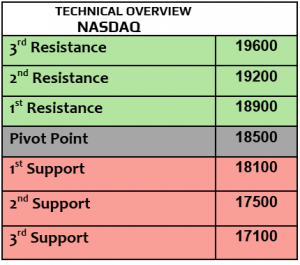

NASDAQ

US stock futures traded slightly higher today after mixed closing on Monday, Dow Jones 0.28%, SPX 0.06% & Nasdaq fell -0.10%. Busy week ahead from America with PCE numbers, GDP growth in Q1 and the most will be nonfarm payrolls on Friday. There are two major factors in US market now, macroeconomics & politics. Higher quarterly earnings from the US companies could support further advance & the risk appetite will improve as well.

Price action is heading higher today ( correction) & targeting 19400 ( executed today then 19650 ). 18500 is support. Volatility remained high.

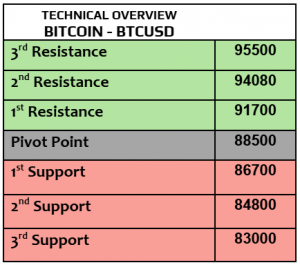

BITCOIN

Major cryptocurrencies gained today , BTC $95020, Eth 1.86%, Cardano 1% & XRP 0.37% . According to Crypto news, Pro Shares set to launch three XRP ETF’s on April 30, the daily trading volume for XRP increased by 67% to $4.2 billion showing that the activities gained momentum.

$91900 & $86800 is support; however, markets’ sentiments still support further advance to $90600 ( executed ) , then $94K ( executed as well this morning ) then $95500 which is approaching. Daily trend index remained bullish.