Market Analysis Review

Canada’s GDP growth at 0.3% as expected, U.S. Core PCE Price index growth at 0.10% and lower as expected, U.S. indices steady, Bitcoin recovered

Previous Trading Day’s Events (28.06.2024)

Consumer spending rose marginally last month. Underlying prices advanced at the slowest pace in six months.

Traders raised their bets for a Fed rate cut in September.

“This was a very Fed-friendly report that should keep the September rate cut in play, while at the same time increasing investor confidence that moderate economic growth can be maintained even as rates stay higher for longer,” said Scott Anderson, chief U.S. economist at BMO Capital Markets. “The sharp slowdown in core inflation is just what the doctor needed to see to keep the economy on the soft-landing glide-path.”

In the 12 months through May, the PCE price index increased 2.6% after advancing 2.7% in April. Last month’s inflation readings were in line with economists’ expectations.

The so-called core PCE price index was previously reported to have climbed 0.2% in April. Core inflation increased 2.6% on a year-on-year basis in May, the smallest advance since March 2021, after rising 2.8% in April.

The Fed tracks the PCE price measures for its inflation target. Monthly inflation readings of 0.2% over time are necessary to bring inflation back to target.

PCE services inflation excluding energy and housing also ticked up 0.1% last month after advancing 0.3% in April. This measure is being watched by policymakers to measure progress in lowering price pressures. Consumer spending, which accounts for more than two-thirds of the U.S. economic activity, increased 0.2% last month after rising 0.1% in April according to the report.

“There was no inflation in May, but there was also no indication of the kind of soft demand – undermined by slower income growth – the Fed believes necessary to keep inflation on a low track,” said Chris Low, chief economist at FHN Financial.

______________________________________________________________________

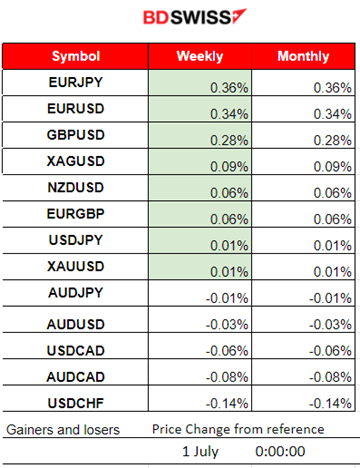

Winners vs Losers

EURJPY is on the top as the EUR started to appreciate heavily and the USD and JPY weakened.EURUSD and GBPUSD follow with all near to 30% gains so far.

______________________________________________________________________

______________________________________________________________________

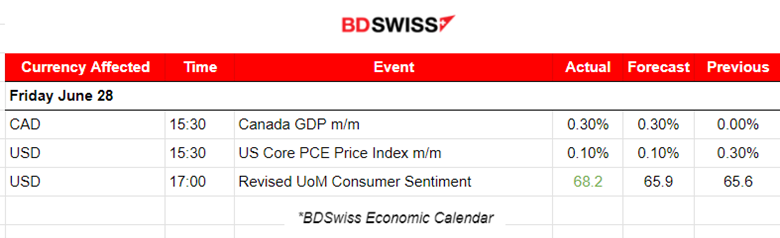

News Reports Monitor – Previous Trading Day (28.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no important scheduled releases.

- Morning – Day Session (European and N. American Session)

At 15:30, the GDP report showed that Canada’s GDP increased 0.3% in April, matching market expectations. No major impact on the market.

The release of the Core PCE price index had no major impact either as the figure was reported 0.10% as expected, lower than the previous figure. The year-over-year gain slowed from 2.7% in April to 2.6% in May. Yet, a Federal Reserve senior official told us last week that it was not time to cut rates yet and the PCE figure is also not so significant in order to be considered sufficient evidence that indeed inflation is lowering, thus not enough to support the cut.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

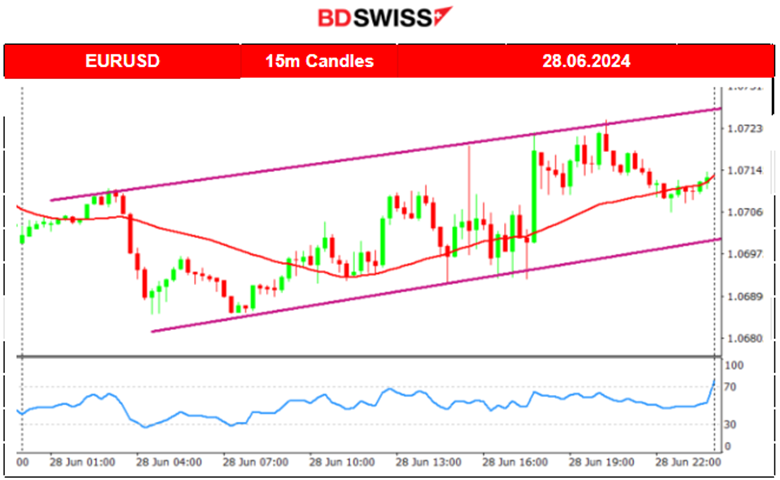

EURUSD (28.06.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The EURUSD experienced low volatility as the released scheduled figures had no major impact on the market. The USD remained stable overall, and moved sideways around the 30-period MA. The range in which the price moved was recorded near 40 pips with an intraday mean close to 1.07100.

___________________________________________________________________

___________________________________________________________________

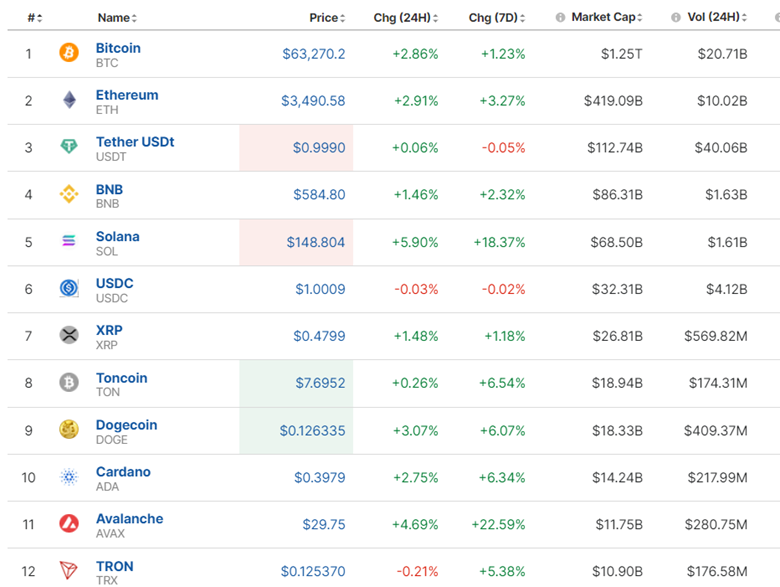

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 24th of June, Monday, Bitcoin plunged to 58,400 before retracing to the 61.8 Fibo level and settling near the 30-period MA, very close to 61K USD. Since the 27th, the price moved sideways around the mean near 61K USD. That changed on the 30th of June when the price eventually moved rapidly upwards breaking the 62K resistance and reaching until the next resistance near the 63,600 USD level before starting to retrace. A big recovery for Bitcoin compared with the latest moves. The 62,500 USD level could serve as the next target level if the retracement continues.

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The Crypto Market got a boost after recovering from the recent drop. All green so far with 7-day performance reaching over 22% for Avalanche.

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 26th, the index tested the resistance near 5,496 without success and retraced to the MA continuing the path sideways. On the 28th breakout of the 5,500 resistance led finally to an upward movement continuation of the index. The index found a strong resistance near 5,530 USD before it started to drop significantly, reversing from the upside, crossing the 30-period MA on the way down and reaching the support area near 5,500 USD again without a successful breakout. Currently, it remains below the MA with the potential of a re-test.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 26th the price tested the support near 80 USD/b without success and retraced back to the MA. Max near 1 USD deviation from the mean. On the 27th however the resistance at 81.7 USD/b broke and Crude oil got a boost, passing the 82 USD/b. It was a quite rapid movement to the upside after that breakout. The price eventually found resistance at near 82.40 USD/b before the price plunged on the 28th by near 1.5 USD/b around 13:00 server time. That was a big dive to 80.70 USD/b and retracement followed soon after reaching the 61.8 Fibo level and back to the 30-period MA. With volatility levels lowering, the path seems sideways for now.

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 25th, the price dropped after breaking a triangle formation and moved lower, remaining below the 30-period MA. The trend eventually continued and Gold moved to the downside. USD appreciation helped. On the 26th, the price broke important support levels and moved lower rapidly to 2,293 USD/oz before retracement took place and settled at 2,300 USD/oz. A triangle breach on the 27th caused it to jump. As mentioned in our previous analysis the price of 2,330 USD/oz was reached and acted as a resistance. The price retraced, reaching the 61.8 Fibo level. On the 28th the price experienced volatility but closed near flat. Looks like a sideways movement for now even though a triangle formation is visible with a breakout. The next target could be 2,319 USD/oz again for re-testing and possible breakout. If the USD appreciates, that could help with the breakout.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (01.07.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no important scheduled releases.

- Morning – Day Session (European and N. American Session)

Manufacturing PMI releases today. Grim picture for the U.K. so far and the eurozone sees roughly the same levels. However, the eurozone manufacturing economy displayed fresh signs of weakness overall at the end of the second quarter. The EUR was affected but currently, elections in France seem to have an impact on the currency. Euro appreciation is currently on as Le Pen’s party set to win the first French vote is the highlight.

The ISM Manufacturing PMI figure usually has a strong impact on the USD pairs. It will be released at 17:00 and possibly create trading opportunities. The PMI is expected to improve, however, the trend has been downwards recently. A significant surprise is not to be excluded.

General Verdict:

______________________________________________________________