Market Analysis Review

Daily Market Report: Expert Technical & Fundamental Insights – 30.10.2024

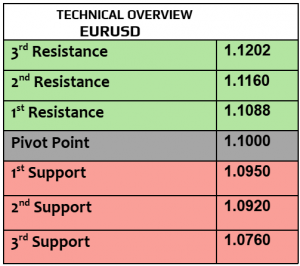

EURUSD

Big day ahead for EUR traders & EZ policy makers who are waiting for EZ GDP & German inflation numbers as well. EURUSD was little changed today, trading at $1.0816 amid tight volatility for the last few sessions. Inflation in Germany is expected to increase to 1.8% from 1.6%, if that happens, that’s not going to be good news for the German government & policy makers.

The forecast poll indicated to more than 80% who were bearish, supported by bearish trend index in 1H chart. Price action remained slow, likely to remain between $1.0780 & $1.0840 until afternoon.

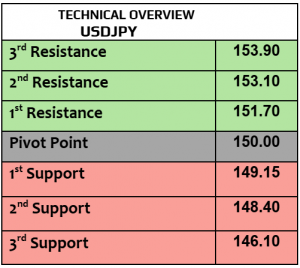

USDJPY

USDJPY was little changed this morning, trading at 153.23. Consumer confidence in Japan weakened in October to 36.2 from 36.9, Japan’s retail trade & industrial production will be due later today. With more US economic releases for today, higher volatility is likely to materialize later, mainly in USD. In the meantime, Japan’s main opposition party the Democratic Party suggested that the central bank should refrain from changing the policy now.

Price action started falling, targeting 152.50 then 151.75 with almost 40% in bearish bias & only 20% bullish.

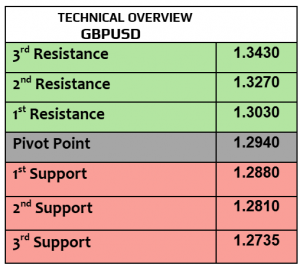

GBPUSD

GBPUSD slightly fell today to $1.2997, after two consecutive days of gaining. UK – HM Treasury will release Autumn Forecast Statement later today, it is one of the two statements treasury issues each year. According to the market expectations, BoE rate cut in November dropped to 86% from 100% before, however if the UK macros keep showing weakness in services & manufacturing then BoE may act sooner than later. Weaker US economic data later today will support GBP’s bulls.

The technical bias is not showing much support to markets’ bulls with almost 60% in a bearish attitude. $1.2940 is support, $1.30 is resistance for day-traders (almost done) then $1.3030.

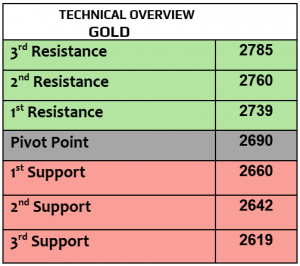

Gold

We have an answer for yesterday’s question about the rally in gold, yes, the rally is not yet over. For the last five consecutive days, the rally has never slowed, and gold kept breaking new records, trading higher today at a new record-high $2784 per ounce. JOLTS reported that the job openings in the US fell to 7.44 million in September, the lowest since 2021. Just think about it, what will happen if the US non-farm payrolls miss the estimates? Gold may have a new record-high again.

Our bullish view was totally accurate, new resistance was added. Trend index remained fully bullish. Profit taking targets are $2772 & $2748.

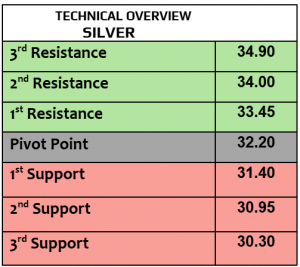

Silver

Silver fell today & traded weaker at $34.20 per ounce, after three consecutive days of positive performance. While there was no major news in silver market, all eyes will be on China’s National People’s Congress meeting on November 4th, more stimulus measures from China will be silver’s best scenario.

Technical chart kept repeating the same scheme, which means that the correction to $33.30 is possible. In the meantime, trend index remained bullish in 1H & daily, targeting $34.50 .

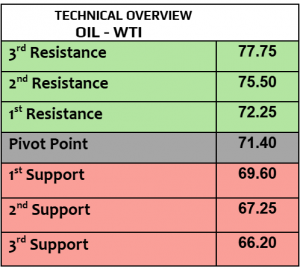

Oil – WTI

Crude oil prices traded higher today, trying to recover after heavy loss on Monday, WTI traded today at $67.77PB, Brent $71.64PB. According to API, the US weekly crude oil inventories fell by 0.57 million barrels last week, after it increased by 1.6 million barrels two weeks before EIA will release the weekly inventories later today. While the geopolitical tensions in the ME remained high, traders ignored these tensions, focusing on the demand outlook, OPEC reaction & China’s possible stimulus measures.

From the 2nd major support, traders bought again, $68.20 is the next target, then $69. Technical channel remained negative (below the pivot) so be careful in your bet.

DAX

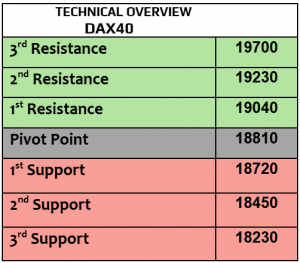

German DAX futures traded weaker today at 19443, after it fell by another -0.2% on Tuesday. VW suffered the biggest loss on Tuesday, falling over -3%, such a loss was highly expected after VW announced it will shut down three factories in Germany. Busy day ahead from Germany with CPI numbers, GDP growth in Q3 and Bundesbank President speech. Keep in mind that Germany remained in recession.

The technical correction started from 19600m targeting 19410 then 19340, however the trend index remained bullish in 1H chart.

Nasdaq

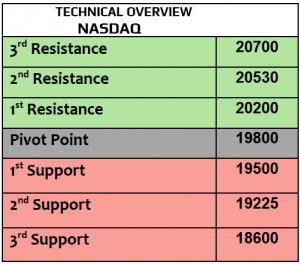

US stock futures traded higher today after Nasdaq gained 0.78% on Tuesday, followed by 0.16% in SPX and Dow Jones fell by -0.36%. Alphabet surged nearly 6% after impressive revenue numbers in Q3, Meta & Microsoft will report Q3 earnings later today. While the US job openings fell in September, traders focused more on the strong earnings & Fed rate cut that will be expected in November. Today is going to be another busy day from the US with ADP employment numbers, GDP in Q3 and pending home sales, so be prepared for higher volatility.

Trend index remained bullish (1H chart), with strong price action, heading higher to 20700 after it broke the 2nd major resistance. Support levels are 20350 & 20180 (profit taking).

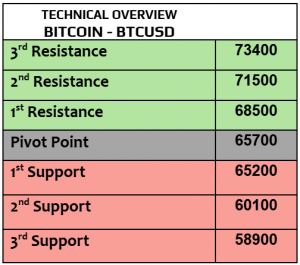

BTCUSD

After four consecutive days of the rally in BTC, Bitcoin traded weaker today at $72300, the highest since last March, and not far from the all-time high at $73750. Cryptocurrencies market cap increased to $2.44 Trillion, supported by greed sentiment, BTC market cap is at $1.429 trillion now, followed by $319B in Eth, and $120B in Tether. Trump’s trade gained momentum recently, Trump’s victory (if happens) is likely to give more bullish sentiments to crypto market.

The daily chart is still fully bullish, while 1H chart may support further correction to $71K. 1H RSI is falling now from overbought level.