Market Analysis Review

Daily Market Report: Expert Technical & Fundamental Insights – 31.10.2024

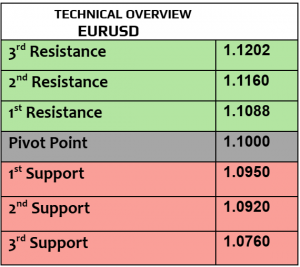

EURUSD

EURUSD was little changed today, trading at $1.0847 after it gained yesterday. EZ GDP unexpectedly grew by 0.4% QoQ in Q3/2024, stronger than the estimates of 0.2%, pushing the traders to buy EUR yesterday amid expectations that ECB may not cut the rates soon. Another busy day ahead from EZ with inflation numbers for the month of October & ECB monthly economic bulletin.

Price action kept advancing, creating new support levels at $1.0775 & $1.0815, cementing re-entry points for market bulls. Next target will be at $1.0870 which is doable.

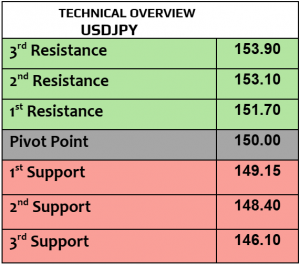

USDJPY

As expected, Bank of Japan kept the interest rate unchanged at 0.25% in today’s meeting. What matters now is BoJ press conference & BoJ governor speech later today, is BoJ going to change or modify its monetary policy? USDJPY traded slightly weaker today at 152.96. Japan’s industrial production improved in September, stronger than before while the retail traded declined. Keep an eye on the US bond yields, as long as the yields remain elevated, USDJPY is unlikely to fall quickly.

Price action started falling, targeting 152.50 then 151.75 with almost 40% in bearish bias & only 20% bullish. 1H index is bearish.

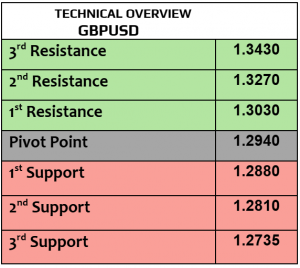

GBPUSD

GBPUSD traded almost unchanged today at $1.2949 amid tight volatility for the last few sessions as the UK calendar has no major economic releases. According to the Office for Budget in the UK, new economic measures by the UK government will increase inflation by 0.4%, which means that the inflation average will be at 2.5% in 2024, that’s not good news for BoE.

The technical bias is not showing much support to markets’ bulls with almost 60% in bearish attitude. $1.2940 is support then $1.2910, $1.30 is resistance for day -traders then $1.3030.

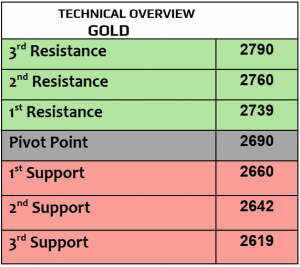

Gold

Gold never sleeps, was little changed today at $2784 per ounce, still at record-high levels. While the US economy is still showing resilience stronger than the estimates, core PCE from the US numbers later today will be vital in tracking the US inflation. In the meantime, China’s manufacturing improved in October while non-manufacturing slightly fell.

Our bullish view was totally accurate, new resistance was added. Trend index remained fully bullish. Profit taking targets are $2772 & $2748.

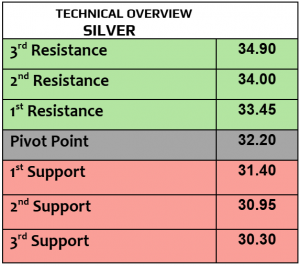

Silver

Even if China’s manufacturing PMI improved in October, silver fell for the second consecutive day, traded lower today at $33.60 per ounce, but why did silver fall? Such a fall is not a strategic re-positioning, it’s more profit taking than a change in the markets’ sentiments. We keep following the developments from China, economically & politically.

Technical chart kept repeating the same scheme, which means that the correction to $33.30 is possible. Trend index remained bullish in 1H & daily, targeting $34.50.

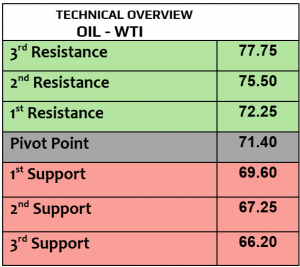

Oil – WTI

According to EIA, the US crude oil inventories fell by 0.5 million barrels last week, defying market expectations of 2.3 million barrels increase. Both , WTI & Brent crude traded higher today at $69.07PB & $72.65PB respectively. China’s improving manufacturing in October supported the prices today, CAIXIN manufacturing PMI from China will be due tomorrow. According to many reports, OPEC+ may delay the planned increase in oil production in December 2024.

Technical channel remained negative (below the pivot) but the price action started improving & aiming higher to $70.25 then $71 . 1H trend index is bullish now.

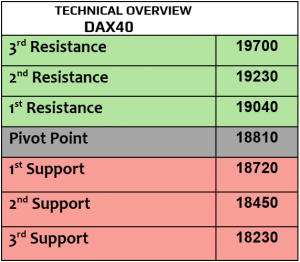

DAX

After losing by more than -1% on Wednesday, DAX futures traded weaker today at 19190. Germany’s inflation increased to 2% in October from 1.6%, while GDP grew by 0.2% in Q3/2024, better than before. Retail sales from Germany will be released later today. Tech sector had the biggest loss yesterday, SAP -2% and Infineon -3.6%.

Our targets at 19410 then 19340 were executed yesterday, the next target is 19200 / 19150. Price action kept falling & 1H RSI is edging lower to support level. Markets’ sentiments were mostly bearish.

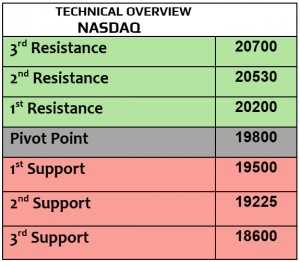

Nasdaq

It was not a surprise to us that the good economic news will have negative impact on equities, that’s what happened yesterday after US ADP employment in private sector increased by 233K in October, stronger than before and US PCE increased by 2.2% in Q3 which means that the US inflation remained sticky. Today, US stock futures traded lower, after falling on Wednesday, Dow Jones -0.22%, SPX -0.33% and Nasdaq -0.56%. Busy day ahead from America with personal income & spending, challenger job cuts, PCE numbers & initial jobless claims, so expect higher volatility. Remember that if the Fed doesn’t reduce the rates in November, US equities may have aggressive correction.

Support levels are 20350 & 20180 (profit taking). 1H price action is falling now with bearish trend index.

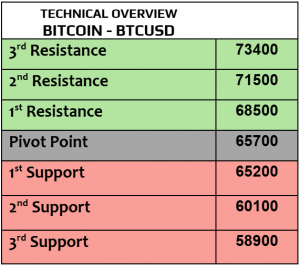

BTCUSD

BTC traded slightly weaker today at $72260, Eth $2645, Cardano $0.3565 & Solana slightly fell to $175.03. Such a minor drop in the major cryptocurrencies is likely to be expected after the strong rally in the last four days. Crypto market sentiment index remained at 66 (greed territory). According to CoinGape, the BTC ETF’s spot cross 1 million BTC holdings in just 10 months.

Daily chart is still fully bullish, while 1H chart may support further correction to $71K. 1H RSI is falling now from overbought level.