Market Analysis Review

RBA rate unchanged at 4.35%, ISM Services PMI surges to 51.4.

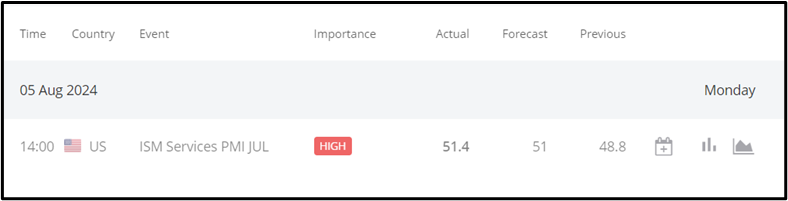

Previous Trading Day’s Events (05.08.2024)

US ISM Services PMI: Rose to 51.4 in July 2024 from 48.8, exceeding the 51 forecast, indicating a moderate uptick in services sector performance.

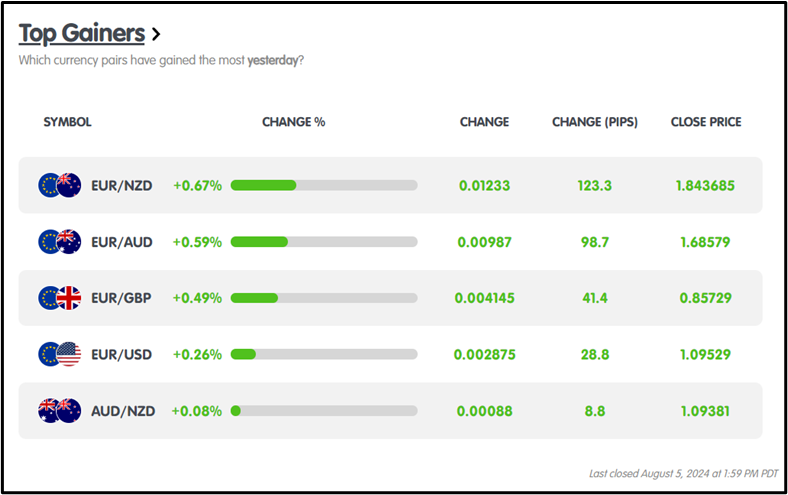

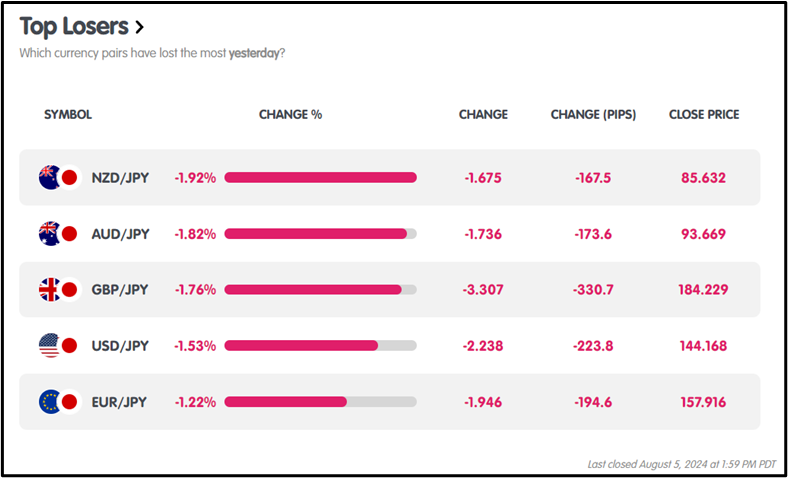

Winners Vs. Losers

On August 5, 2024, EURNZD was the top performer, gaining 0.67% and 123.3 pips, while NZDJPY was the biggest loser, dropping 1.92% and 167.5 pips.

On August 5, 2024, EURNZD was the top performer, gaining 0.67% and 123.3 pips, while NZDJPY was the biggest loser, dropping 1.92% and 167.5 pips.

News Reports Monitor – Previous Trading Day (05.08.2024)

Server Time / Timezone EEST (UTC+03:00)

Tokyo Session: No news

London Session: No news

New York Session:

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (05.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

EURUSD exhibited a bullish trend, opening at 1.09051 and closing at 1.09512, reaching a daily high of 1.10080, and a low of 1.08919.

CRYPTO MARKETS MONITOR

CRYPTO MARKETS MONITOR

BTCUSD (05.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

BTCUSD exhibited a bearish trend, opening at $58,541.93 and closing at $54,304.97, with a daily low of $49,583.77 and a high of $58,541.93.

STOCKS MARKETS MONITOR

STOCKS MARKETS MONITOR

APPLE (05.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Apple exhibited a bullish trend, opening at $202.63 and closing at $209.43, with a high of $213.35 and a low of $202.63.

EQUITY MARKETS MONITOR

EQUITY MARKETS MONITOR

S&P500 (05.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

The S&P 500 exhibited a bearish trend, opening at $5,299.14, and closing at $5,207.63, with a high of $5,299.14 and a low of $5,091.72.

COMMODITIES MARKETS MONITOR

COMMODITIES MARKETS MONITOR

XAUUSD (05.08.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

XAUUSD exhibited a bearish trend, opening at $2,443.75, and closing at $2,409.03, with a low of $2,363.71 and a high of $2,458.86.

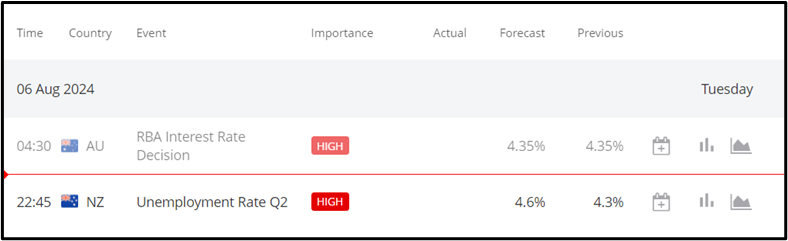

News Reports Monitor – Today Trading Day (06.08.2024)

News Reports Monitor – Today Trading Day (06.08.2024)

- Tokyo Session: The Reserve Bank of Australia held the cash rate at 4.35% during the August meeting, in line with market expectations, resulting in a bearish impact on the market.

- London Session: No relevant data.

- New York Session: No relevant data.

- Sydney Session: New Zealand Unemployment Rate

General Verdict:

Source :

https://marketmilk.babypips.com/

https://km.bdswiss.com/economic-calendar/

Metatrader 4 ( MT4 )