Technical Analysis Post

Daily Market Report: Expert Technical & Fundamental Insights – 17.03.2025

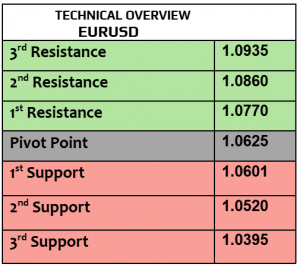

EURUSD

EURUSD was little changed today, trading at $1.0876, increased by 0.41% in a week, and still at the highest level since last November. EUR strength was mainly due to USD weakness that happened because of Trump’s chaotic tariffs and stability of EZ economy. The next bullish step for EUR would be political which means that the end of ongoing war between Russia & Ukraine is likely to have positive impact on traders’ sentiments & stronger trust in EUR.

1H RSI is trading sideways now amid mixed sentiments and low volatility. $1.0830 is support.

USDJPY

After it gained by more than 1% in a week, USDJPY kept heading higher , trading at 149 today. All eyes will be on BoJ next move, higher rate by BoJ is highly probable. What matters to us now is that the ongoing global tensions due to Trump’s tariffs will support the demand for safe-haven currencies including Yen. Last week, Japanese firms agreed to significant wage hikes for third consecutive year, higher wages are likely to boost Japan’s inflation which may result in higher interest rates.

Price action is still moving higher, targeting 149.50. Traders’ sentiments were divided between 25% bullish & 25% bearish. 148.30 & 147.60 are support levels.

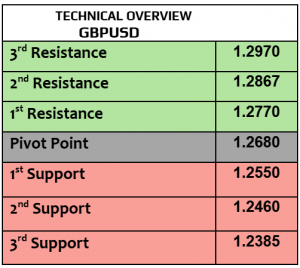

GBPUSD

Two consecutive weeks of gains, GBPUSD traded unchanged today at $1.2934, the highest since last November. UK economy unexpectedly contracted by -0.1% in January , missing the estimates of 0.1% increase, BoE rate decision will be next Thursday. BoE quarterly report will be released later today, giving comments on market developments & UK monetary policy. The weaker the UK economic data, the more the dovish BoE is likely to be.

In the meantime, 1H RSI is trading sideways, with low volatility index. $1.2875 is support.

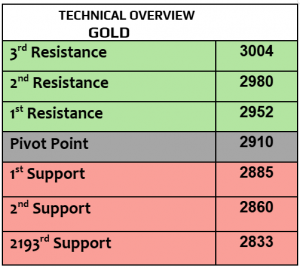

Gold

What’s next for gold ? After it gained by more than 3.6% in a week, gold exceeded $3000 per ounce for the first time ever, trading today at $2989 per ounce, near record levels. Strong demand for ETF’s & Central Banks purchases supported the prices. Traders are still expecting that the consequences of Trump’s tariffs are likely to impose higher inflationary pressure, another reason to bet on gold. Reducing the rates by the Fed was already priced in as well.

Price action is still supporting further advance with bullish trend index. Traders’ sentiments remained mostly bullish with 67% of the traders and no bearish sentiments.

Silver

Since the beginning of 2025, silver outperformed gold , silver gained 17.2%, gold 14%. After two consecutive weeks of gins, silver slightly increased today to $33.81 per ounce, the highest since last October. As long as the global economy faces huge challenges & obstacles due to Trump’s tariffs, the demand for tangible assets is likely to remain robust. China’s industrial production increased by 5.9% in February, exceeding expectations of 5.3% with the expansion of mining & manufacturing sectors, positive news for silver’s outlook.

Daily trend remained bullish. $33 is strong support.

Oil – WTI

After weekly gains by more than 2%, crude oil prices traded higher today, WTI $67.55PB, Brent $70.95PB. China’s top oil importer promised new measures to boost consumption, China remained the World’s second biggest oil consumer, & World’s biggest oil importer. The US attacks on Yemen’s Houthis re-triggered the geopolitical tensions in the Red Sea , however theses tensions are likely to be short-lived.

Markets’ sentiments remained mostly bearish with average forecast at $66.50. $66.50 & $65.50 are important support levels. $68.40 will be the target for the buyers. Price action is still supporting further advance but slow.

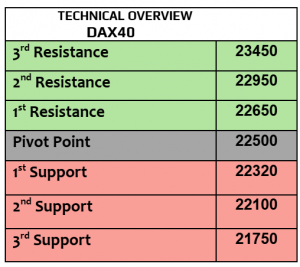

DAX

German DAX futures traded slightly weaker today after weekly gains by more than 1.4%, better performance than France40 index -1.14%, Spain35 index -1.90% and Italy index that rose 1%, German DAX outperformed all other major EZ stock indexes in 2025. What German DAX lacks now is the end of the war between Russia & Ukraine, and the final approval of massive spending by new coalition government, mainly in defense & infrastructure sectors.

Trend index remained strongly bullish, heading higher to 23220. 22880 is support, then 22600.

Nasdaq

US stock futures traded strongly lower today after mixed weekly performance with Dow Jones -1.5%, SPX -0.32% and Nasdaq gained only 0.60%, Dow Jones’s weekly performance was the worst since 2023. Nasdaq lost more than -20% from the highest level last February at 22100 which means that Nasdaq entered bear market. Fed rate decision will be next Wednesday, and the full attention is likely to remain on the developments of Trump’s tariffs, & retail sales later today.

Technically speaking, daily trend index remained bullish. Keep in mind that the sentiments may change quickly, 19400 is support then 19150. Momentum indicator is negative now.

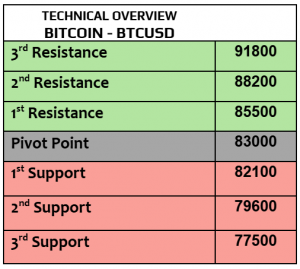

BTCUSD

Major cryptocurrencies traded higher today after positive weekly closing. BTC is trading today at $83300 after more than 6% in weekly gain, Eth $1899, Binance token rose by almost 20% last week, Solana 9% and XRP 16%. Abu Dhabi MGX invested a record $2 billion in Binance, World’s largest crypto exchange with UAE’s growing presence & influence in crypto world.

The monthly forecasts remained mostly bearish without bullish bets with average forecast at $77500, however 1 week forecast was much better & divided between bearish & bullish. What price action shows now is that the traders aim higher & target $84800. $82100 then $80K are support levels