Weekly Outlook

BOE and BOC Rates Unchanged, U.K.s Labor Market Steady, Australia’s Inflation Elevated, Worries for U.S. Inflation Pressures, NFP Ahead

PREVIOUS WEEK’S EVENTS (Week 23 – 27 Oct 2023)

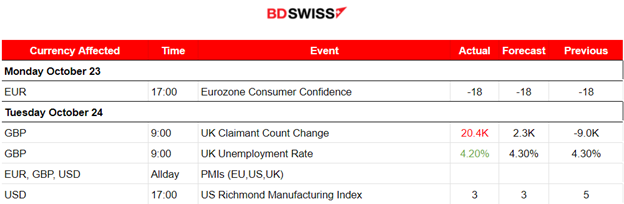

Announcements:

U.K. Economy

In the U.K. the unemployment rate held steady at 4.2%, lower than the previous figure of 4.3%. The Bank of England (BoE) is monitoring the labour market closely as it considers whether it needs to resume raising interest rates. A large majority of economists think the BoE will hold its Bank Rate at 5.25% on Nov. 2.

The Claimant Count (Change in the number of people claiming unemployment-related benefits during the previous month) was reported way higher than expected. A clear indication of the negative effect on employment from elevated borrowing costs.

______________________________________________________________________

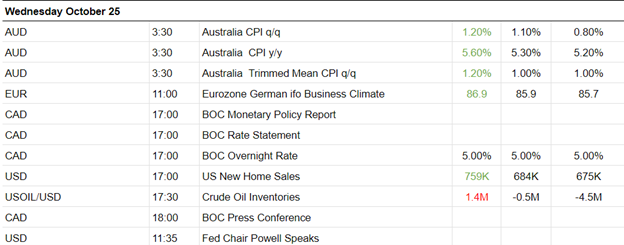

Inflation

Australia:

The CPI data for Australia’s 3rd quarter, plus yearly inflation data was surprisingly reported higher than expected creating problems for policymakers who do their best to fight inflation and desire lower figures instead.

The annual pace of inflation slowed to 5.4%, from 6.0%, but was again above forecasts of 5.3%. For September alone, the CPI rose 5.6% year-on-year, up from 5.2% in August.

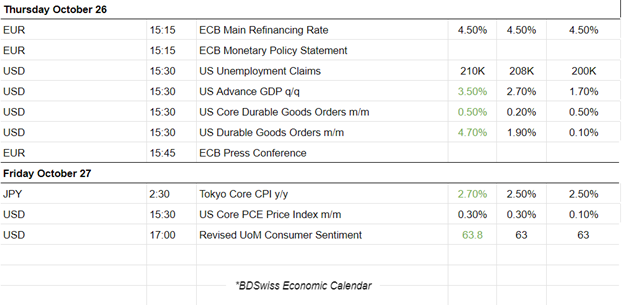

United States

The increase in the PCE price index monthly figure was reported higher, 30% vs 0.10%.

U.S. consumer spending surged in September keeping spending on a higher growth path heading into the fourth quarter. Spending is, however, seen cooling off in early 2024 leaving economists convinced the Federal Reserve is done raising interest rates.

Monthly inflation readings of 0.2% on a sustainable basis are needed to bring inflation back to the U.S. central bank’s 2% target, according to economists. The core PCE price index rose 3.7% on a year-on-year basis in September, the smallest gain since May 2021, after increasing 3.8% in August.

The Fed tracks the PCE price indexes for monetary policy. It is expected to leave interest rates unchanged next Wednesday as a recent surge in the U.S. Treasury yields and stock market sell-off have tightened financial conditions. Thus, the probability of keeping rates unchanged is now estimated to be over 90%. But risks of a rate hike remain.

_____________________________________________________________________________________________

Interest Rates

Bank of Canada

The Bank of Canada decided to keep its key overnight rate at 5.0% as expected and have a minimal impact on the markets. The bank increased rates 10 times between March 2022 and this July.

Inflation in September dipped to 3.8% from 4.0% in August and it is expected to return to the 2% target by the end of 2025.

European Central Bank

The European Central Bank (ECB) left interest rates unchanged as expected. The record-high borrowing costs had the desired but heavy effect on business conditions, enough for the ECB to pause for now.

Inflation is significantly lower than last year, while the economy has slowed so much that a recession may be underway, making further hikes unlikely.

The ECB President Christine Lagarde kept a further rise in rates on the table as a distant possibility.

Markets now see a high chance the ECB will start cutting interest rates in April and fully price in a move by June, followed by two other cuts before the end of the year.

_____________________________________________________________________________________________

Sources:

https://www.reuters.com/world/uk/uk-unemployment-rate-holds-42-ons-2023-10-24/

https://www.reuters.com/markets/us/us-consumer-spending-beats-expectations-september-2023-10-27/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 23 – 27 Oct 2023)

Server Time / Timezone EEST (UTC+02:00)

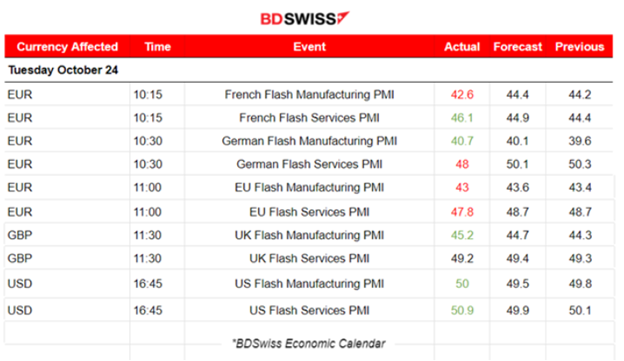

PMI releases for both the Manufacturing and the Services sector:

Eurozone

The French economy starts the fourth quarter with contraction. Another solid reduction in business activity across the eurozone’s second-largest economy in October. The Manufacturing PMI figure is the worst reported at 42.6 points while the services PMI showed some improvement but was still below the 50 threshold. Demand weakness, new orders fell markedly and for a sixth successive month. Sales to non-domestic customers plummeted.

The German economy also remained in contraction in October. Manufacturing PMI still reported at low levels close to 40, while the services sector activity remained close to 50, although October also saw a renewed decline in services business activity since the PMI was reported at 48 versus the previous 50.3 points.

The Eurozone downturn deepened in October. The economic downturn accelerated at the start of the fourth quarter. Manufacturing PMIs reported low at 43 points while the services sector PMI was reported at 47.8 points also in the contraction area. Private sector output is declining at the steepest rate. New orders fell at an accelerating rate as well, a worsening demand environment.

United Kingdom

PMIs for the U.K. were also reported disappointing and in contraction. Ongoing weakness in the UK service sector adds to the case for policymakers to keep rates on hold for a second time. The U.K. private sector output declined for the third month running in

October. Also saw reductions in new order volumes and staffing numbers at private sector firms.

United States

The Manufacturing PMI figure was reported to be 50 points, an improvement from the previous figure. The Services sector PMI was reported just above 50 as well. These data suggested a marginal expansion in business activity during October. Manufacturers and service providers alike reported improved activity levels despite the moderate downturn in demand and with inflationary pressures to have eased in October.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

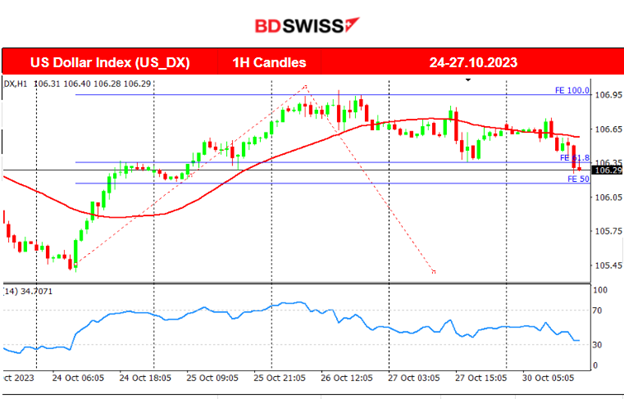

DXY (US Dollar Index)

The dollar index rapidly moved to the upside last week. It crossed the 30-period MA on its way up and found resistance before eventually retracing. The Fibo tool shows that the retracement back to 61.8% of the move is complete as the USD weakens currently.

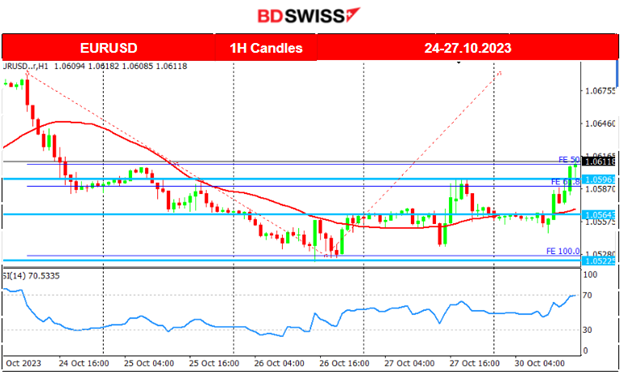

EURUSD

The EURUSD dropped instead, the chart mirrors the DXY chart because the USD appears to be the main driver. The dollar was gaining strength at the beginning causing the EURUSD to drop. The reversal followed with the pair moving to the upside after the 26th Oct. The pair is currently breaking resistance levels and looks for more upside movement. Until the NFP at least.

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin and several cryptocurrencies and related stocks such as Coinbase Global (COIN), Marathon Digital Holdings (MARA), Riot Platforms (RIOT) and Microstrategy (MSTR) experienced a surge in value after a U.S. appeals court ordered the Securities and Exchange Commission to review Grayscale’s application for a spot Bitcoin ETF. Bitcoin has moved significantly to the upside breaking all important resistance levels reaching even until near the level of 35,200 USD, clearly visible on the chart on the 24th Oct. That was the level at which the rapid surge in price finally ended with its price soon retracing back to the 30-period MA. Bitcoin remains in consolidation and with low volatility levels, having 35000 USD as an important resistance level. Fundamentals remain the key factors that push the price to deviate significantly from the mean. Important resistance remains at the 35200 USD level.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

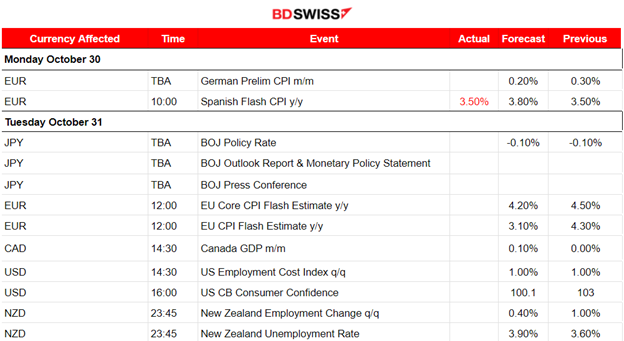

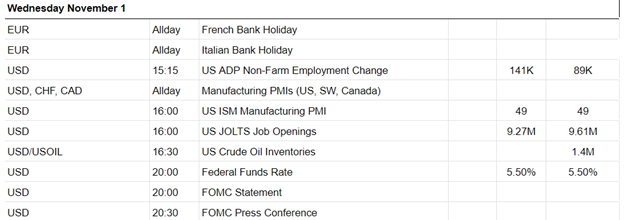

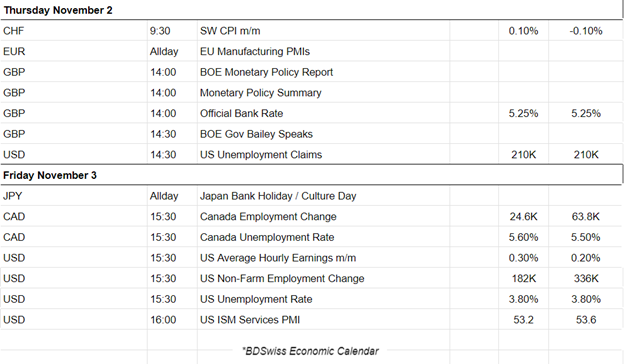

NEXT WEEK’S EVENTS (Week 30 Oct – 03 Nov 2023)

This week we have rate decisions: BOJ, FED, BOE.

NFP week with important employment data releases for the U.S., New Zealand and Canada.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

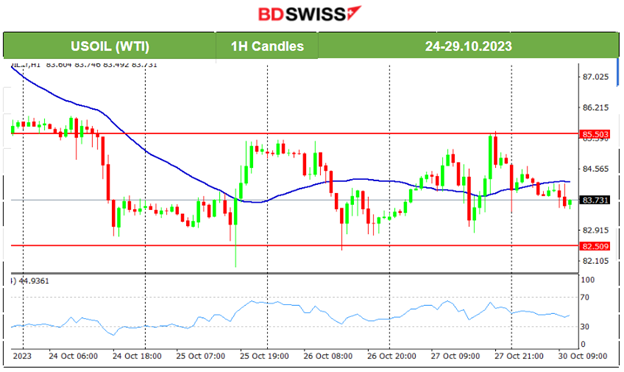

U.S. Crude Oil

Crude remains in consolidation and in a range that has support near 82.5 USD/b while resistance is near 85.5 USD/b as the peaks suggest. It is moving with high volatility sideways around the mean currently and is heavily affected by the fundamentals. War-related: The Gaza war rages currently. Israeli forces expand ground operations.

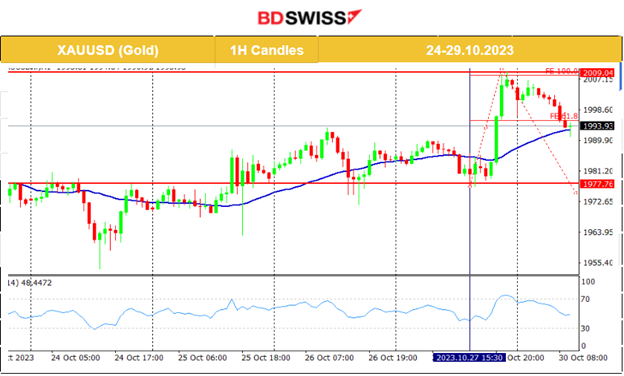

Gold (XAUUSD)

The price of gold moved to the upside as mentioned in our previous report. Gold jumped over the 2000 USD/oz reaching the resistance near 2009 USD/oz before it retraced to the mean after the market opening today. The risk-off mood is still on as war is ongoing. Gold performance is over 8% for this month so far.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

The index tries to recover from the massive drop since the 25th Oct. It found strong support currently at near 14070 USD and remained close to the 30-period MA without experiencing for now any other sudden moves to the downside. Other benchmark U.S. indices have actually experienced more movements to the downside instead. Risk-off mood.

______________________________________________________________