Weekly Outlook

Central Banks (BOJ, BOC, BOE): Unchanged Int. rate policy, U.S. business sectors in expansion, U.S. Core PCE inflation below 3%, FOMC, Fed fund rate and NFP ahead

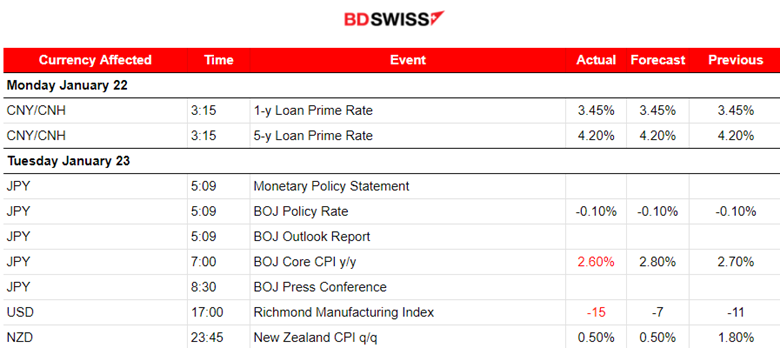

PREVIOUS WEEK’S EVENTS (Week 22-26.01.2024)

Announcements:

U.S. Economy

The quarterly GDP report for the U.S. last week showed that the economy grew at a faster pace than expected in the fourth quarter, suggesting the Federal Reserve would be in no rush to cut interest rates. The Advance GDP estimate showed a 3.3% annualised rate, compared with the consensus forecast of a 2% growth rate.

Initial claims for state unemployment benefits increased 25K to a seasonally adjusted 214K for the week ended Jan 20th. This was a strong increase showing tighter labour market conditions entering in January, and soon after the holiday season.

______________________________________________________________________

U.S. Inflation

U.S. prices rose marginally in December. The annual increase in core PCE inflation stayed below 3% for a third straight month. The U.S. central bank however is expected to keep its policy rate unchanged at the current 5.25%-5.50% range at its meeting this week. Excluding the volatile food and energy components, the PCE price index climbed 0.2% after rising 0.1% in November. The Fed tracks the PCE price measures for its 2% inflation target. Monthly inflation readings of 0.2% over time are necessary to bring inflation back to target.

New Zealand Inflation

New Zealand consumer inflation grew at a slower pace in the December quarter, meeting expectations. High-interest rates are having a desirable effect on inflation, however, it is not yet enough as the target level is still way lower. The Consumer Price Index (CPI) inflation rose 0.5% quarter-on-quarter, slowing from the 1.8% growth seen in the prior quarter. On an annualised basis, CPI rose 4.7% in the December quarter, easing from the previous quarter’s 5.6% growth.

Inflation is above the Reserve Bank of New Zealand’s (RBNZ’s) 1% to 3% annual target range and so interest rates are expected to remain higher for longer until inflation falls within its target range. The RBNZ has not said anything about trimming rates soon.

______________________________________________________________________

BOJ Interest Rates

The Bank of Japan (BOJ) maintained the -0.1% policy rate, an ultra-easy monetary policy. The decision was widely expected. The central bank also suggested that an end to negative interest rates could take place soon. Negative rates have been in place since 2016.

BOJ Governor Kazuo Ueda: “The prospects of seeing trend inflation hit 2 percent are gradually heightening. That is a desirable development. But it is hard to quantify how close we have come.”

BOC Interest Rates

As widely expected the Bank of Canada (BOC) held its key overnight rate at 5% on Wednesday and mentioned that cutting borrowing costs, rather than hikes, are more probable.

Annual inflation in December accelerated to 3.4%, still higher than the central bank’s 2% target but below a June 2022 peak of 8.1%.

ECB Interest Rates

The European Central Bank’s (ECB) decision was to hold the 3 key interest rates steady and reaffirmed its commitment to fighting inflation, commenting that soon will be the time to cut borrowing costs. The ECB mentioned that it is too soon to discuss a reversal in interest rates since price pressures persist.

While fighting inflation aggressively, economists worry about the economies in the Eurozone, since recent data show worsening business conditions.

The ECB expects household and government spending to drive a recovery but data appear to be painting a bleaker picture, with manufacturing remaining in recession and services cooling.

Disruptions to trade from attacks by Yemen’s Houthi group on shipping in the Red Sea could add to inflation by pushing up energy and freight costs, she warned. “We are observing it very carefully,” Lagarde said.

______________________________________________________________________

https://www.reuters.com/markets/new-zealand-4q-cpi-rises-05-quarter-2024-01-23/

_____________________________________________________________________________________________

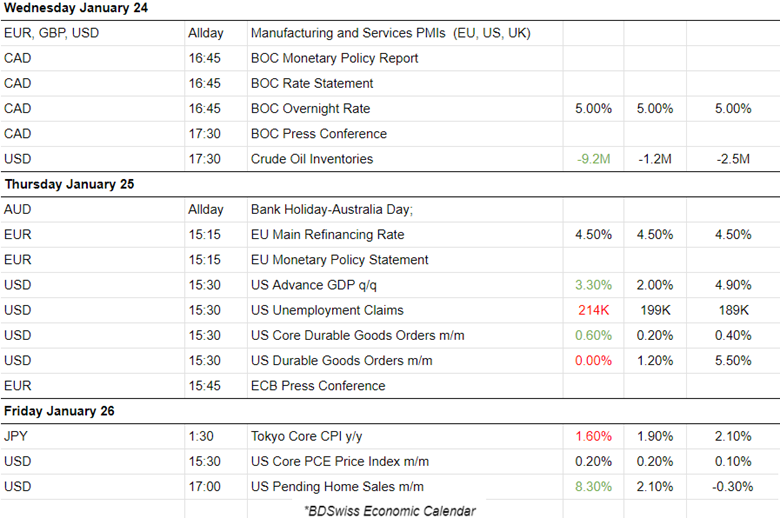

Currency Markets Impact – Past Releases (Week 22-26.01.2024)

Server Time / Timezone EEST (UTC+02:00)

PMI releases for both the manufacturing and the services sector. Eurozone PMIs

Eurozone PMIs

The French economy continues to show grim PMIs for both sectors with the manufacturing sector showing the worst figure of 43.2. Overall the economy ended the year 2023 in deep contraction and began the new year with more deterioration in January, with faster falls in output at both service providers and manufacturers leading to the steepest overall rate of decline since last September.

Germany continued the downturn in the private sector while stepping into the new year as business activity fell for a seventh straight month in January. The manufacturing PMI, despite improvement to a 45.4 figure, remains in contraction while the services PMI actually moved away from the 50 threshold, to a worse 47.6 points figure.

The Eurozone downturn moderates somehow at the start of 2024. The PMI figures are still reported in contraction however reports show that business activity fell at the slowest rate for six months in January. Downturns persist significantly in both manufacturing and service sectors, however, the market runs with a sense of optimism about future business conditions.

The U.K.’s PMIs are obviously showing a better picture, especially for the services sector. The Manufacturing sector saw an improvement but is still in contraction while the services sector continues with a stable expansion with the last PMI figure for services to be recorded at 53.8 points, in the expansion area. The rise in service sector activity was the fastest since last May, whereas manufacturing production decreased to the greatest extent for three months.

The U.S. PMI for the manufacturing sector, surprisingly, was recorded in expansion while the services PMI improved. Business activity expanded at the fastest pace in seven months boosting confidence with stronger orders growth and expectations for lower inflation in 2024.

_____________________________________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin started to recover slowly from the recent downturn that followed after the long-awaited ETF approval from the U.S. regulator for some major asset managers. On the 26th Jan, it recorded a rapid price movement to the upside, leaving from the 40,000 USD mean, and reaching the resistance 42,250 USD. Retracement followed back to the 61.8 Fibo level that coincides with the 30-period MA. The price continued upwards steadily breaking that resistance and reaching the next at 42,800 USD before it reversed back to the MA and finally settled near the 42,250 USD level. _____________________________________________________________________________________________

_____________________________________________________________________________________________

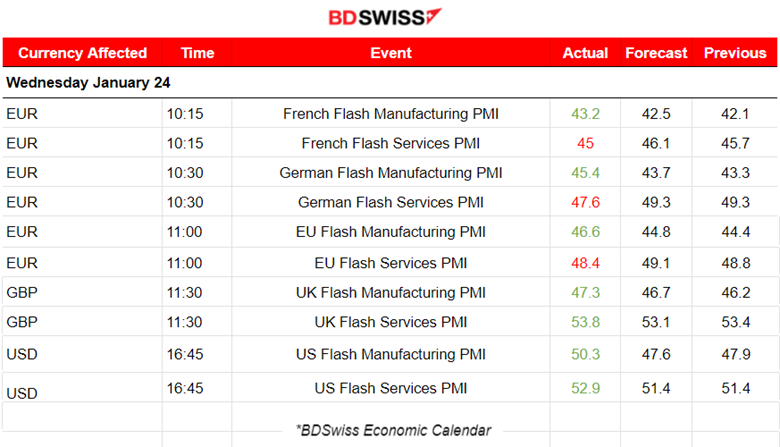

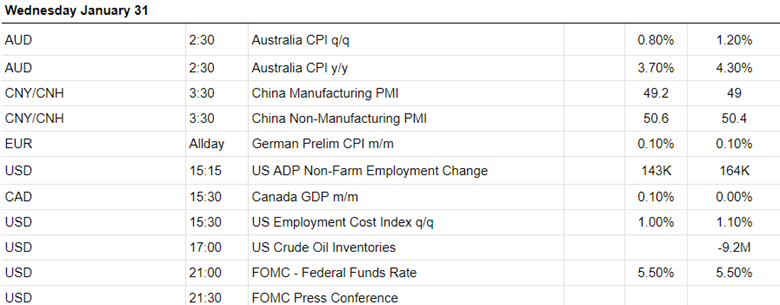

NEXT WEEK’S EVENTS (29.01 – 02.02.2024)

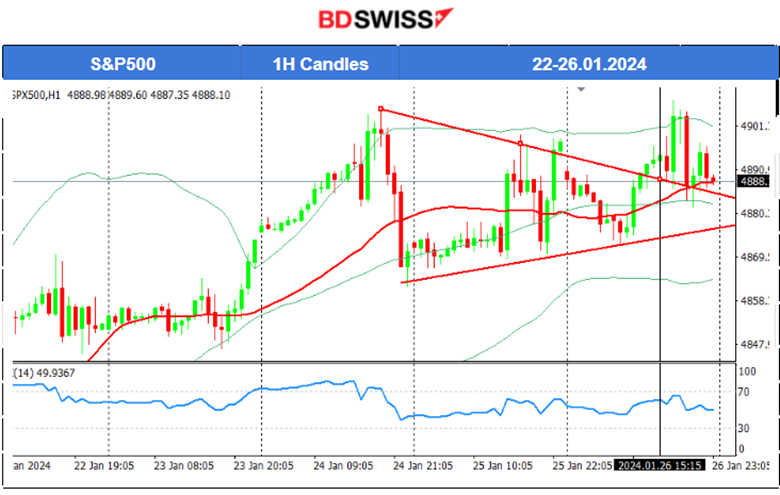

Coming up next week, two Central Banks, the Federal Reserve (Fed) and Bank of England (BoE) will comment on monetary policy and release their interest rate decisions.

Major news include labour market data releases for the U.S. with a focus on the NFP report on Friday.

Manufacturing PMI releases this week.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

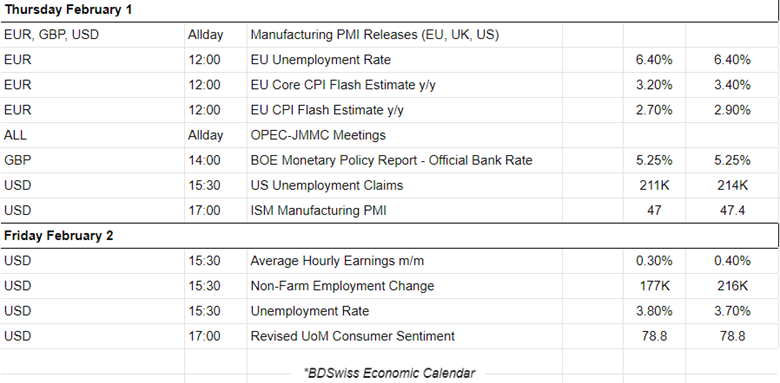

Crude oil moved higher, as mentioned in our previous report since technicals were strongly supporting an upward movement. During last week the price had steadily formed an upward wedge that was broken to the upside on the 25th. Crude oil moved upwards to find resistance at near 77.5USD/b before retracing to the 30-period MA and bouncing upwards until it reached 78 USD/b.

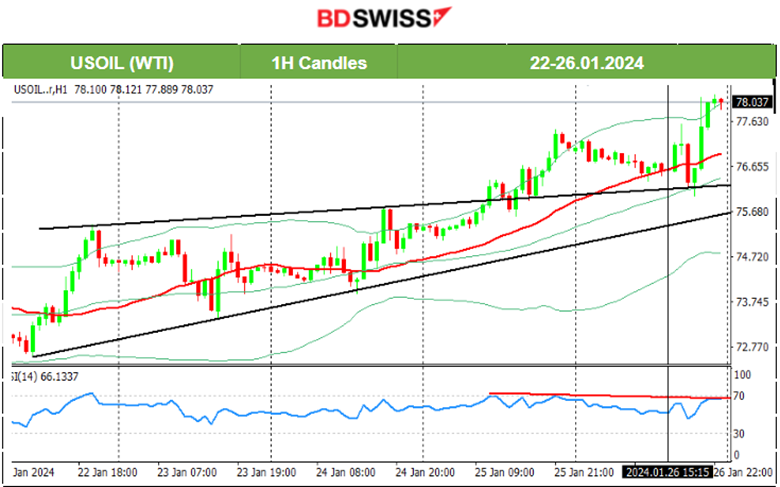

Gold (XAUUSD)

Gold (XAUUSD)

A triangle formation was apparent on the 24th Jan. The price dropped heavily breaking the triangle formation and moving to the 2010 USD/oz support level. Retracement followed back to 2020 USD/oz and the 61.8 Fibo level. On the 25th, gold experienced high volatility but the path remained sideways overall. That day it reached the resistance of 2025 USD/oz when it jumped after the ECB news, and reversal followed soon after back to the lows. It finally retraced later back to 2020 USD/oz. On the 26th Gold tested the resistance at near 2025 USD/oz without success during the volatile moves that took place, caused by the U.S. PCE Price Index news. It reversed immediately back to the MA continuing with the path around it and settled near the range 2018-2020 USD/oz once more.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

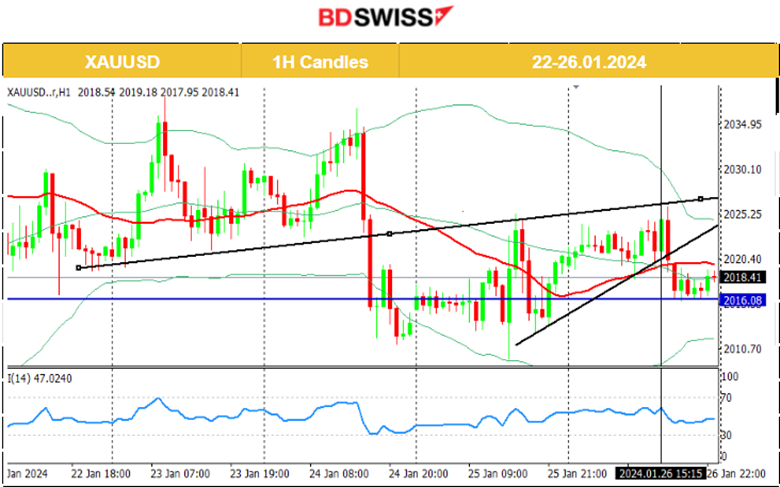

All benchmark U.S. indices moved to the upside quite rapidly in the past few days, particularly since the 17th Jan. The uptrend is clear with some retracements taking place every day, however not being complete as the path is quite strong to the upside. The 4H chart below shows why this is clear. Volatility levels are higher than usual. I am expecting a retracement soon. Upon NYSE opening it would be more clear if the index will move further to the upside or break the intraday support and eventually retrace to the 61.8 Fibo level as per the chart.

______________________________________________________________