Weekly Outlook

Handoff to ECB at Jackson Hole

Two weeks ago, we were all waiting to hear what Fed Chair Jay Powell would say about the US central bank’s rethink of its monetary policy framework. Now for the past week and much of next week, the European Central Bank (ECB) is in focus. We expect that they will either ease policy further or at least hint at easing policy further. That “monetary policy divergence” may continue to weaken the euro lower for some time.

The focus on the ECB started a few hours after Powell finished speaking, when ECG Chief Economist Philip Lane delivered a speech on “The pandemic emergency: the three challenges for the ECB.” He laid out the three challenges as follows:

The nature of the pandemic shock called for an extraordinary policy response. From the outset, there were three challenges for the ECB: (i) to stabilise markets; (ii) to protect credit supply; and (iii) to neutralise the pandemic-related downside risks to the inflation path.

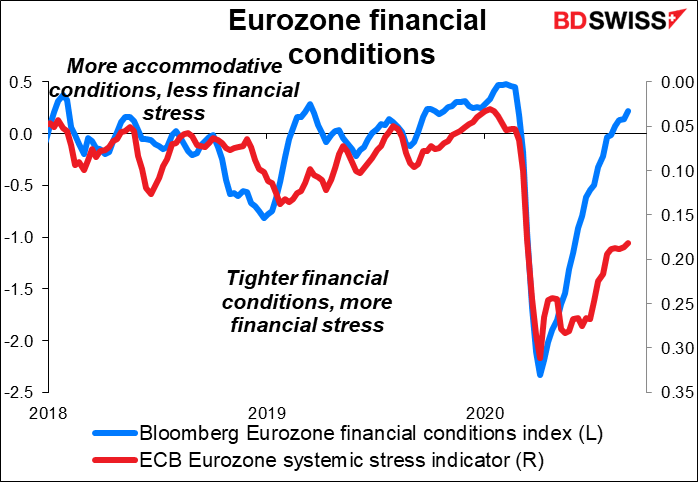

The ECB has managed to accomplish the first two stages. Financial conditions became very stressed at the beginning of the pandemic but are now back to neutral, although the ECB’s own Eurozone systemic stress indicator is still showing more stress than before.

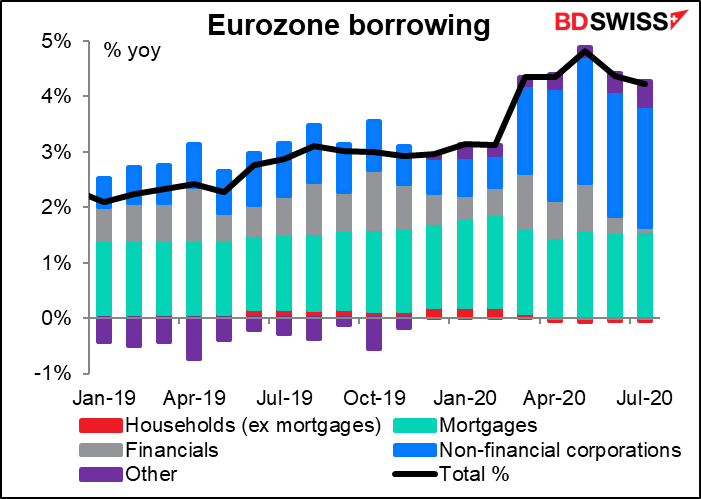

As for #2, protecting the credit supply, lending has accelerated since the pandemic began, so that’s mission accomplished.

The remaining challenge for the ECB then is “to neutralise the pandemic-related downside risks to the inflation path.” Lane summed up this challenge as a two-stage process. This is the part that got people thinking (and trading):

Accordingly, the monetary policy challenge consists of two stages. The first stage is to counteract the negative shock to the expected inflation path caused by the pandemic…Once the negative shock has been sufficiently offset, the second stage is to ensure that the post-pandemic monetary policy stance is appropriately calibrated in order to ensure timely convergence to our medium-term inflation aim. To these ends, the ECB Governing Council stands ready to adjust all of its instruments, as appropriate.

In talking of a second stage, Lane is implying that the ECB hasn’t yet accomplished this part of the challenge. And that’s where mentioning specifically that the Council “stands ready to adjust” blah blah blah is significant. Why would he say this if they weren’t thinking of adjusting anything?

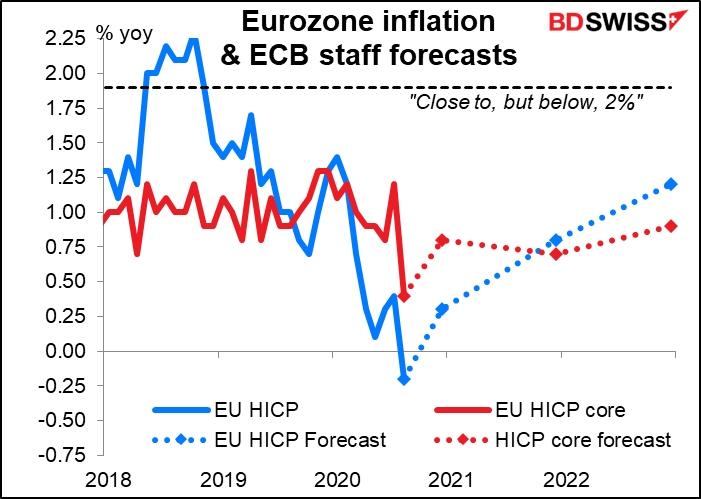

At next week’s meeting, the Council will get an updated version of the staff forecasts. These already show core inflation, which is what the ECB targets, remaining below 1% all the way out to the end of the forecast period in 2022. And these forecasts were made for the June meeting, when core inflation was 0.9% yoy – it’s since dropped to 0.4%. The new staff forecasts are likely to lower the forecast even further. That makes some “recalibration” of the policy stance almost inevitable.

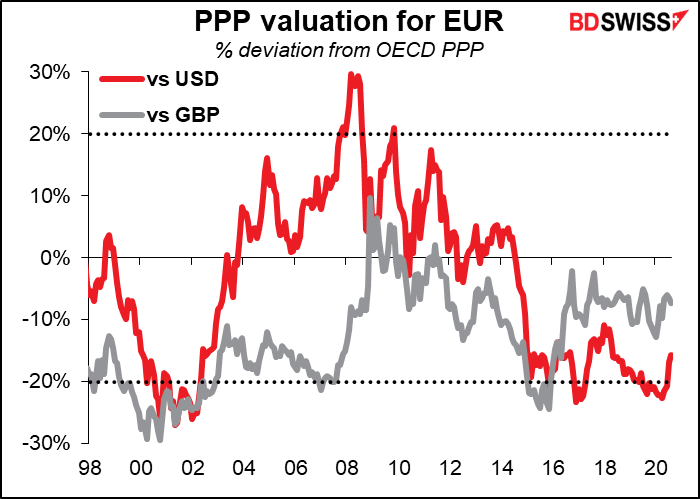

There’s also a lot of talk that the ECB is getting worried about the level of the euro. This makes good newspaper copy and gets a lot of clicks, but if they think that, they haven’t got a leg to stand on. The fact is, the euro is significantly undervalued, at least using the Organization for Economic Cooperation and Development (OECD) methodology, which is probably the best way to value a currency.

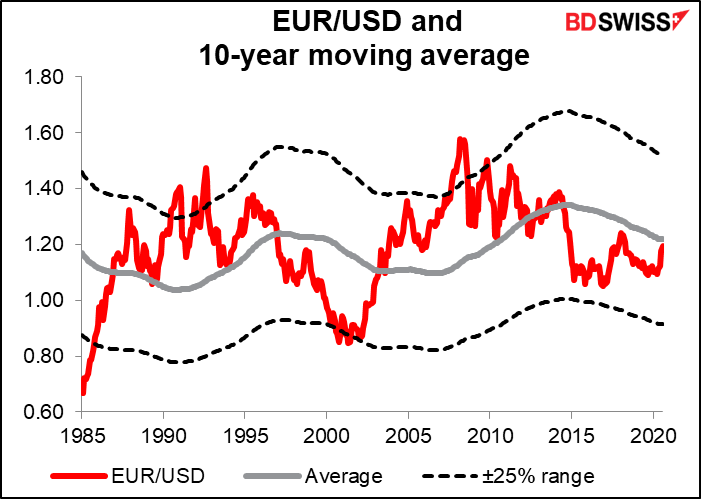

Of course, not everyone thinks in real terms. Most people just think in nominal terms. In that respect too, the nominal level of EUR/USD, the metric that most people would use to judge the currency’s value, is just about average. It’s nowhere near the level that usually signals a turnaround.

Certainly officials might want a weaker currency for various reasons, such as helping to boost inflation. As Mr. Lane observed this week, “the euro-dollar rate does matter.” “If there are forces moving the euro-dollar rate around, that feeds into our global and European forecasts and that in turn does feed into our monetary policy setting,” he said. A stronger euro reduces inflation by pushing down the cost of dollar-denominated commodities and goods, also by reducing foreign demand for EUR-denominated exports.

However, the impact of the exchange rate on inflation isn’t as much as one might think, no matter what Mr. Lane may say in public. A recent paper by the ECB’s own experts, The transmission of exchange rate changes to euro area inflation, concluded that the impact of exchange rate movements “is strong in the case of import prices, much weaker in the case of the producer price index (PPI) and barely noticeable for the consumer prices of non-energy industrial goods.” (emphasis added) They estimate that a 1% depreciation of the euro raises import prices by “about 0.30% within a year.” “Over the same period, headline HICP rises by about 0.04%, although the estimates are not always significantly different from zero,” they added.

If indeed they are worried about the exchange rate, it’s clearly not because of its impact on inflation. Rather, it’s just good ol’ fashion beggar-thy-neighbor export policy.

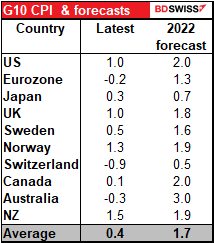

In any case, the ECB would probably be thinking of taking some action at this meeting anyway as the pandemic is reducing inflation world-wide. The market expects most of the G10 countries won’t be able to get inflation back to 2% by 2022.

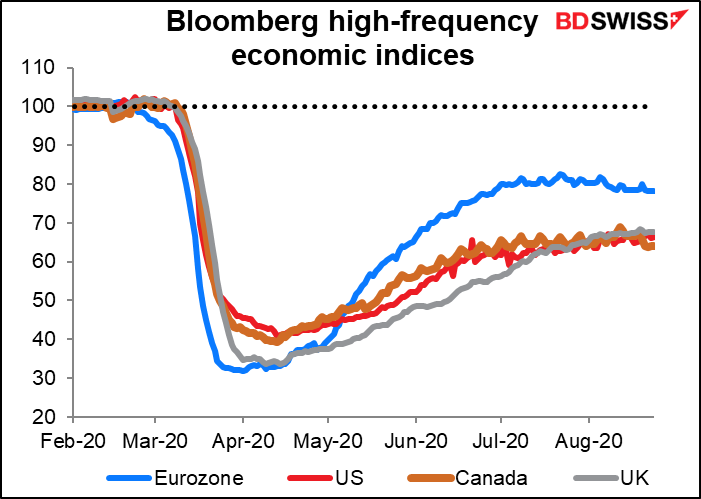

Besides, high-frequency data suggest that growth in the Eurozone is stalling. That’s got to be worrisome for the ECB as well. And that’s probably where the exchange rate and hopes for export-led growth come in.

Especially with the pandemic worsening again.

We then get into the thorny question of, what more can they do? With their deposit rate at -0.5% and their lending rate at zero, with an entire alphabet soup of lending programs, what can they come up with next?

They could choose just to talk or they could decide to act. If the former, they would simply add a lot of caveats about the uncertainty and the downside risks to the forecasts etc etc while talking about the need for further clarity about the path of the virus and the economic outlook. That would be a set-up for a move in December.

If they do decide to act, they have several alternatives. They could lower the deposit rate further. Governing Council Member Isabel Schnabel’s recent speech on negative rates made it clear that they think negative rates are an effective policy tool, although she did warn about the possible effects on the banking system if rates remain negative for too long, especially in the wake of the pandemic. They could firm up their forward guidance, adding more specific criteria or extending the duration. Or they could increase their quantitative easing through the Asset Purchase Programme (APP) They’re not out of tricks yet.

Impact on the market: Looking at the sharp move down from 1.20, it’s clear that the market expects them to do something at this meeting. That sets us up for a “sell the rumor, buy the fact” response if they fail to live up to market expectations. I would expect EUR/USD to decline further ahead of the meeting and then probably rebound a little afterward. There could be a further drop if they manage to equal or surpass expectations but speculators may well see that as a chance to take profits and go long again.

Bank of Canada: not so complicated. On hold

By comparison, Wednesday’s Bank of Canada meeting presents no such major issues. The BoC’s Governing Council is largely a bunch of happy campers as far as I can tell, except who knows? Senior Deputy Gov. Wilkins may well be stewing about being passed over for the Governorship, although she certainly hasn’t shown any signs of that in public.

Aside from that though they seem to be satisfied with the results of their monetary policy and the way the Canadian economy is behaving. At their 15 July meeting they said that the decline in activity was “considerably less severe than the worst scenarios presented in the April Monetary Policy Review.” “There are early signs that the reopening of businesses and pent-up demand are leading to an initial bounce-back in employment and output,” they added.

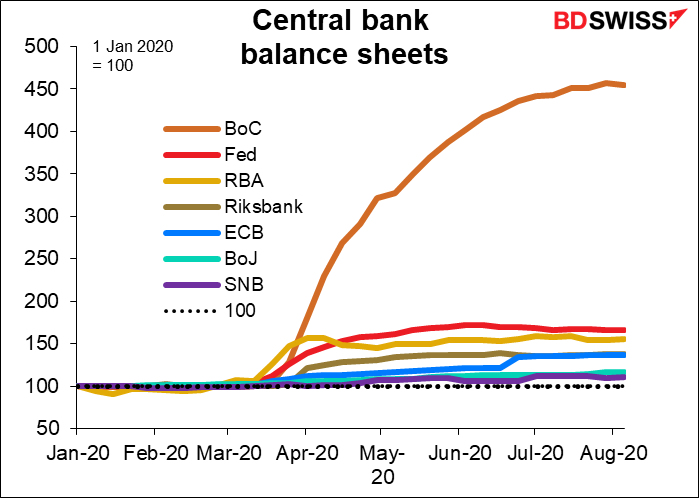

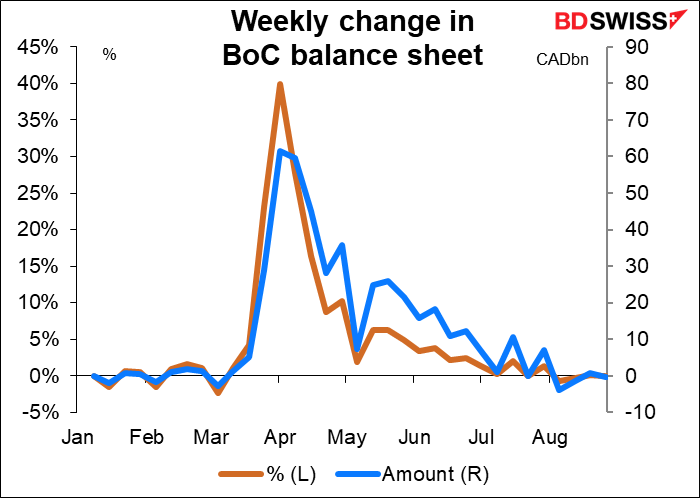

The most obvious sign of what they’re likely to do is what they’ve been doing with their balance sheet. The BoC was far and away the most aggressive of the major central banks in blowing up its balance sheet following the pandemic.

They blew it up by 40% in one week back in April! But recently they’ve begun to shrink their balance sheet. That suggests to me that they’re satisfied with where they are and don’t plan on taking any new steps at this meeting.

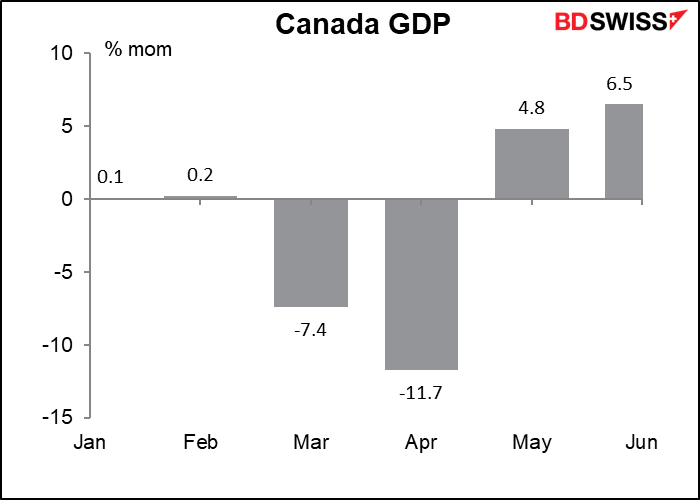

Despite the shrinking balance sheet, the Governing Council seems to be keeping its pledge to continue “its large-scale asset purchase program at a pace of at least $5 billion per week of Government of Canada bonds… until the recovery is well underway.” (emphasis added). My question is, might they declare at this meeting that the recovery is indeed “well underway” and thereby give themselves room to reduce these purchases? Growth has been bouncing back…

…although there are signs from the high-frequency data that it may be plateauing, as is the case elsewhere too.

I think we could have a hawkish change in that they could reduce their QE program. That might be positive for CAD. Otherwise I expect policy to remain unchanged. In particular, I see no change in their pledge to “hold the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved.”

Economic indicators: US CPI, UK short-term indicator day

Outside of those two central bank meetings, the calendar is rather bare next week, as is usual for the second week of the month. The main features will be the US consumer price index (CPI) and Britain’s short-term economic indicator day, both on Friday.

The headline rate of inflation is expected to pick up a bit in the US, while the core rate is expected to remain the same. Last month the CPI was quite a surprise and had a big effect on the market – but not the effect you might expect (well, not the effect I expected). The headline CPI rose 0.6% mom, double what was expected, and core CPI also rose +0.6% mom vs +0.2% expected. The notable point was that the dollar dropped after the news – in days gone by, currencies used to rise when inflation accelerated because the news made a subsequent rise in interest rates more likely. But with the Fed on hold indefinitely, any acceleration in inflation just means a decline in real interest rates, which is negative for the currency.

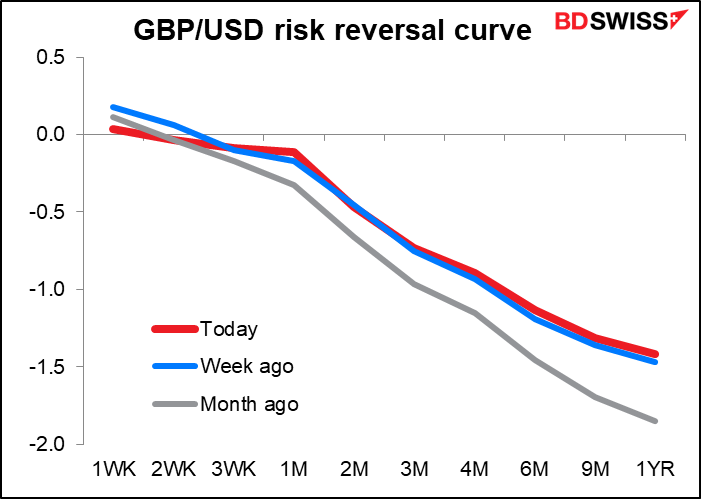

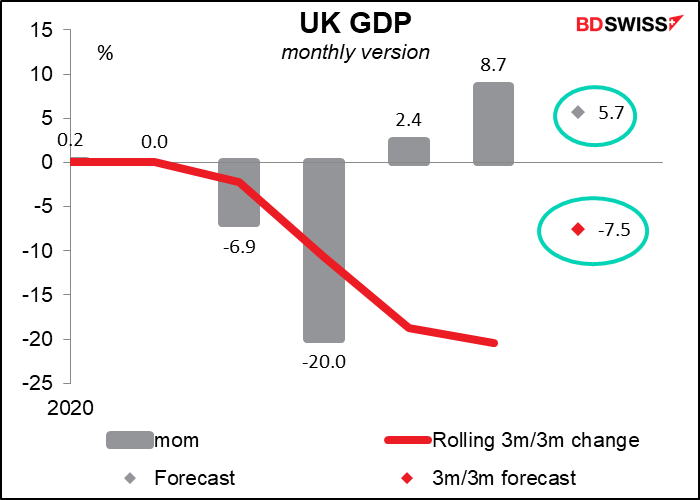

Finally, with UK short-term indicator day, we get UK monthly GDP, industrial & manufacturing production, and the trade balance. Much to my surprise, the Bloomberg ranking indicators show the GDP figures are the least-watched of these three sets, but I piut them as the most important for the FX market. They’re expected to show a continued recovery in the UK economy in July, which may help to reassure the markets about the health of the UK economy and boost GBP (assuming people ignore the Brexit talks).

In addition to those indicators, Round Eight of the Brexit talks will take place in London. So far there are no signs of a breakthrough and I don’t expect any this time, either. EU Brexit negotiator Michel Barnier has said he is “worried and disappointed” about the UK’s approach to the talks. He said the EU was willing to compromise, but that the UK was refusing even to put proposals on the table for the key points of fisheries and state aid to industry. Meanwhile, a spokesman for PM Johnson admitted that “major difficulties remain” in the talks.

Much to my surprise though the market doesn’t seem to care very much about Brexit any more – either it’s such old news by now that it’s been entirely discounted, or against the background of a pandemic that threatens the very existence of humanity, it’s not as big a deal as it was before. Surely no matter how big the problems are next January, it’s not going to result in another 20.4% qoq drop in GDP like Britain already had in Q2. (For the record, the market is forecasting +1.3% qoq GDP growth in Q1, the first quarter of real Brexit.)