Weekly Outlook

Interest Rates and NFP: Fed holds at 5.25%-5.50%, 122K jobs added in July

PREVIOUS WEEK’S EVENTS (Week 29.07 – 02.08.2024)

U.S. Economy

CB Consumer Confidence: The Consumer Confidence Index increased to 100.3 in July from 97.8 in June. However, the Present Situation Index decreased to 133.6 from 135.3, while the Expectations Index rose to 78.2, indicating recession concerns as it remains below the critical 80 mark.

JOLTS Job Openings: Job openings were stable at 8.184 million, slightly down from 8.23 million in May but above the forecast of 8 million. Key sector changes included an increase in accommodation and food services (+120K) and a decline in durable goods manufacturing (-88K).

US ADP Employment: The private sector added 122K jobs in July, falling short of forecasts, with continued moderation in pay gains.

US Fed Funds Rate: The Federal Reserve maintained the target range at 5.25%-5.50%, noting progress towards the 2% inflation goal.

ISM Manufacturing PMI: The ISM Manufacturing PMI dropped to 46.6 in July, below the 48.8 estimate, with jobless claims rising to 249,000, surpassing the 236,000 forecast.

Mastercard Earnings: Mastercard reported Q2 net income of $3.3 billion with EPS at $3.50. Revenue grew by 11%, gross dollar volume increased by 9%, and purchase volume rose by 10%.

Apple Earnings (NASDAQ: AAPL): Apple reported EPS of $1.40 and revenue of $85.78 billion, with iPhone revenue at $39.30 billion, all exceeding estimates.

German Economy

German Prelim CPI m/m: The inflation rate stood at 2.3% YoY, with a provisional CPI increase of 0.3% MoM. The HICP rose by 2.6% YoY and 0.5% MoM, while core inflation excluding food and energy reached 2.9%.

Euro Area Economy

Euro Area Inflation: Annual inflation increased to 2.6% in July 2024, higher than expected, primarily driven by a 1.3% rise in energy costs.

Euro Area Unemployment Rate: The unemployment rate ticked up to 6.5% in June from 6.4% in May.

Australian Economy

Monthly CPI: The Consumer Price Index rose 3.8% YoY in June, down from 4% in May, with transport costs being a key driver of the decrease.

Australia Balance of Trade: The trade surplus expanded to AUD 5.59 billion in June, exceeding the forecast of AUD 5 billion, with exports increasing by 1.7% to AUD 43.77 billion.

Japanese Economy

BOJ Interest Rate: The Bank of Japan raised the short-term interest rate to approximately 0.25% in July, reducing bond purchases to JPY 3 trillion from JPY 6 trillion starting January 2026.

Canadian Economy

Canada Monthly GDP: The economy is expected to grow by 0.1% in June, with positive contributions from the construction and finance sectors, while manufacturing declined.

United Kingdom Economy

United Kingdom Interest Rate: The Bank of England cut the Bank Rate by 25 basis points to 5% in August.

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 29.07 – 02.08.2024)

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

Dollar Index (US_DX)

Last week, the dollar index experienced a bearish trend, opening at 103.890 and closing at 102.787, with a high of 104.362 and a low of 102.780. It is now approaching support at 101.998; a breakdown could lead to further declines toward 100.885 and 99.400. If the support holds, a rebound to 102.897 and 103.603 is likely.

EURUSD

EURUSD

Last week, EUR/USD showed a bullish trend, opening at 1.08579 and closing at 1.09092, with a low of 1.07776 and a high of 1.09269. Currently, a potential resistance breakout is spotted at 1.09814 on the 4-hour chart. If the breakout holds, the pair could rise to 1.10851 and 1.12170. However, if the breakout fails, the exchange rate may decline to 1.08999 and 1.08358.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

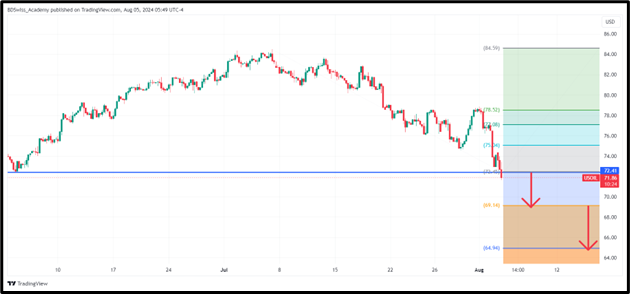

CRYPTO MARKETS MONITOR

BTCUSD

BTCUSD saw a bearish trend last week, opening at $68,179.08 and closing at $58,019.46, with a high of $69,993.30 and a low of $57,172. The support level at $52,631.79 has been broken to the downside. If this breakout holds, prices could drop further to $48,874.77 and $43,110.68. Alternatively, if the breakout fails, prices may rebound to $56,971.16 and $59,769.91.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

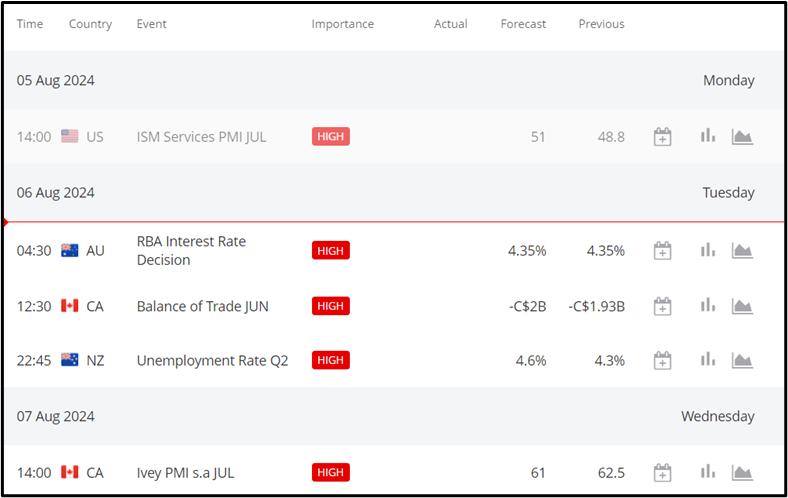

NEXT WEEK’S EVENTS (Week 05 – 09.08.2024)

Coming up:

Currency Markets Impact:

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

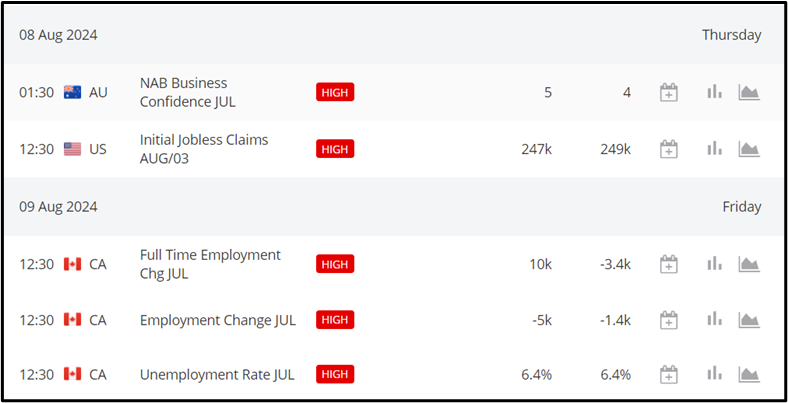

U.S. Crude Oil

USOIL had a bearish trend last week, opening at $77.51 and closing at $74.09, with a high of $78.84 and a low of $72.79. A support breakout is spotted on the 4HR chart at $72.45. If this support is broken, prices could decline further to $69.14 and $64.94. However, if the breakout fails, prices may rebound towards $75.04 and $77.08.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500)

Price Movement

The S&P 500 experienced a bearish trend last week, opening at $5,478.88 and closing at $5,346.55, with a high of $5,567.03 and a low of $5,300.13. A downside breakout of the uptrend line has been identified on the 4-hour chart at $5,427.40. If the breakout holds, prices could decline further to $5,322.16 and $5,242.54. Alternatively, if the breakout fails, prices may rise to $5,552.47 and $5,716.44.

Sources:

Sources:

https://km.bdswiss.com/economic-calendar/

https://www.tradingview.com/u/BDSwiss_Academy/