Weekly Outlook

Now on to Brexit

The US presidential farce winds down, but the COVID-19 tragedy is in full swing

The drama of the US election is over. Trump has lost, Joe Biden is the President-elect, and only Republicans continue to deny reality – as they do climate change, the utility of wearing masks, even the existence of COVID-19, among other topics. The administration is even ending with the same delusion that it began with: lies about the size of the crowd gathered to support Trump.

Lest you think this tendency to ignore reality is unique to Trump and his myrmidons, let me remind you of a comment by some anonymous “senior official” during the George W. Bush years:

The aide said that guys like me [American journalist Ron Suskind] were “in what we call the reality-based community,” which he defined as people who “believe that solutions emerge from your judicious study of discernible reality.”… “That’s not the way the world really works anymore,” he continued. “We’re an empire now, and when we act, we create our own reality. And while you’re studying that reality — judiciously, as you will — we’ll act again, creating other new realities, which you can study too, and that’s how things will sort out. We’re history’s actors … and you, all of you, will be left to just study what we do.”

Anyone interested in where Trump comes from and how he could command the votes of some 70mn people should click the link above and read that rather long article about George W. Bush. You’ll learn that Trump isn’t the first Republican president who wasn’t very bright and didn’t appreciate anyone contradicting him. And that many Americans actually like that kind of confidence. And you’ll learn why people in the middle of America – “flyover country” – prefer presidents who are despised by the educated elites. “Because you know what those folks don’t like? They don’t like you!“

Trump’s lies have real-life consequences. There was a depressing thread on Twitter making the rounds recently. It’s by a nurse in South Dakota, a Republican state that is currently suffering the second-worst COVID-19 outbreak in the world (165 new cases a day per 100,000 population) (North Dakota is the world’s worst, with 181 new cases per 100,000 – by contrast, hard-hit England has 40 new cases per 100,000 and the worst-hit part of Spain, 71.)

I have a night off from the hospital. As I’m on my couch with my dog I can’t help but think of the Covid patients the last few days. The ones that stick out are those who still don’t believe the virus is real. The ones who scream at you for a magic medicine and that Joe Biden is going to ruin the USA. All while gasping for breath on 100% Vapotherm. They tell you there must be another reason they are sick. They call you names and ask why you have to wear all that “stuff” because they don’t have COViD because it’s not real. Yes. This really happens. And I can’t stop thinking about it. These people really think this isn’t going to happen to them. And then they stop yelling at you when they get intubated. It’s like a horror movie that never ends. There’s no credits that roll. You just go back and do it all over again.

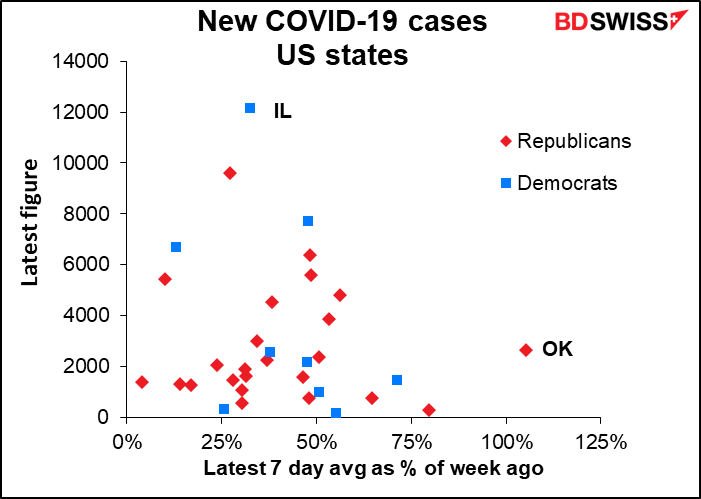

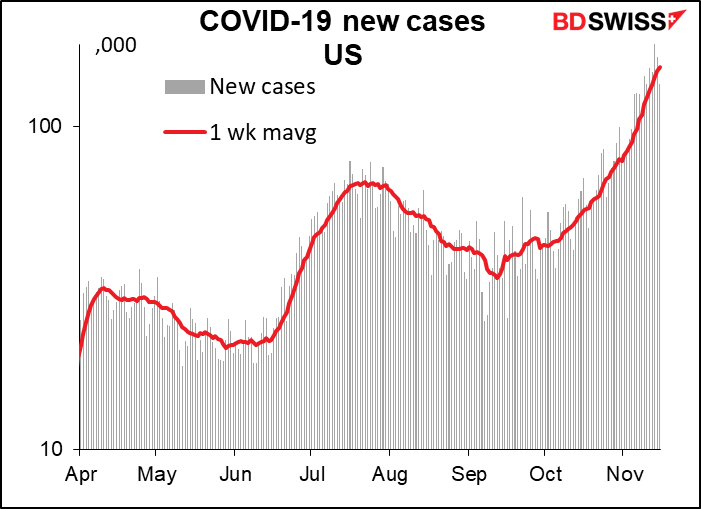

As a result, the virus is exploding across America. There are over 150,000 new cases a day in the US now, up 40% over just the last week, with several states seeing increases of over 50%. Hospitals are becoming overwhelmed. In some states, infected health workers can’t even go into quarantine because they are so desperately needed. Yet because Trump continues to contest the election, President-elect Biden doesn’t have the authority to start tackling the problem. That’s going to delay a solution even longer.

It seems that the lockdown measures in the EU have started to have some impact there, but in the US, Republican politicians (and citizens) have resisted such measures and continue to do so. That suggests to me that while the pandemic may start to get under control in Europe, its explosion is just starting in the US.

Note that when we plot the US cases in logarithmic scale, the red line is still curved. That means the US is not just in exponential growth (in which case the red line would be straight) but rather is in accelerating exponential growth. That’s a disaster.

The big question for this week is which of the two narratives wins out: the “virus is exploding” narrative or the “vaccine is around the corner” narrative.

While reality is getting worse and worse, hopes are getting higher and higher. Moderna, another pharmaceutical company working on a vaccine, is expected to release the first interim analysis data on late-stage trials of its vaccine. It uses a technology similar to that of the successful Pfizer’s vaccine and therefore is expected to prove highly effective. And according to the WHO, there are more than 150 vaccines for the virus currently in development, with around 44 candidates in clinical trials and 11 undergoing the same sort of late-stage testing that encouraged the market so much last week.

The former is distinctly negative for risk and the dollar: with little chance of any near-term fiscal stimulus, the burden of supporting the imploding US economy will fall entirely on the Fed. The latter however is clearly “risk-on” and less negative or even positive for the dollar, as it implies less Fed easing will be necessary.

Brexit to be center stage this week

With the US elections all over but the demonstrating, Brexit will be the focus of interest this week. The two sides set a deadline of 15 November – yesterday – as the deadline for reaching an agreement. I can now predict with some certainty that that deadline will not be reached!

Instead, the deadline is Thursday, when the EU leaders will meet in a videoconference. According to the European Council (EC), the meeting will focus on “the EU response to the COVID-19 pandemic.” Of course there’s plenty to discuss on that topic; since their last conference on the subject (29 October), there’s been substantial progress on a vaccine. Nevertheless, I’m sure they could find some time to discuss Brexit, if there’s anything new to discuss. That’s not a given by any means however. It looks likely to me that the talks will extend into December. The real deadline is probably the 10 December EC meeting. If they don’t reach an agreement by then, there won’t be enough time to have it ratified by all the EU governments before 1 January 2021, when agreement or no agreement, the UK will cease being part of the European Union.

One wonders what (if any) impact Dominic Cummings’ departure from #10 Downing Street will have on the negotiations. Cummings was PM Boris “The Big Umbrella” Johnson’s chief adviser and architect of Britain’s exit from the EU. A spokesman for the PM denied that the departure of Cummings and one of his allies would soften Britain’s stance. On the contrary, s/he said that the government’s position was “unchanged.” The Guardian, apparently talking to the same source, reported that Johnson is the main one holding out for better terms.

There’s one theory making the rounds that contrary to popular belief, a “no-deal” Brexit might be better for the PM than a deal. That’s because deal or no deal, there’s likely to be chaos on 1 January as new customs barriers go into effect and the new IT systems used to implement them boot up. As for the private sector, the Bank of England’s Decision Maker Panel noted that 33% of businesses surveyed were either only “partially” prepared or “not prepared at all” for Brexit, while only 5% said they were “fully prepared.” It would be easier for PM Johnson to say “it’s all because of the evil Mr. Barnier and the cruel EU” than it would for him to explain why there was such chaos when the government had five years to prepare. Plus any compromise might create an opening for the risible Nigel Farage, who is back in the news with his relaunched Brexit Party, now called Reform UK Party.

I still expect Johnson to fold like an umbrella. I don’t believe anyone is irresponsible enough to go through with a “no-deal” Brexit, especially now that Trump is out of office and compromise has come back into style. News of a compromise agreement would no doubt be beneficial for the pound. Nonetheless, I have to say it’s getting late in the day to work out a compromise.

US: vote on Judy Shelton

In the US, there are several important indicators, but the main focus (aside from the virus & politics, of course) is likely to be the Senate confirmation vote for Fed Board of Governors nominee Judy Shelton. Shelton and Trump’s other pick, Christopher Waller, were nominated a year ago but their confirmation has been held up due to doubts whether Shelton could garner the necessary support in the Senate. They may come up for a vote on Tuesday or Wednesday.

Waller is currently Executive Vice President and Director of Research at the St. Louis Fed. Before joining the Fed he held a variety of academic and advisor positions. He’s a typical candidate for the Board of Governors, a PhD in Economics whose research has focused on a variety of topics related to monetary policy. Although some may disagree with his dovish bias, no one doubts his competence. He may well be approved without a vote so long as no one objects to him.

But Shelton…where does Trump find these people? It’s as if he has an HR department devoted to finding the most unqualified and inappropriate people possible. (That’s no exaggeration. We found out last week that the head of White House personnel is one Johnny McEntee. He was Trump’s aide and official bag-carrier until he was kicked out in 2018 after a security clearance check revealed a serious online gambling habit. He was brought back to the White House in February in his new post, for which he has no qualifications whatsoever.) Shelton used to be a staunch supporter of the gold standard and critic of the Fed’s 2% inflation target, arguing that instead the Fed should aim for zero inflation. She even questioned the need for a central bank in the first place. At least she did until Trump became president, whereupon she suddenly changed her tune and argued for a more expansive monetary policy, in line with Trump’s point of view. And now here she is.

Initially there were fears that Trump wanted her on the Board so that he could eventually install her as Fed Chair, either by firing Powell (not likely) or when Powell’s term ended in February 2022. It may be that the prospect of the appalling Shelton as Fed Chair was a bridge too far even for Trump’s spineless Senate lapdogs, who collectively have the backbone of a bed of kelp. But with that disastrous possibility now out of the way, they’re moving to get her (and Waller) on the Board at least, much like their recent last-minute appointment to the Supreme Court. That would give Trump five of the seven members of the central bank’s governing board, not to mention appointing the Chair.

On the one hand, Shelton is, like most of Trump’s appointees – indeed, like Trump himself – simply not up to the job. On the other hand, the full Board of Governors has seven members, while the policy-setting Federal Open Market Committee (FOMC) adds five regional Fed presidents to its voting members. So one bizarre non-consensus view will probably not have any discernable impact on policy unless it comes down to a tied vote.

Looking at the entire history of 814 FOMC votes since 1936, there were only three occasions when the policy measure was decided by one vote, and the last of those was in 1973 under the now-disgraced leadership of Arthur Burns. (The other two were in the 1960s under William Martin Jr., the longest-serving Fed Chair.) Under Powell, Yellen, and Bernanke, the closest votes have been 7-3, while Greenspan had one 7-4. So while Shelton is likely to be yet another Trump embarrassment for the US and a long-lasting one at that, she probably won’t have that much impact at the end of the day (unless of course sometime during her 14-year tenure on the Board another Republican president gets a chance to nominate the Fed Chair…) Furthermore, when she was the US representative on the European Bank for Reconstruction and Development she missed almost half the meetings, so we can always hope.

There are no G10 central bank meetings this week, but we will be hearing from a large number of central bank officials, including ECB President Lagarde (five times!), Bank of England Governor Bailey, Bank of Canada Gov. Macklem, and Fed Vice Chair Clarida, plus several other members of the Fed’s rate-setting Federal Open Market Committee (FOMC). It’s getting a bit boring though — we’ve heard over and over from most of them recently so I don’t expect to be blinded by any new fulgurating insights. Is Lagarde really going to say anything different in her five presentations this week than she did in her three last week? Bailey only speaks once this week, but will he suddenly change his mind after speaking three times last week?

Indicators: retail sales from US & UK, US industrial production

We’ll learn a lot more about October this week.

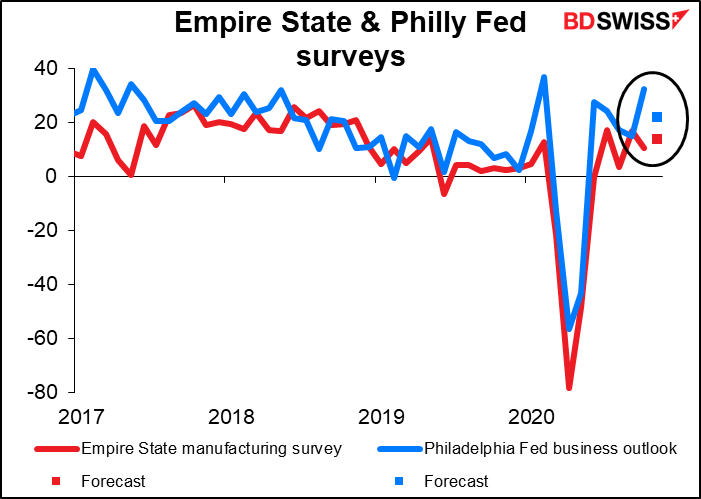

Among the “hard” data releases from the US are retail sales (Tue), industrial production (Tue), and housing starts and building permits (Wed). The “soft” data feature the Empire State and Philadelphia Fed surveys (Mon & Thu, respectively), our first official indications about conditions in November.

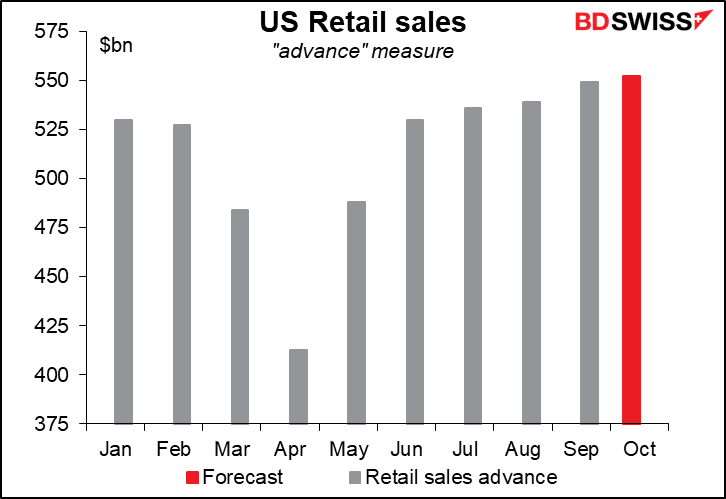

Growth in US retail sales is expected to slow somewhat, especially at the headline level, as sales of autos fell slightly last month.

That would still be enough to keep retail sales a healthy 4.5% above pre-pandemic levels.

Nonetheless, past performance is no guarantee of future performance. With virus cases surging across the US and renewed restrictions coming into force in many states, it’s almost inevitable that spending will fall over the next few months. And when the special unemployment payments under the CARES Act expire in January, many people won’t have any money to spend even if they had any place to spend it. October or November could be the high point for retail sales for now.

US industrial production is forecast to be up a relatively healthy 1.0% mom, but this would still leave it a depressing 6.2% below pre-pandemic levels.

As for the Empire State manufacturing survey and the Philly Fed business outlook survey, the former is expected to rise a bit and the latter is expected to fall a bit, with both remaining in expansionary territory. The combined image should be that the US economy continues to heal although at a slowing pace.

Britain besides Brexit

There are a couple of interesting UK indicators out this week: inflation data on Wednesday and retail sales on Friday.

Growth in the headline UK consumer price index (CPI) is expected to accelerate slightly to +0.6% yoy from +0.5%, but that would still leave it way below the Monetary Policy Committee’s area of tolerance (2% ±1 percentage point). The core inflation rate is forecast to remain unchanged. I doubt if this modest change will have any significant impact on anyone’s thinking.

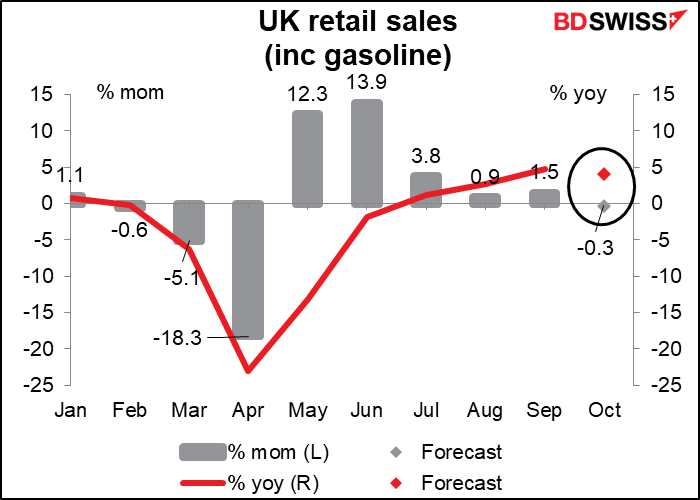

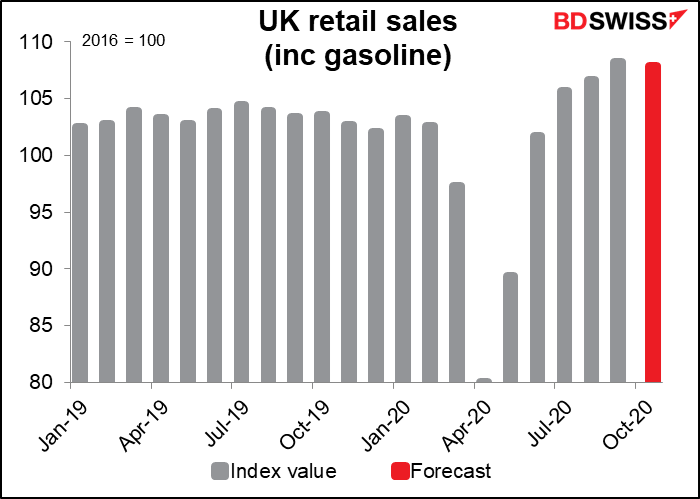

The retail sales figures however may be more of a problem for sterling. Sales are expected to register their first mom decline since April, and what with restrictions being reimposed across the country, it’s likely that they’ll fall further from here.

That said, just as in the US, sales have held up well so far – on the basis of the consensus forecast, they’re expected to be 4.8% above the pre-pandemic level as people continue shopping online.

Japan: start of the preliminary PMIs

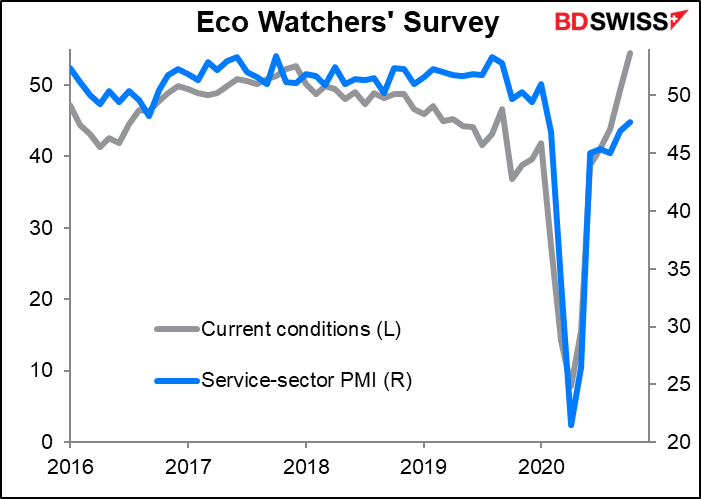

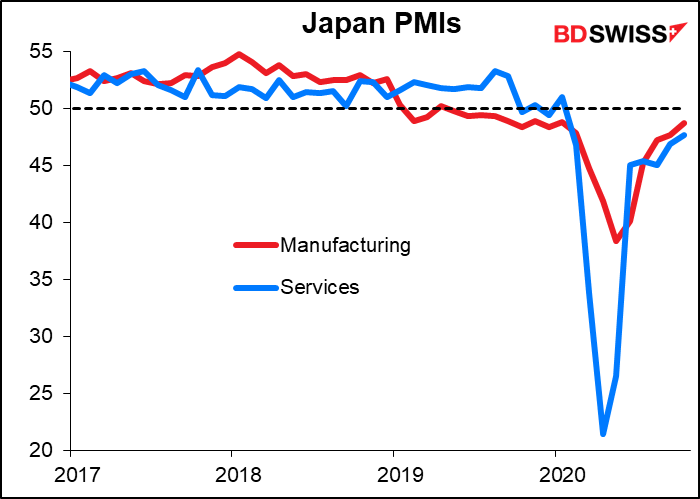

Finally, the only major indicators out from Japan during the week are the preliminary purchasing managers’ indices (PMIs) Friday morning. The rest of the preliminaries will come out the following Monday, Nov. 23rd, but that’s a holiday in Japan. As usual there are no forecasts for Japan’s PMIs. We will be waiting to see if they manage to poke their noses over the 50 line. The Eco Watcher’s survey

The Eco Watcher’s Survey has returned to a level consistent with the service-sector PMI over 50, but you never know – it seems to me that the Eco Watchers is more volatile than the PMI is.