Weekly Outlook

Nvidia Falls: Opens at $129.66, closes at $119.37 despite 122% YoY revenue surge, USOIL drops on Libya production cut, Core PCE index matches forecast at 0.2%

PREVIOUS WEEK’S EVENTS (26.08.2024 – 30.08.2024)

1. U.S. Economy:

Aug 27, 2:00 pm: CB Consumer Confidence (Actual: 103.3, Forecast: 100.9)

Aug 29, 12:30 pm: Prelim GDP q/q (Actual: 3.0%, Forecast: 2.8%)

Aug 29, 12:30 pm: Unemployment Claims (Actual: 231K, Forecast: 232K)

Aug 30, 12:30 pm: Core PCE Price Index m/m (Actual: 0.2%, Forecast: 0.2%)

2. Australian Economy:

Aug 28, 1:30 am: CPI y/y (Actual: 3.5%, Forecast: 3.4%)

3. European Economy:

Aug 29: German Prelim CPI m/m (Actual: -0.1%, Forecast: 0.0%)

Aug 30, 9:00 am: CPI Flash Estimate y/y (Forecast: 2.2%)

4. Canadian Economy:

Aug 30, 12:30 pm: GDP m/m (Actual: 0.0%, Forecast: 0.1%)

Currency Markets Impact – Past Releases (26.08.2024 – 30.08.2024)

1. U.S. Economy:

Aug 27, 2:00 pm: Bearish USD. CB Consumer Confidence (Actual: 103.3, Forecast: 100.9)

Aug 29, 12:30 pm: Bullish USD. Prelim GDP q/q (Actual: 3.0%, Forecast: 2.8%)

Aug 29, 12:30 pm: Bullish USD. Unemployment Claims (Actual: 231K, Forecast: 232K)

Aug 30, 12:30 pm: Bearish USD. Core PCE Price Index m/m (Actual: 0.2%, Forecast: 0.2%)

2. Australian Economy:

Aug 28, 1:30 am: Bullish AUD. CPI y/y (Actual: 3.5%, Forecast: 3.4%)

3. European Economy:

Aug 29, All day: Bearish EUR. German Prelim CPI m/m (Actual: -0.1%, Forecast: 0.0%)

Aug 30, 9:00 am: Bullish EUR. CPI Flash Estimate y/y (Forecast: 2.2%)

4. Canadian Economy:

Aug 30, 12:30 pm: Bullish CAD. GDP m/m (Actual: 0.0%, Forecast: 0.1%)

FOREX MARKET MONITOR

EURUSD (26.08.2024 – 30.08.2024) 1HR Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Last week, EUR/USD followed a bearish trend, opening at 1.11860 and closing at 1.10453, with a weekly low of 1.10452 and a high of 1.12008.

Looking ahead, EUR/USD is testing key support at 1.10443. A confirmed breakout to the downside could lead to further declines toward the 1.10018 and 1.09477 levels. However, if the support holds, the pair could rebound toward resistance at 1.10778 and 1.11040.

CRYPTO MARKET MONITOR

CRYPTO MARKET MONITOR

BTCUSD (26.08.2024 – 30.08.2024) 1HR Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Last week, BTCUSD exhibited a bearish trend, opening at $64,404.63 and closing at $59,216.34, with a weekly high of $64,405.78 and a low of $57,258.49.

Looking ahead, BTCUSD may potentially break the downtrend line to the upside at $58,778.88. If this breakout sustains, the price could target $59,981.84 and $60,926.22. Conversely, if the breakout fails, the price could retrace to $57,249.88 and $55,304.91.

STOCKS MARKET MONITOR

STOCKS MARKET MONITOR

NVIDIA (26.08.2024 – 30.08.2024) 1HR Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Last week, Nvidia experienced a bearish trend, opening at $129.66 and closing at $119.37, with a weekly high of $131.39 and a low of $116.73.

Looking ahead, Nvidia is approaching a potential breakout above the downtrend line at $119.90. If the breakout holds, the price could rally towards $122.36 and $124.29. However, if the breakout fails, the price may decline towards $116.78 and $112.80.

INDICES MARKET MONITOR

INDICES MARKET MONITOR

S&P 500 (26.08.2024 – 30.08.2024) 1HR Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Last week, the S&P 500 exhibited a bullish trend, opening at 5637.99 and closing at 5648.39, with a weekly high of 5651.78 and a low of 5561.40.

In the coming week, the S&P 500 is eyeing a potential breakout above resistance at 5651.28. If this breakout holds, the index could rally towards 5675.56 and 5706.44. Conversely, if the breakout fails, there is a risk of a pullback to 5632.11 and 5617.18.

COMMODITIES MARKET MONITOR

COMMODITIES MARKET MONITOR

USOIL (26.08.2024 – 30.08.2024) 1HR Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Last week, USOIL experienced a bearish trend, opening at $75.24 and closing at $73.59, with $73.59 marking the weekly low and $77.56 the weekly high.

In the upcoming week, USOIL could potentially reject the support of around $73.42. If this level holds, there is a strong probability of a bullish move toward $74.28 and $74.98. However, if the support fails, downside targets could extend to $72.26 and $70.81.

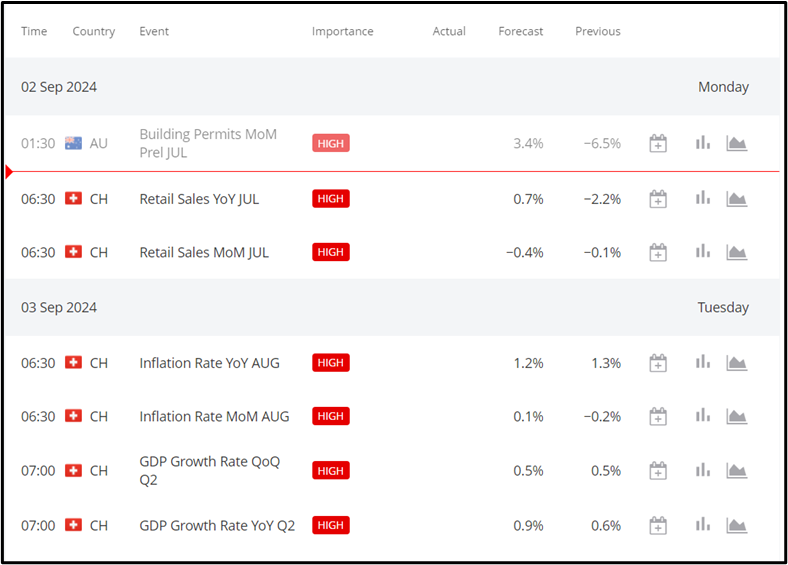

THIS WEEK’S EVENTS (02.09.2024 – 06.09.2024)

Coming up:

- Switzerland Economy

Sep 3, 6:30 AM: CHF CPI m/m. Higher than forecast may strengthen CHF; lower may weaken it.

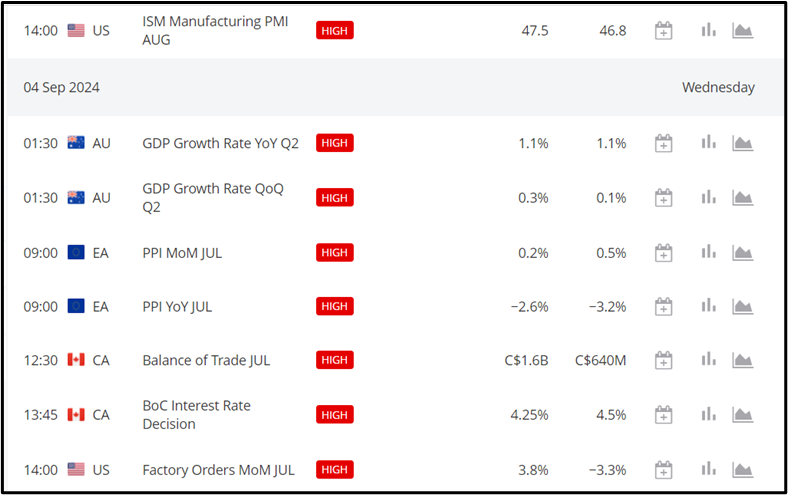

2. US Economy:

Sep 3, 2:00 PM: ISM Manufacturing PMI. The above forecast boosts the USD; the below forecast weakens the USD.

Sep 4, 2:00 PM: JOLTS Job Openings. Higher than forecast strengthens USD; lower weakens it.

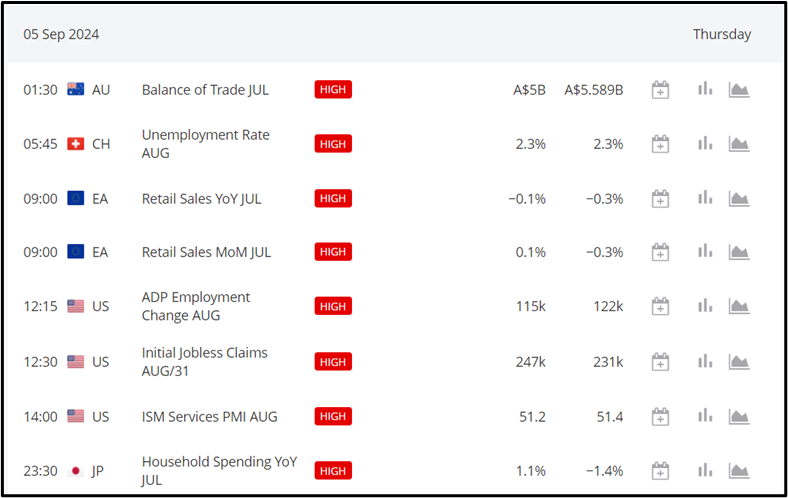

Sep 5, 12:15 PM: ADP Non-Farm Employment Change. The above forecast strengthens the USD; the below weakens it.

Sep 5, 12:30 PM: Unemployment Claims. Lower than forecast strengthens USD; higher weakens it.

Sep 5, 2:00 PM: ISM Services PMI. The above forecast strengthens the USD; the below weakens it.

Sep 6, 12:30 PM: Non-Farm Employment Change. The above forecast strengthens the USD; the below weakens it.

Sep 6, 12:30 PM: Unemployment Rate. Lower than forecast strengthens USD; higher weakens it.

Sep 6, 12:30 PM: Average Hourly Earnings m/m. The above forecast strengthens the USD; the below weakens it.

3. Australia Economy:

Sep 4, 1:30 AM: AUD GDP q/q. The above forecast strengthens AUD; the below weakens it.

Sep 5, 2:00 AM: RBA Gov Bullock Speaks. Remarks may influence AUD volatility.

4. Canada Economy:

Sep 4, 1:45 PM: BOC Rate Statement & Overnight Rate. A higher rate strengthens CAD; a lower weakens it.

Sep 4, 2:30 PM: BOC Press Conference. A hawkish tone strengthens CAD; a dovish tone weakens it.

Sep 6, 12:30 PM: Employment Change. The above forecast strengthens CAD; below weakens it.

Sep 6, 12:30 PM: Unemployment Rate. Lower than forecast strengthens CAD; higher weakens it.

SOURCE:

https://www.bfs.admin.ch/bfs/en/home.html