Weekly Outlook

PPI inflation lowered, worse U.S. consumer sentiment with 1-year inflation expectations to remain high at 3.3%, U.K. labour data show weakening, U.S. inflation lowered, FED and BOJ kept rates steady, RBA, SNB and BOE rate decisions ahead

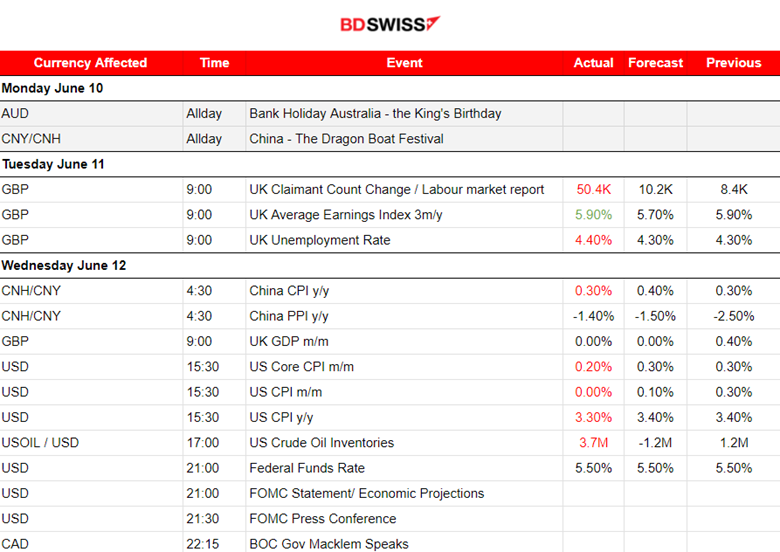

PREVIOUS WEEK’S EVENTS (Week 10- 14.06.2024)

U.S. Economy

PPI, U.S. producer prices, unexpectedly fell in May providing another indication that inflation was subsiding after surging in the first quarter. The producer price index for final demand dropped 0.2% last month after advancing by an unrevised 0.5% in April.

Fed officials pushed out the start of rate cuts to perhaps as late as December, with policymakers projecting only a single quarter-percentage-point reduction for this year.

U.S. consumer sentiment declined in June. The University of Michigan’s preliminary reading on the overall consumer sentiment index came in at 65.6 this month, down, compared to a final reading of 69.1 in May.

The survey’s reading of one-year inflation expectations was unchanged at 3.3%. Its five-year inflation outlook increased to 3.1% from 3.0% in the prior month.

U.K Economy

The U.K.’s unemployment figure unexpectedly rose to the highest in more than two and a half years. The jobless rate climbed to 4.4% in the three months through April, a level not seen since the middle of 2021. Average weekly earnings in the private sector, which the central bank is keeping a close eye on, increased by 5.8% — the slowest pace in two years even though the minimum wage increased by almost 10%.

The figures indicate that inflation may be lowering even further, allowing the central bank to reduce the highest borrowing costs in 16 years. Average earnings are rising in real terms as inflation falls but they could remain an obstacle if they are kept steady.

______________________________________________________________________

Inflation

U.S.

The U.S. inflation data showed cooling shaking the markets as the monthly and yearly inflation figures were reported unexpectedly lower. However, inflation likely remains too high for the Federal Reserve.

Excluding the volatile food and energy components, the CPI climbed 0.2% in May, less than April’s 0.3% rise. The core CPI increased 3.4% yearly, the smallest 12-month gain since April 2021, after a 3.6% advance in April. Inflation continues to run above the U.S. central bank’s 2% target.

______________________________________________________________________

Interest Rates

FED

The Federal Reserve held interest rates at a 23-year high while scaling back its estimate of rate cuts this year to one from three. The central bank kept its benchmark interest rate in a range of 5.25%-5.50% completing its two-day policy meeting.

Fed officials now see a median of four additional rate cuts happening in 2025. That is up from a prior forecast of three. The 2024 outlook for inflation, sees prices end the year at 2.8% from 2.6% previously as measured by their preferred inflation measure — the “core” Personal Price Expenditures (PCE) index.

The Fed needs better data to gain greater confidence that inflation is moving sustainably toward 2%. Fed Chair Powell has previously made it clear that, before cutting rates, the Fed will need more than a quarter’s worth of data to make a judgement on whether inflation is steadily falling toward the central bank’s goal of 2%.

Jerome Powell at the press conference declined to offer any guidance on when a first cut could happen. The odds of a first cut in September rose following the CPI report Wednesday morning and stayed at 58% following Powell’s comments.

BOJ

The Bank of Japan (BOJ) announced a quantitative tightening plan next month and kept interest rates unchanged. The BOJ said on Friday it would start trimming its bond purchases and announce a detailed plan to reduce its nearly $5 trillion balance sheet in July. It maintained its short-term policy target at 0%-0.1%.

BOJ is expected to raise interest rates at its next policy meeting on July 30-31.

______________________________________________________________________

Sources:

https://www.reuters.com/markets/europe/ecb-cuts-rates-keeps-next-move-under-wraps-2024-06-06/

https://www.reuters.com/article/idUSLDE68E0JH/

https://www.reuters.com/markets/us/us-producer-prices-unexpectedly-fall-may-2024-06-13/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 10- 14.06.2024)

Server Time / Timezone EEST (UTC+02:00)

Currency Markets Impact:

Currency Markets Impact:

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

Dollar Index (US_DX)

Last week the market was quite volatile due to the important scheduled releases and news that took place. Before the 12th of June, the dollar index was moving to the upside steadily with low volatility. The upside path was the result of a higher-than-expected NFP report that boosted expectations of a Fed rate cut delay. The path was interrupted on the 12th of June upon the release of the weaker U.S. CPI data release, causing the USD to depreciate heavily and the dollar index to drop, until it finally found support at near 104.27. After that event a reversal took place. Despite the weak figures for inflation the Fed kept interest rates steady and indicated that interest rate cuts could delay further past September. That caused the dollar to start strengthening significantly and the dollar index to follow an upward trend until the end of the week.

EURUSD

EURUSD

The pair was moving sideways around the mean with moderate volatility. The EUR is facing lower interest rates having an impact on the EURUSD. After the NFP the pair fell heavily around 80 pips before the sideways path started. On the 12th the U.S. inflation news caused the USD depreciation and a jump of the EURUSD pair. It eventually reversed to the downside and continued with a downward trend since the USD is currently experiencing strength.

USDJPY

USDJPY

The pair was moving sideways as well as the USD was driving the pair. On the 12th of June the pair experienced a drop with the U.S. inflation data release and a reversal took place soon during the trading day, back to the 30-period MA. The JPY sees weakening occasionally and due to that reason, the USD gains a lot of ground against the JPY. However, on the 14th of June, the BOJ kept rates steady and announced its decision for a future quantitative tightening plan. At the time of the rate decision, the pair dropped heavily and reversed to the upside. After the start of the press conference at 9:00 the JPY appreciated heavily causing the pair to drop again, reversing to the 30-period MA.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD

After some consolidation that lasted since the 11th of June, the price eventually crashed further, reaching a support near 67,200 USD. The price eventually retraced to the 61.8 Fibo level and settled at near 67.5K USD. On the 12th of June, the U.S. CPI news caused dollar depreciation and Bitcoin jumped to test again the 70K USD resistance. It was however unsuccessful and reversed to the 30-period MA. Volatility levels lowered but the price returned near the 67K USD support. On the 13th of June, the price tested the support without success and it reversed. Currently, volatility has lowered and the price remained close to the 67K USD level. On the 14th of June, after the U.S. news at 17:00, the price dropped and tested the support near 65K USD before it retraced to the 30-period MA. It remained low during the weekend and settled at near 66K USD.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

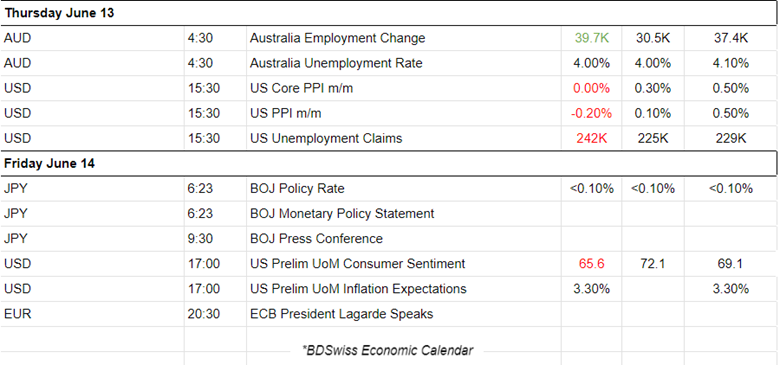

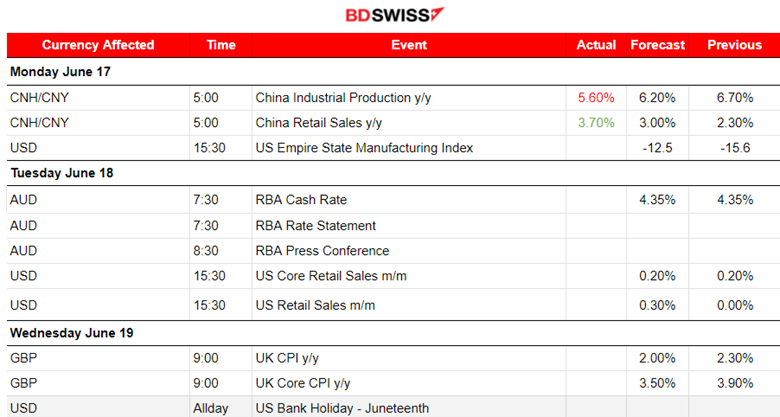

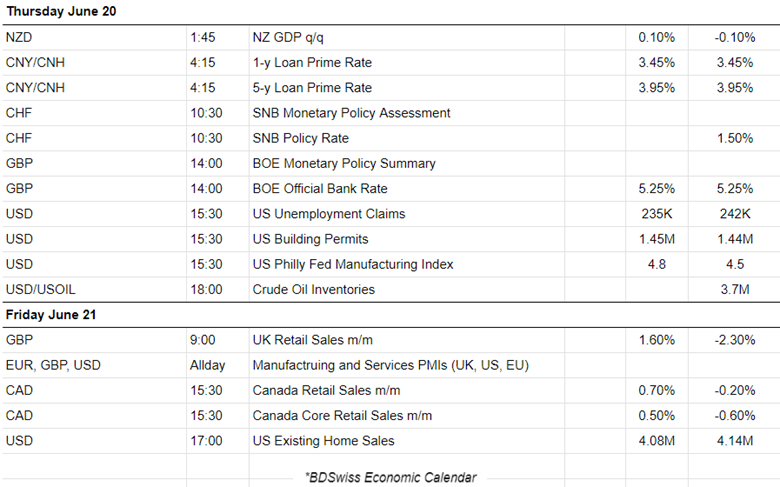

NEXT WEEK’S EVENTS (Week 17- 21.06.2024)

Coming up:

Currency Markets Impact:

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

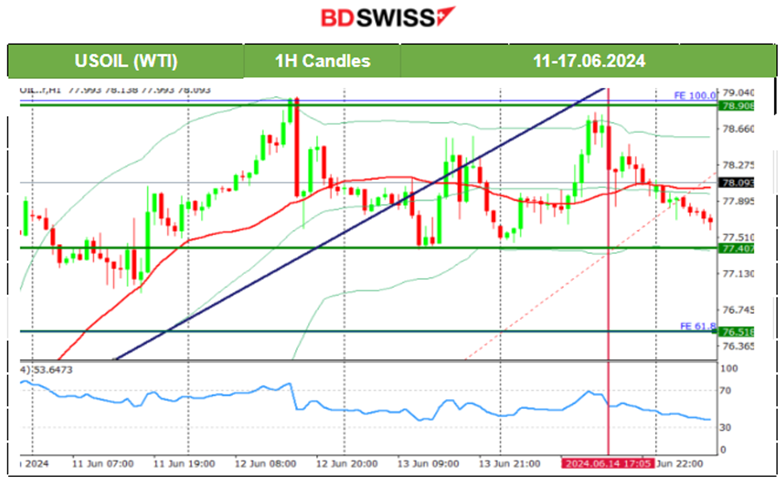

On the 12th of June, the resistance mentioned in our previous analysis was broken as predicted and the price moved higher. However, the U.S. inventories report released the same day at 17:30 had a negative impact on the price. Technically, that 79 USD/b level resistance looks like a turning point. On the 13th of June, the pierce remained on a sideways path despite the volatility, forming a triangle. That was broken on the 14th causing the price to jump and reach the resistance near 79 USD/b as mentioned in the previous analysis. The price finally reversed fully and stayed close to the mean, 78 USD/b. After a long-term uptrend, Crude oil is finally in a consolidation phase as it moves sideways in a 1.5 USD range. Why this is important because a breakout of that consolidation could cause the start of a new trend and price rapid moves in the relevant direction. 76.5 USD/b is the retracement 61.8% Fibo level and target if we have a downward breakout which is the logical thing to expect after a long way up that reached a near 6.5 USD move.

Gold (XAUUSD)

Gold (XAUUSD)

On the 12th of June, the U.S. CPI news caused the USD to depreciate and Gold to jump. After a jump of almost 30 dollars, it reversed when it found resistance at near 2,342 USD/oz. The reversal was quick. The dollar had not yet appreciated enough but the reversal started to happen indicating demand perhaps weakening, keeping the metal lower. On the 13th that view was confirmed as the price moved even lower. After reaching the support at 2,295 USD/oz the price retraced to 2,311 USD/oz, which acted previously as support, and settled there. On the 14th of June, the price reversed to the upside and tested the resistance again, at near 2,340 USD/oz unsuccessfully. It reversed back to the 30-period MA and is on this consolidation path for now with the mean price at near 2,320 USD/oz.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500)

Price Movement

A consolidation phase was broken to the upside on the 12th of June when finally the index moved higher. At 15:30 the U.S. CPI news caused the index to jump as inflation was reported lower than expected. This gave a hint that interest rates, and borrowing costs, could lower soon. After reaching resistance at near 5,450 USD the index retraced near 5,420 USD and continued sideways. The sideways path continued to the 13th of June as volatility lowered. The U.S. news that day did not have much impact. A triangle formation was broken to the downside on the 14th of June and support near 5,400 USD was reached as mentioned in our previous analysis. The index reversed fully after that and it moved slightly above 5,440 USD, above what looks like to be a channel now. The level 5,445 USD looks like the next important resistance.

______________________________________________________________