Weekly Outlook

Take a hike!

There are three major central bank meetings next week: the Reserve Bank of New Zealand (RBNZ) and Bank of Canada on Wednesday and the European Central Bank (ECB) on Thursday.

The ECB is likely to be on hold as usual at this meeting, so let’s go straight to the other two. The market is expecting 50 bps hikes from both, the first time in this hiking cycle that we’ve seen such aggressive moves from the central banks that we cover (other central banks have been even more aggressive; the Central Bank of Poland hiked by 100 bps this week!).

We shouldn’t be surprised at a 50 bps hike. The minutes of the March meeting of the rate-setting Federal Open Market Committee (FOMC) showed that “many participants” would have preferred a 50 bps hike but thought 25 bps was more appropriate due to the uncertainty caused by the fighting in Ukraine. “Many participants” also thought that “one or more 50 basis point increases…could be appropriate at future meetings, particularly if inflation pressures remained elevated or intensified.”

Bank of Canada: +50

The Bank of Canada is widely expected to hike 50 bps.

Deputy Gov. Sharon Kozicki said in a recent speech (March 25th) that “the pace and magnitude of interest rate increases and the start of QT” (quantitative tightening) are likely to be “active parts of our deliberations at our next decision in April.” Mentioning the “magnitude” was a sign that a 50 bps hike is on the table. “We are prepared to act forcefully,” she added for those who hadn’t gotten the hint.

She continued, “The reasons are straightforward: inflation in Canada is too high, labour markets are tight and there is considerable momentum in demand.”

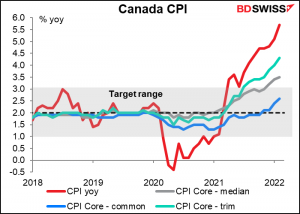

Inflation definitely is too high. Not just the headline consumer price index, which at 5.7% is almost double the upper limit of their 1%-3% target range, but also two of their three core measures are above the target range (although the monetary policy target is defined in terms of the headline figure, not the core measures.

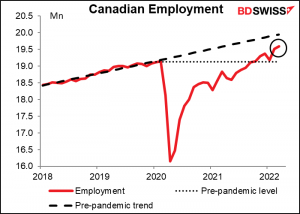

Labor markets are definitely tight, too. The unemployment rate at 5.3% is significantly below the level prevailing before the pandemic (5.6%-5.7%) while employment is higher (although not yet back to the pre-pandemic trend).

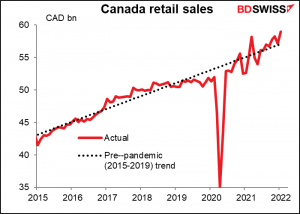

As for demand, retail sales are somewhat above their pre-pandemic trend, but it looks to me that demand was unusually sluggish in 2018/2019 and has since recovered to trend. Either way, it’s indisputable that there is “considerable momentum in demand.”

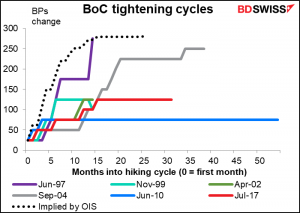

Accordingly, the market is expecting a very steep tightening cycle – the rapidest on record with the total tightening equal to the most on record (at least since they started using the overnight lending rate in December 1992).

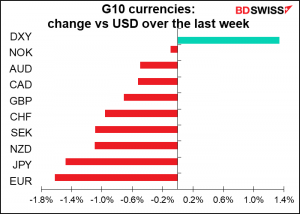

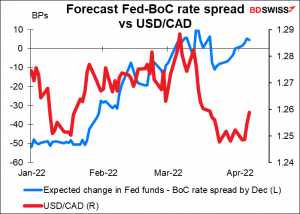

The thing is, the US is also expected to tighten policy rapidly. As a result, the gap between Canadian and US rates at the end of this year is now expected to move about 5 bps in favor of the US, whereas at the start of the year it was expected to move 50 bps in Canada’s favor. Nonetheless that hasn’t particularly hurt CAD, probably because the price of Canada’s oil is up about 30% so far this year.

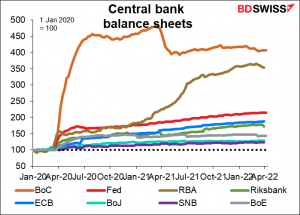

There’s also the question of what to do about the Bank of Canada’s bloated balance sheet. The Bank of Canada had far and away the most expansive quantitative easing (QE) policy of any of the major central banks – it blew up its balance sheet to almost 5x its pre-pandemic size! This compares with a 114% increase for the Fed and 88% increase for the ECB. Deputy Gov. Kozicki said they would be discussing the start of QT – we can hope to hear some specifics on this topic.

At this point, I think oil prices and the outlook for global growth are probably more important than interest rates in determining USD/CAD. Nonetheless if the market perceives the Bank of Canada as being more hawkish than expected – particularly if they hint at a more rapid reduction in their balance sheet than the Fed – this could help to bolster the currency.

RBNZ: also a good chance at +50

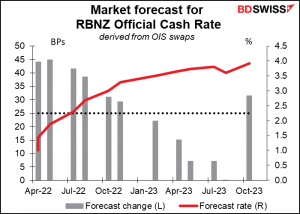

Ditto for the Reserve Bank of New Zealand (RBNZ). The RBNZ was expected to start hiking in August last year but held off because the country went into lockdown. It did become the first of the G10 central banks to hike rates (if I remember correctly) at the next meeting, in October, when it raised the Official Call Rate (OCR) by 25. It’s hiked by 25 bps at each of the subsequent two meetings since then and left no misunderstanding about its intentions when it titled the February announcement “More Tightening Needed.” “The Committee agreed that further removal of monetary policy stimulus is expected over time given the medium-term outlook for growth and employment, and the upside risks to inflation,” they said.

The question is not whether they’ll hike rates this time but rather whether they’ll hike by 25 bps or 50 bps. So far, the five economists polled by Bloomberg are unanimous in expecting 25 bps. The overnight index swap (OIS) market isn’t so sure however – that market is discounting a 47 bps hike, i.e. an 87% chance of a 50 bps hike (if I’m reading the table correctly).

Commenting on the economy at the last meeting, the Monetary Policy Committee said, “Economic capacity pressures have continued to tighten. Employment is now above its maximum sustainable level, with a broad range of economic indicators highlighting that the New Zealand economy continues to perform above its current potential. Headline CPI inflation is well above the Reserve Bank’s target range…”

What news have we had since the last RBNZ meeting on Feb. 23rd that might prod them into hiking by 50 bps? There hasn’t been a new print of the NZ inflation or employment data, which only come out quarterly. The former will be released on April 20th and the latter on May 3rd, meaning there will be new updates by the time of the May 25th RBNZ meeting. That meeting will also be accompanied by a new Monetary Policy Statement with an update on the RBNZ’s forecasts. It might make more sense for the RBNZ to hike by just 25 bps at this meeting and wait for more information at the May meeting before accelerating the pace of increases.

The main reason they would have for hiking 50 bps is their “least regrets framework.” Under this framework, they ask the question: if we make a policy mistake, which would we regret less: too loose or too tight? In the minutes to the February meeting, they said in this context that “the most significant risk to be avoided at present was longer-term inflation expectations rising above the target and becoming embedded in future price setting.” The 10-year breakeven inflation rate has indeed climbed to 3.0%, the top of the RBNZ’s 1%-3% target zone. They might want to hike at a faster pace in order to prevent inflation expectations from becoming unanchored.

I expect they will go through with it and hike by 50 bps. I think given the talk globally about 50 bps hikes and the risk of inflation becoming embedded vs the risks of crashing the economy that they will think the former is the greater risk and move by 50 bps. Such a move would no doubt surprise some market participants and therefore could prove positive for NZD.

ECB: Not so interesting

Usually I write a whole big piece about the European Central Bank (ECB) meeting. Not this time. They just updated their forecasts and won’t do it again until June (although some Governing Council members believe the forecasts were DOA because the war in Ukraine wasn’t fully factored in). The Pandemic Emergency Purchase Programme (PEPP) ended on schedule at the end of March and they already announced an accelerated tapering of the Asset Purchase Programme (APP). All I would expect at this meeting is a change in nuance and, in the face of surging inflation, perhaps some stronger forward guidance about how they “stand ready to adjust all of our instruments to ensure that inflation stabilises at our two per cent target over the medium term.”

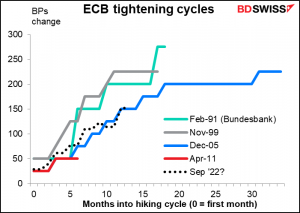

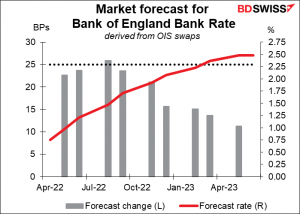

Unlike the Bank of Canada and the RBNZ, the estimated path of ECB rates is relatively shallow. There is definitely room to accelerate tightening if the Governing Council decides to go along with the general global rates gestalt.

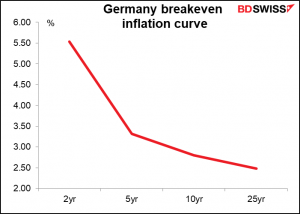

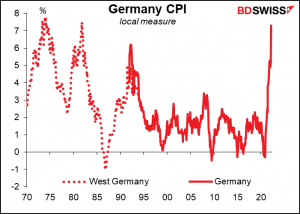

Their forward guidance as it stands now is “Any adjustments to the key ECB interest rates will take place some time after the end of our net purchases under the APP and will be gradual.” How long is “some time”? How quickly is “gradual”? With German inflation expectations now above their 2% target all the way out to 25 years, they might want to clarify these points at this meeting and perhaps even adjust them. The minutes from the March ECB meeting showed that Governing Council members are increasingly concerned about the risks of inflation expectations becoming unanchored. “A large number of members held the view that the current high level of inflation and its persistence called for immediate further steps towards monetary policy normalisation.”

The excitement with the ECB will probably start in June, when the new forecasts may be the occasion for an accelerated end to the APP. That would pave the way for “lift-off,” the first hike in rates, as early as the September meeting. And at some point they’re likely to announce a new policy instrument that is not constrained with regards to which countries’ bonds it can purchase in order to maintain market and financial stability across countries and ensure that their monetary policy stance is transmitted smoothly across all member states.

But this time around ECB President Lagarde is likely to stick to emphasizing that policy decisions will be governed by the principles of optionality, gradualism, and flexibility, as they’ve said for several months now. Nonetheless, in the face of the highest EU inflation since 1981, Lagarde is likely to turn more hawkish in her emphasis and nuance. That could be positive for EUR in the short term.

Other indicators: US inflation data, lots of UK data, French elections

In addition to the central bank meetings there are some key economic indicators coming out next week.

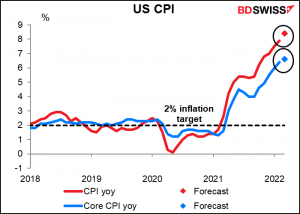

In the US, we have the consumer price index (CPI) on Tuesday and producer price index (PPI) on Wednesday. We also get US retail sales on Thursday and industrial production and the Empire State manufacturing index on Friday.

Within this, the CPI will no doubt be the main focus of attention. As I mentioned above, the minutes of the FOMC meeting said that “Many participants noted that one or more 50 basis point increases in the target range could be appropriate at future meetings, particularly if inflation pressures remained elevated or intensified” (emphasis added). That means there’s going to be a lot of attention to see whether “inflation pressures remained elevated or intensified.”

The market’s forecasts is that they have. The headline CPI is forecast to climb further to an astonishing 8.4%.

Producer prices too are expected to rise further, at least at the headline level.

Figures like these are likely to solidify the market’s expectation of several 50 bps hikes in the US and therefore could be positive for the dollar.

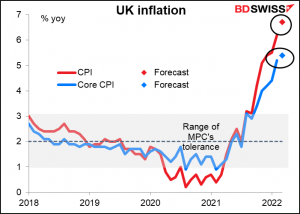

Britain will release its “short-term indicator day” on Monday, with the monthly GDP, industrial & manufacturing production, and trade balance. Tuesday brings the employment data, while Wednesday sees the all-important CPI. This figure is expected to be bad – the market is looking for the headline inflation rate to rise to 6.7% from 6.2% yoy.

But even that’s likely to be just the calm before the storm in April, when the UK household energy price cap rose by 54%. (I have to admit I’m a little sketchy on what this cap is exactly – it’s far too complicated for mere mortals to understand. But the concept of “price cap” seems pretty straightforward and 54% is a big increase.)

With inflation so far above the Bank of England’s 1%-3% area of tolerance, there’s a chance that they too feel the need to hike 50 bps at an upcoming meeting instead of the 25 bps that’s priced in for each of the next several meetings. That could be positive for GBP.

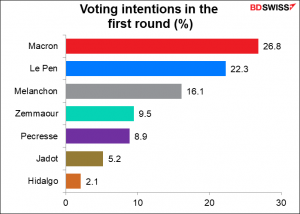

Finally, on Sunday there’s the first round of the French presidential elections. This round will winnow down the field to two candidates, who will then have a run-off election on May 8th.

It’s likely to come down to a run-off between President Macron and Le Pen. President Macron is expected to win that race, but the odds have been narrowing in recent days. He’s now ahead by only 6 percentage points.

Mdme. Le Pen is not the firebrand that she (or her father) used to be, but she’s still out of the mainstream. Meanwhile President Macron is a known quantity who’s been doing well and established himself as a leader in Europe. Generally speaking, the market prefers the known quantity to the unknown. The larger President Macron’s lead, the better for the euro. On the other hand, if it looks like Le Pen has a good chance in May, EUR is likely to come under further selling pressure.