Weekly Outlook

The ECB’s Taper Dilemma, the US CPI Surge

Exciting week in store! The Bank of Canada meets on Wednesday and the European Central Bank (ECB) on Thursday. Also on Thursday, we get the US consumer price index (CPI), second only to last week’s US nonfarm payrolls in its significance for the market nowadays. There’s a G7 Summit over the weekend. And the monthly Job Offers and Labor Turnover Survey (JOLTS), which usually doesn’t get that much attention, is likely to command a headline or two as investors try to figure out whether the job market is failing to live up to expectations due to a lack of demand or a lack of supply.

Let’s start with the central bank meetings.

ECB: to taper or not to taper (or to taper operationally)?

The big issue to be decided at Thursday’s ECB meeting is the pace of bond purchases in their Pandemic Emergency Purchase Programme (PEPP).

Just to remind you, the PEPP is “a non-standard monetary policy measure initiated in March 2020 to counter the serious risks to the monetary policy transmission mechanism and the outlook for the euro area posed by the coronavirus (COVID-19) outbreak.” It was initially set at EUR 750bn, then raised by EUR 600bn in June and by another EUR 500bn in December, for a total of EUR 1.85tn. The Governing Council said it will end the purchases “once it judges that the COVID-19 crisis phase is over, but in any case not before the end of March 2022.”

At the April meeting, they said:

Since the incoming information confirmed the joint assessment of financing conditions and the inflation outlook carried out at the March monetary policy meeting, the Governing Council expects purchases under the PEPP over the current quarter to continue to be conducted at a significantly higher pace than during the first months of the year.

And indeed since the April meeting, purchases have averaged EUR 24.6bn a week, vs EUR 18.4bn a week in January – March.

The key phrase in the paragraph above is “over the current quarter,” i.e. April, May, and June. That means they have to decide at this meeting whether to continue buying bonds at this pace or to slow down their purchases, which could be considered “tapering.”

The decision is finely balanced, in my view.

Note that the Council mentioned “financing conditions and the inflation outlook” in their decision to increase the purchases. Financing conditions are extremely loose. Cutting back the purchases would probably not disrupt things that much even if it were interpreted as the beginning of “tapering,” much like the Bank of Canada did at its April meeting.

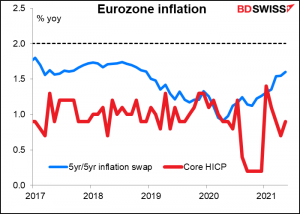

On the other hand, the inflation outlook is not yet to their liking. The inflation forecasts were revised down at the March meeting; the ECB staff now expects that it will take until 2023 to reach the inflation rate that they had expected to reach last year (1.3%), which is still far below their 2% target.

And the market still doesn’t see EU inflation coming back to target five years from now (the five-year/five-year inflation swap, which gives the market’s estimate for inflation for the five years starting five years from now).

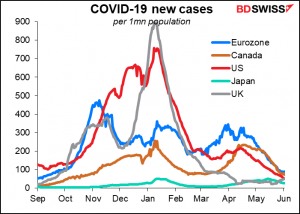

Furthermore, while new cases of the virus have come down dramatically, it’s still way too early to say that “the crisis phase is over,” especially as new variants circulate.

I suspect that the Euro will be the determining factor. The issue came to the fore in September last year, when ECB Chief Economist Lane made a speech in which he pointed out that the level of the euro did matter for the ECB because of its impact on inflation. That was followed a few days later by an ECB meeting that incorporated a comment on the exchange rate into its forward guidance. [“…the Governing Council will carefully assess incoming information, including developments in the exchange rate, with regard to its implications for the medium-term inflation outlook.” (emphasis added).] EUR/USD was around 1.18 at that time; now it’s close to 1.22. (Although I should note that the ECB’s nominal trade-weighted index is actually about 1% below where it was then, so they really have nothing to complain about.)

The ECB is surely aware of what happened to USD/CAD when the Bank of Canada tapered its bond purchases.

If they decide to continue purchases at the current pace, I think EUR/USD would probably weaken a bit. It’s not a change in policy so it’s not cause for a major rethink of the outlook for the currency, but it would remove one risk.

The main reason I could be wrong is the new staff forecasts. The ECB staff will issue a new set of forecasts that is likely to have a faster growth and higher inflation profile. That could be a reason for trimming the bond purchases, perhaps with a big explanation that they’re not “tapering” but just returning them to their previous pace as financing conditions are loose and the vaccine rollout is going well, etc etc. Or they could portray it as an operational decision rather than a strategic one, as the Bank of England did when it slowed the pace of its bond purchases back in May.

Following the meeting, the market will inevitably begin to consider, when will the ECB end the PEPP? Will then end it at the earliest possible date, namely next March? Will they continue to buy bonds after March, but just at a slower pace? We should hear something about that by December.

Bank of Canada: no fireworks likely

As mentioned above, the Bank of Canada cut its weekly bond purchases at its last meeting, in April. I doubt whether they will make any more changes at this meeting. I think they’re unlikely to taper their bond purchases further, because the economic data recently has been somewhat weaker than forecast in the April Monetary Policy Report. For example, Q1 growth was 5.6% qoq SAAR, below the Bank’s 7% forecast.

At the same time, it’s not been weak enough to warrant reversing that decision or taking any further action.

Inflation at the headline level is outside the Bank’s target range, while their three core measures are resolutely in the center of it. That could be the rationale for some further normalization of policy, but I think it’s likely to come later in the year, perhaps at the following meeting in July, when a new Monetary Policy Report will bring new forecasts. For now, I think the Bank will probably stick with its explanation from April that the rise in inflation is “temporary” and repeat its comment that “The Bank expects CPI inflation to ease back toward 2 percent over the second half of 2021…”

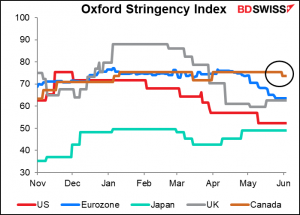

Canada’s pandemic measures are still relatively restrictive.

New cases are coming down rapidly though as the vaccine rollout ramps up. As more people are vaccinated, the government can remove more restrictions and the economy should rebound as it reopens. That will provide the opportunity for the Bank to wind down its extraordinary operations.

The main thing to watch for then is any change in language regarding further adjustments to the asset purchase program. In April, the Bank said, “Decisions regarding further adjustments to the pace of net purchases will be guided by Governing Council’s ongoing assessment of the strength and durability of the recovery.” Let’s see if they make that any more concrete. There was also the pledge to keep rates at the effective zero bound until “some time in the second half of 2022,” which was a change from March’s “until into 2023.” Will they adjust that in light of recent developments?

US indicators: CPI and JOLTS

The US CPI is not the Fed’s preferred inflation gauge – the Fed has been framing its inflation forecasts in terms of the personal consumption expenditure (PCE) deflator since 2000. However, it is the market’s preferred inflation gauge. The Bloomberg relevance score for the mom change in the CPI is 96.1, meaning about 96% of the people who have any alerts set for US indicators have an alert set for this indicator. The only indicators with a higher score than the CPI are nonfarm payrolls (99.2), initial jobless claims (98.4), and GDP (96.9). By contrast, the highest figure for any of the PCE deflators is 60.1 for the mom change in the core deflator. That’s quite low. I’m at a loss to explain why the market places so much more weight on the CPI than on the PCE deflator – maybe it’s only nerds like me who care about the PCE deflator.

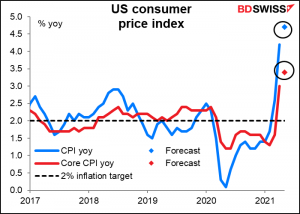

In any case, following April’s eye-popping 4.2% yoy print for the headline number, this month the market is expecting a jaw-dropping 4.7% yoy increase. That would be the fastest yoy rate of increase since September 2008.

An argument could be made – and I’m sure will be made by some officials – that this is largely due to base effects. If we look at the mom rate of change, the expected +0.4% mom increase is nothing unusual. It would be down sharply from +0.8% mom in April and +0.6% mom in March.

The figure isn’t necessarily as important as how officials spin it. This week will be difficult in that respect because Fed officials are in their “purdah” period when they’re not allowed to talk to the press ahead of the Federal Open Market Committee (FOMC) meeting the following week. So, we won’t get any reassuring comments from officials to soothe the furrowed brows of traders.

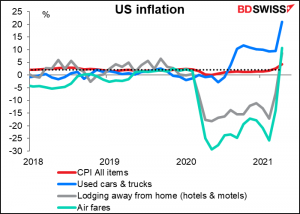

So far though the story that they’ve been telling seems to be largely correct: the higher inflation is mostly due to temporary supply/demand imbalances that occurred as the economy reopens and people go out and spend their stimulus payments. The poster boy for this phenomenon is used cars & trucks (blue line). During the pandemic, car rental companies reduced their fleets dramatically to conserve cash and stay in business (some failed anyway). Now that people are traveling again, they’re rushing to buy more cars. They’ve had to resort to buying used cars by the thousands, which has pushed up prices dramatically — +21% yoy. Similarly, airfares and hotel rates have risen sharply from a year ago (+10.7% yoy and +8.7% yoy, respectively) as more people are traveling but the industry hasn’t gotten its capacity back to where it was.

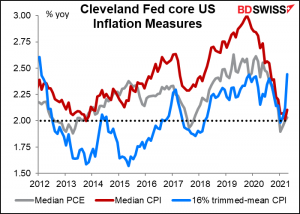

But these sorts of bottlenecks are temporary and limited to a few sectors. If we eliminate the more exaggerated price movements, as the “median” and “trimmed mean” measures calculated by the Cleveland Fed do, we get inflation that’s not that high — 2.0% to 2.4% yoy. This is probably why the Fed can continue to be optimistic about the rise in inflation being only “temporary” and “transitory.”

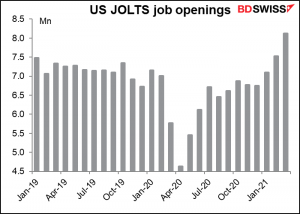

There’s no forecast yet for the JOLTS report. Last month there were 8.123mn job openings, the highest recorded (data back to Dec 2000) and 27% higher than the pre-pandemic average.

Last week, St. Louis Fed President Bullard observed that the unusually low ratio of unemployed workers to job openings “suggests a very tight labor market.” Assuming the JOLTS job openings are unchanged for the next two months, the figure will be 1.15 unemployed person for each job opening, vs the average of 2.33 over the last 20 years and a low of 0.81. That would fuel more discussion of just why people are not taking jobs: is it because they can make more money sitting home & collecting unemployment insurance, or because they’re still worried about the virus, or because they have to take care of their children? By October, when schools are back in session and most states have ended their special supplementary benefits, we’ll start to get an answer to those questions.

Friday is short-term indicator day for the UK, when they announce the monthly GDP, industrial & manufacturing production, and trade data. GDP is the key figure here. The recovery is being driven largely by strong services sector growth. Manufacturing and construction continue to expand as well as the economy gradually opens up and more furloughed employees return to work. The further signs of accelerating growth should be positive for GDP.

Other important data out during the week include China CPI & PPI on Wednesday and German factory orders Monday & industrial production Tuesday.

The G7 summit meeting begins on Friday and runs until Sunday. The Group of Seven is an international organization made up of the world’s seven largest advanced economies: US, Japan, Germany, UK, France, Italy, and Canada. The heads of government plus representatives of the EU meet at the summit. Australian Prime Minister Morrison, South Korean President Moon, South African President Ramaphosa, and Indian PM Modi will attend as guests. The meeting will be President Biden and PM Suga’s first and probably Chancellor Merkel’s last summits.

The UK, as host for the summit, sets the agenda. According to their website, the summit will focus on:

-

- leading the global recovery from coronavirus while strengthening our resilience against future pandemics

- promoting our future prosperity by championing free and fair trade

- tackling climate change and preserving the planet’s biodiversity

- championing our shared values

Usually nothing concrete comes out of these summits, but there are press conferences and pledges that can contain some market-sensitive information.

Finally, last week I mentioned the big reveal that’s coming in June: the US intelligence agencies’ report to Congress on “unidentified aerial phenomena.” The unclassified report, compiled by the director of national intelligence and the secretary of defense, aims to make public what the Pentagon knows about unidentified flying objects and data analyzed from such encounters. While the release date isn’t set yet, the New York Times had an article summarizing the as-yet-unreleased report. It said, “American intelligence officials have found no evidence that aerial phenomena witnessed by Navy pilots in recent years are alien spacecraft, but they still cannot explain the unusual movements that have mystified scientists and the military…” The only thing that they said for sure is that these were not sightings of secret US projects. But if they’re not secret US projects, what are they? “…the very ambiguity of the findings meant the government could not definitively rule out theories that the phenomena observed by military pilots might be alien spacecraft,” according to the NYT article. So, as the saying goes, we’re left “none the wiser but much better informed.”