Weekly Outlook

The Russians are coming! Or maybe not...

Sometimes markets are driven by economics, sometimes they’re driven by technicals. But right now they’re being driven by politics and I have no special insight into politics. My grandparents on my mother’s side came from Ukraine (Odessa) but aside from that I have no connection whatsoever to the country and no more information about what’s going on there than you do. My view of the matter isn’t worth the paper it’s printed on.

I can however make a stab at guessing the market reaction to events there. This is not the most difficult call I’ve ever made. Generally speaking, fighting = risk-off = JPY & CHF up, oil up, AUD & NZD down, stocks down. No fighting = risk-on = stocks up, AUD up, JPY & CHF down, oil down (temporarily).

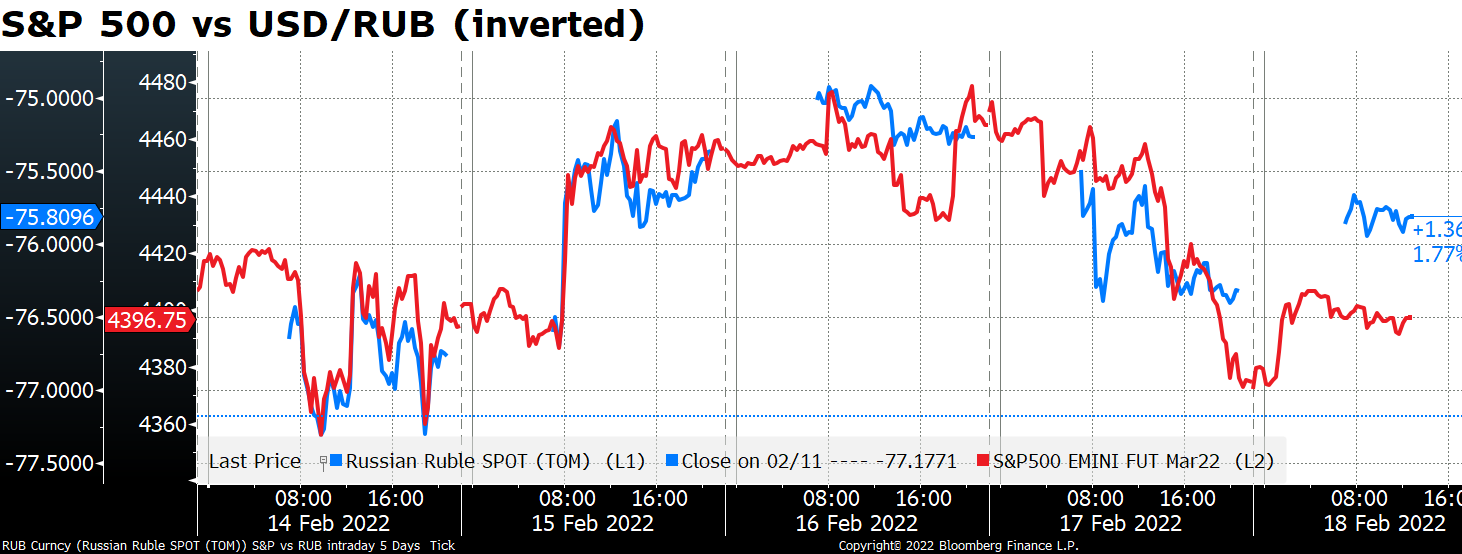

By Friday though I think the market is starting to suffer from “boy-who-cried-wolf” fatigue. That is, we’ve heard so many alarms about an imminent attack and so many denials, it seems that the impact of Ukraine-related news on asset prices is starting to be attenuated..

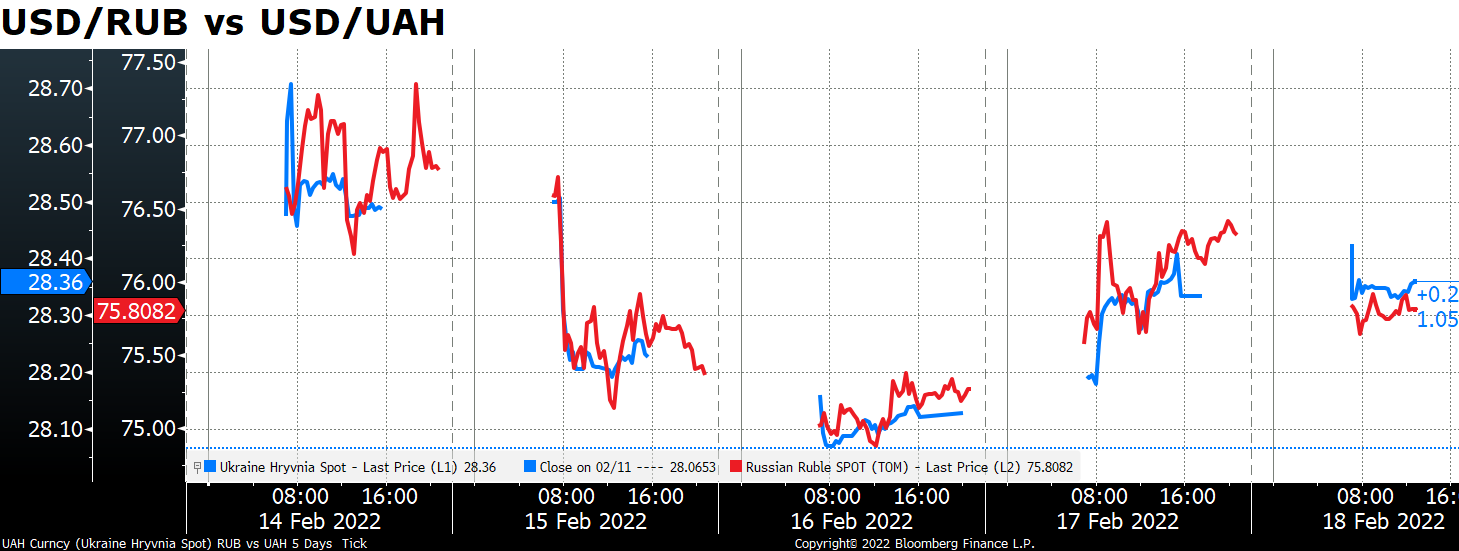

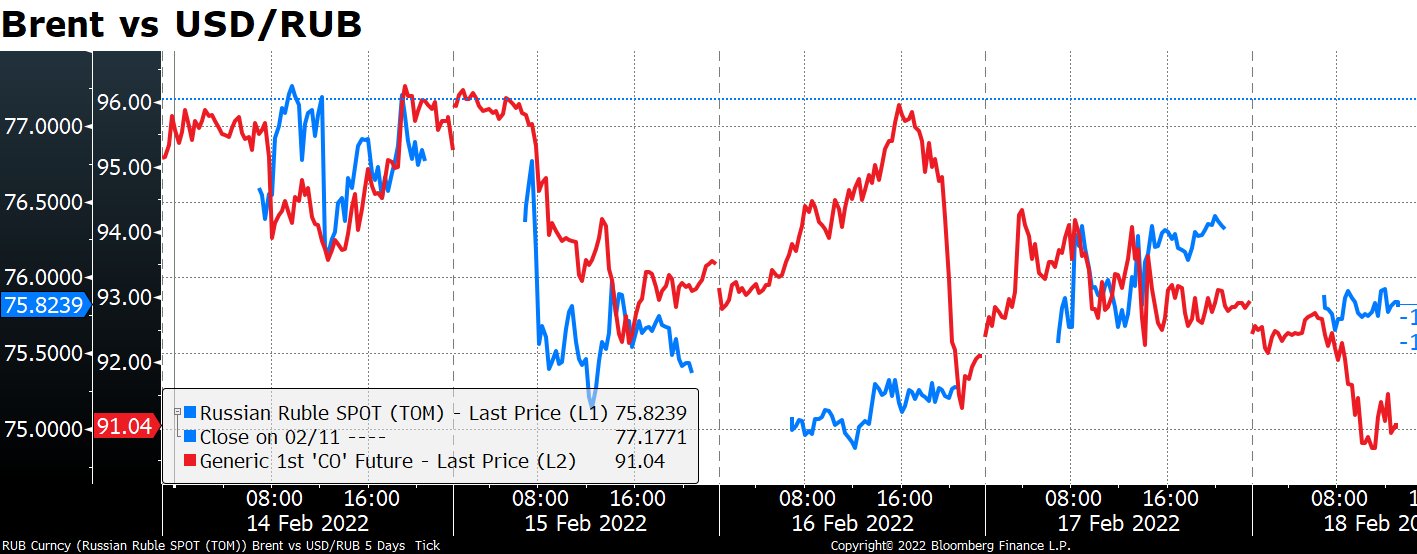

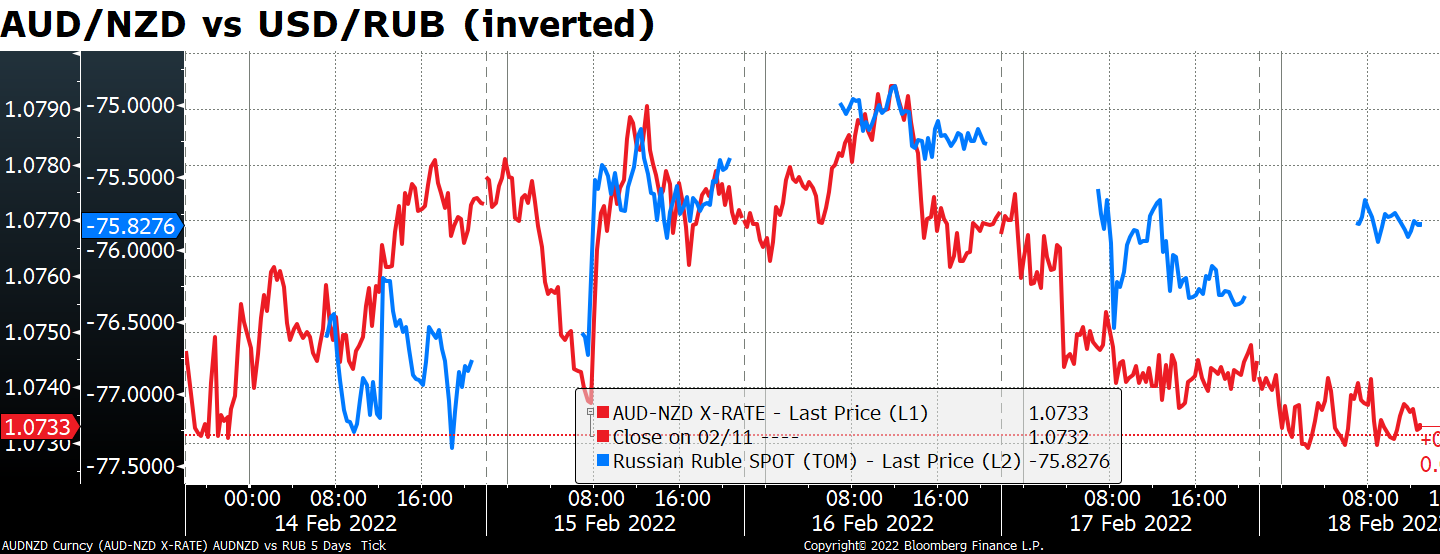

We can take the value of the Russian Ruble (USD/RUB) as an instant poll on the market’s view about the likelihood of fighting. In theory we should use the Ukrainian Hryvnia (USD/UAH), but liquidity in UAH is even worse than in RUB and trading hours shorter. Plus there doesn’t seem to be that much difference in the end result.

The ruble has been determining risk sentiment, as you can see from the close correlation between its movement and the S&P 500.

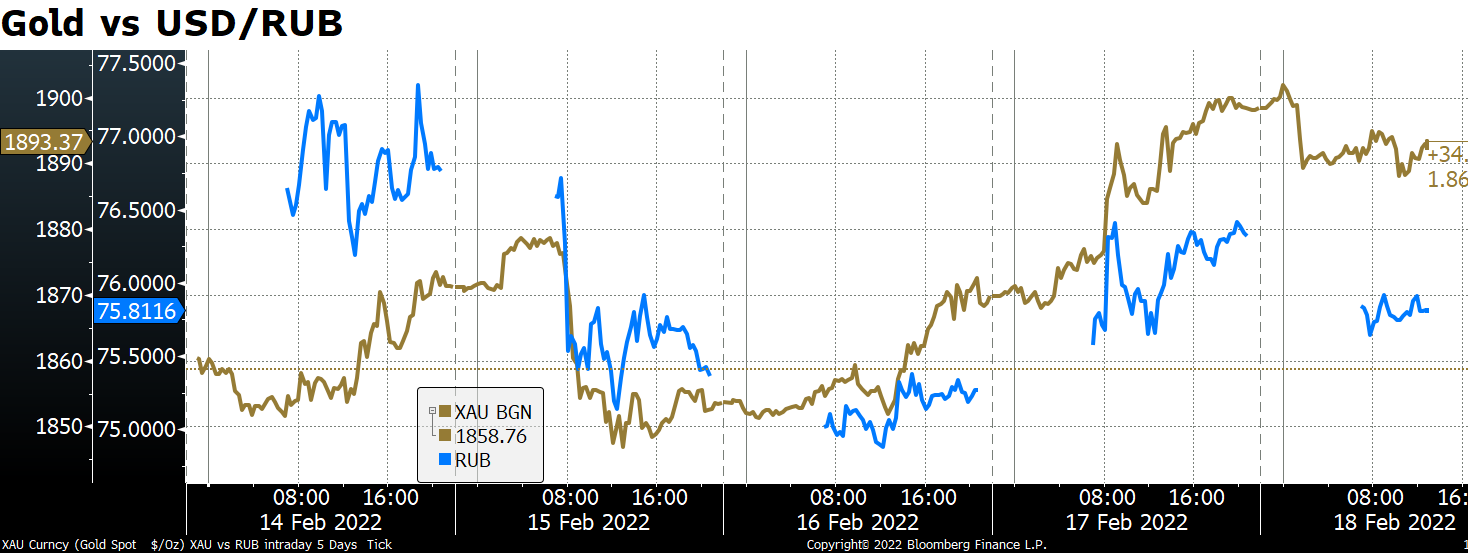

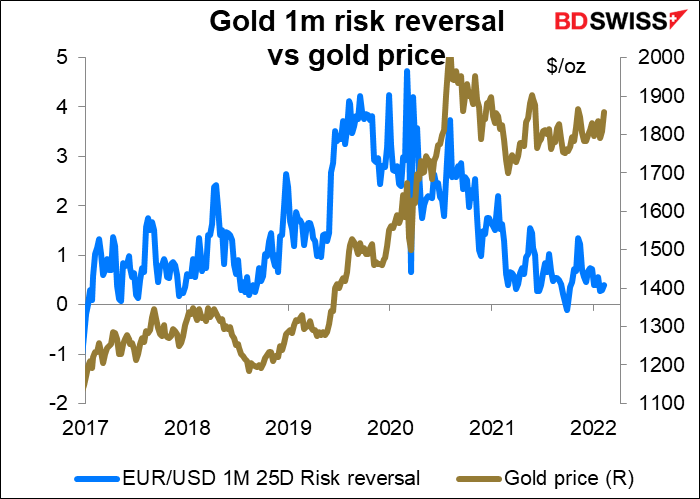

You might well wonder, War? What is it good for? One thing: gold! If you want to take a view on what Mr. Putin is likely to do, I recommend the gold market. Gold has been tracking USD/RUB fairly well.

The price of gold has gone shooting up in the last few days and with it the gold risk reversal, which is showing a preference for gold calls (as it usually does).

(A risk reversal (RR) is the difference in implied volatility between out-of-the-money call and put options with similar specifications. This measure tells us whether the market is willing to pay more for calls or puts. That information is useful in judging whether the market thinks it’s more likely that the pair will rise (in which case the call will cost more) or fall (in which case, the put would be more highly valued).

Still from a historical point of view the risk reversal is still quite low. People don’t seem to think there’s that much potential for a surge higher.

War is also good for oil, as that’s Russia’s main export.

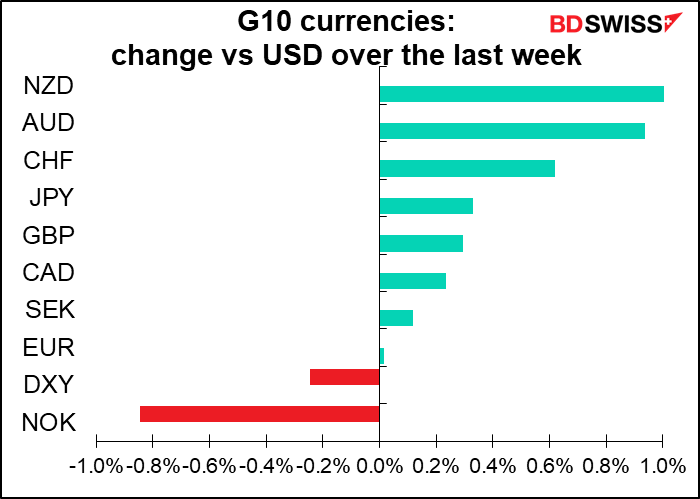

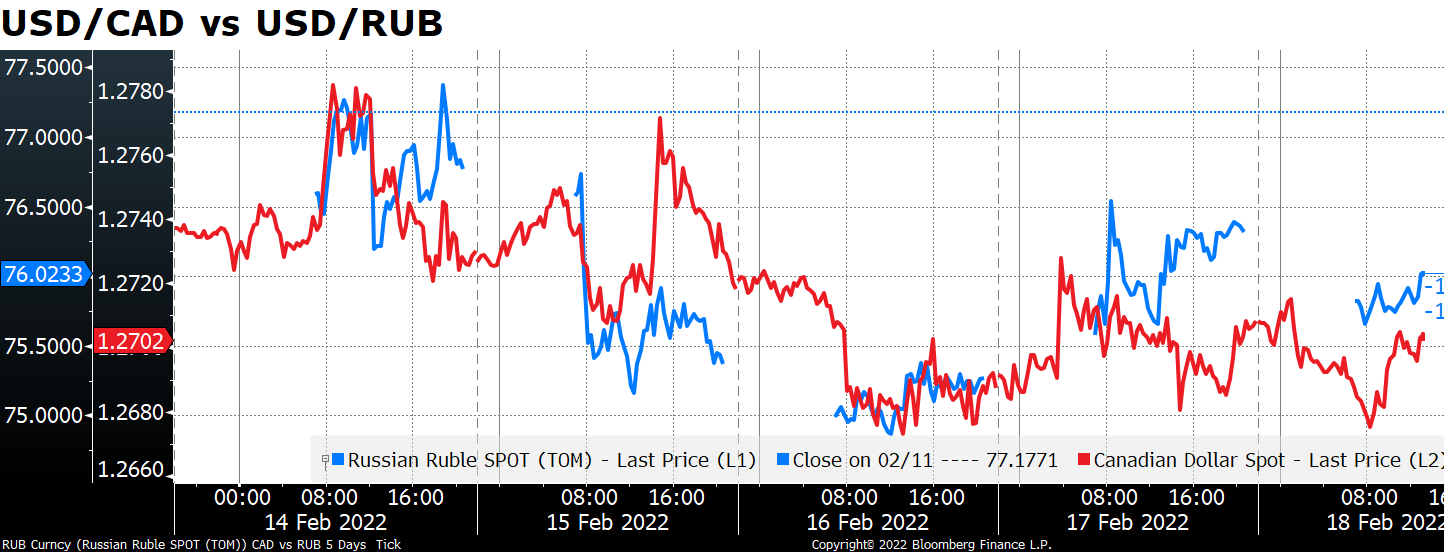

But that doesn’t mean it’s good for oil-linked currencies, such as CAD. On the contrary, USD/CAD tends to move along with USD/RUB as the “risk-off” sentiment seems to dominate the oil-price impact. The oil-linked NOK was the worst-performing currency of the week.

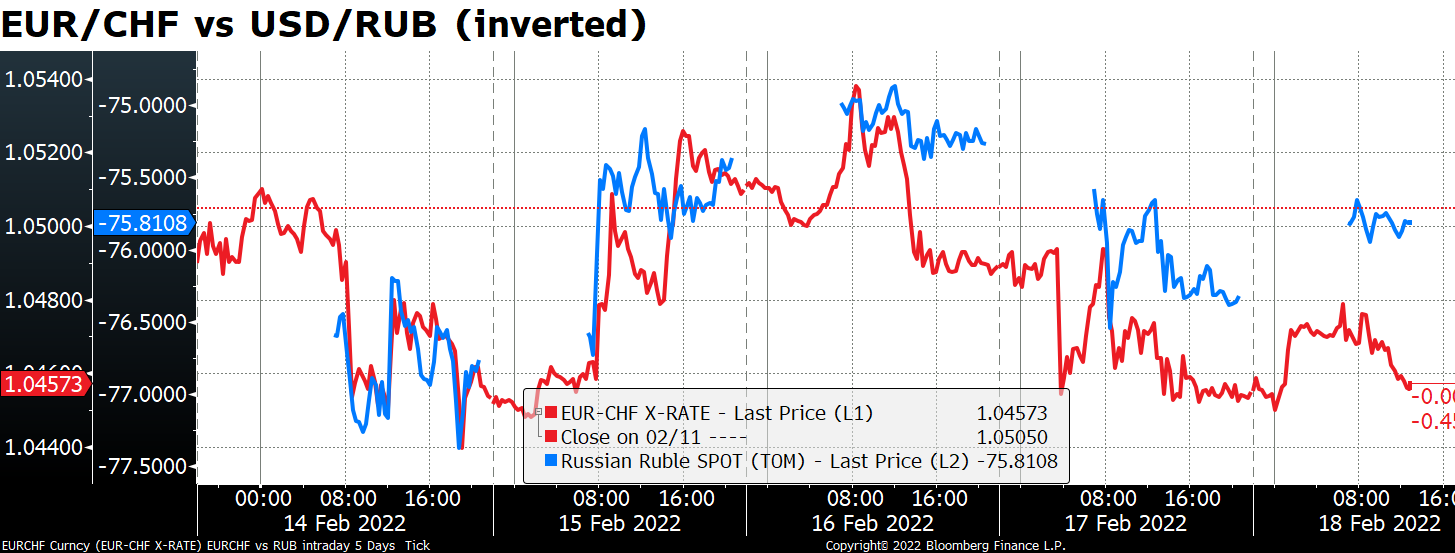

In the currency market, fears of war have pushed down EUR/CHF and battered AUD. Although I have to say that with EUR/CHF it’s hard to disentangle the fears of fighting from the fears of not tightening.

AUD is the pre-eminent “risk-on” currency and JPY is the #1 “safe haven” currency. As a result, AUD/JPY has followed USD/RUB closely (but inverted).

So has AUD/NZD. I suppose when people are looking to sell AUD, what better currency to sell it against than NZD? This is why NZD has been one of the best-performing currencies recently.

This may seem logical on the surface but it’s actually not, IMHO. I’d say the reverse should happen. Russia is not only a major oil & gas exporter but also exports a lot of minerals, including a lot of iron (mostly finished, not iron ore). If other countries decide to penalize Russia with sanctions it’s going to push up the price of commodities that Australia exports much more than the price of what New Zealand exports. (Russia and NZ only compete in the timber market as far as I can tell.) From that point of view it seems to me that fighting in Ukraine might well be beneficial for AUD as long as it doesn’t impinge on the Chinese housing market, the major outlet for Australian iron ore. (Russia does not seem to be a significant export market for either country.)

Nonetheless, markets aren’t so discerning. Traders have to make split-second decisions to buy or sell and rarely have the luxury to do a deep dive into the details of a situation. I remember an incident back in 1984 when the pound was a petrocurrency and moved along with oil prices. The UK miners went on strike, which forced the UK government to use fuel oil instead of coal to generate electricity. As a result Mexico, which produces the kind of heavy sour crudes used to produce fuel oil, raised its selling prices. The pound rose on the news even though it was actually negative for Britain. Not only was Britain’s light sweet Brent crude not affected, but on the contrary, the whole reason Mexico was raising its oil prices was that Britain had to import more oil, which would be negative for the country’s balance of payments and therefore negative for the pound.

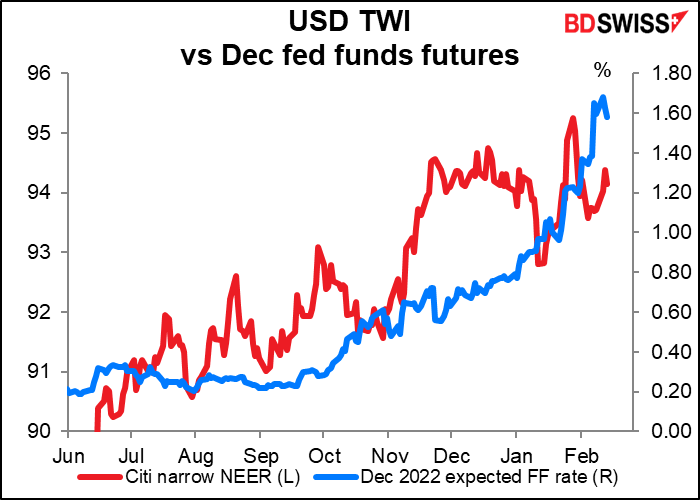

Meanwhile, back in the States, the big debate in the markets has been whether there will be a 25 bps or 50 bps hike in March. The idea of a 50 bps hike started to get traction at the beginning of February when the blowout January nonfarm payroll figure came out. Then last week when the US consumer price index hit 7.5% yoy the markets were convinced. Now it’s seen as almost a 50-50 bet. This week’s minutes of the January meeting of the rate-setting Federal Open Market Committee (FOMC) didn’t clarify matters much.

The dollar has been generally, but not exactly, following along on this ride.

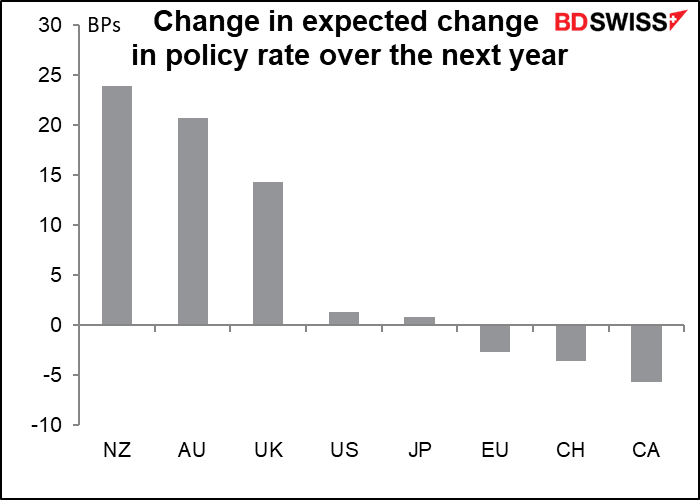

That’s because the US isn’t acting in a vacuum. Other countries’ rate expectations are changing too. Some of them are changing more than the US is. The interplay between rates and risk aversion is complicated though. AUD was relatively weak despite seeing an increase in rate expectations this week, while JPY was relatively strong with almost no change at all (as usual for JPY, which isn’t expected to see a change in monetary policy during the remainder of the Anthropocene Epoch.)

War vs rates…those are the two main forces pushing and pulling asset prices this week.

Next week: RBNZ, preliminary PMIs, PCE deflators, Australian wages

There’s not that much on the schedule next week but what there is, is rather important for each country.

Reserve Bank of New Zealand: Another hike likely

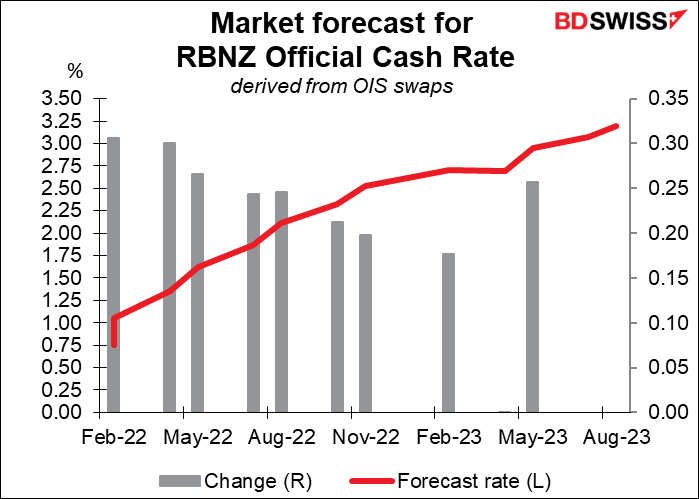

The Reserve Bank of New Zealand (RBNZ) has already hiked rates twice and is widely expected to hike rates again at next week’s meeting. In fact it’s expected to hike rates by 25 bps at every meeting this year, although some doubts start to creep in around November.

So what will the market be looking for? The main question seems to be whether they’ll hike by 25 bps or 50 bps. The market has priced in 29 bps of tightening, so a small (16%) chance of hiking by 50 bps.

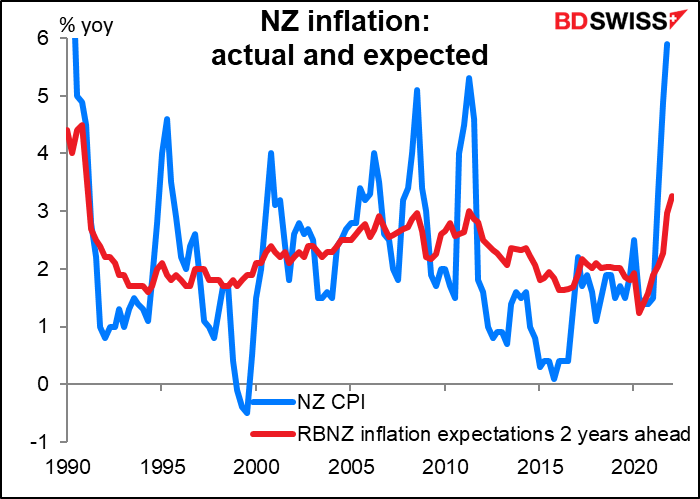

Reasons to hike 50 bps: Inflation jumped to 5.9% yoy in Q4 from 4.9% in Q3 and the RBNZ’s 2-year-ahead inflation expectations series hit 3.3% in Q1, the highest it’s been since 1991, the year after the RBNZ first adopted an inflation target.

Reason not to hike 50 bps: Employment barely grew at all in Q4 (up only 0.1% qoq) and there was a fall in the participation rate.

What I expect: I expect they’ll discuss a 50 bps hike but in the end hike only 25 bps. Even that might be considered “hawkish” and positive for NZD, just as the 5-4 vote at the last Bank of England Monetary Policy Committee meeting was considered hawkish, not for what they did but for what they weighed doing.

PMIS: Continued recovery

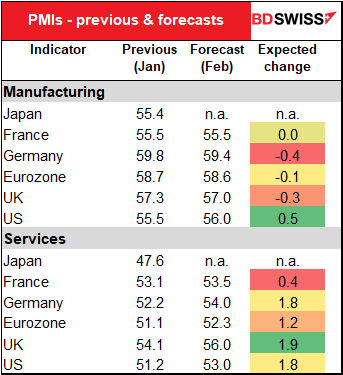

The preliminary purchasing managers’ indices (PMIs) will be released on Monday, except for the US, which will be released on Tuesday because Monday is a holiday (President’s Day). (It’s also a holiday in Canada, by the way.)

The manufacturing PMIs are generally expected to slip a bit, which is no big deal since they’re already so high. These things don’t go up forever.

The more important point is that the service-sector PMIs are all expected to improve substantially. This would be a sign of significant healing from the pandemic, since the service sector has been impacted much worse than the manufacturing sector. It would be particularly significant given the omicron wave that’s been crashing all over the world recently. I think this would be a vote of confidence in the global economy’s ability to heal and recover and would therefore be positive for the risk-sensitive commodity currencies.

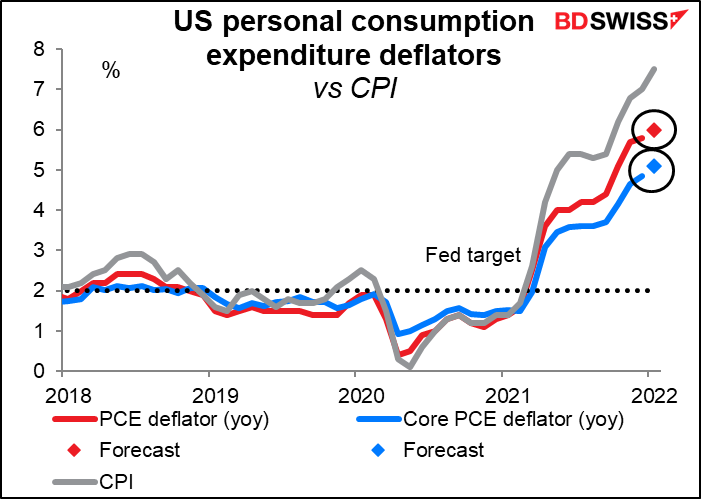

As for the US, the big indicator of the week will be on Friday, when the personal consumption expenditure (PCE) deflators are released. These are in theory the Fed’s preferred inflation gauges and indeed are what they formulate their forecasts in terms of. However I’ve heard more Fed officials refer to the consumer price index (CPI) than the PCE deflators, while of course the market overwhelmingly focuses on the CPI too. I guess it’s just data nerds like me who pay attention to this one.

Both the headline and the core figures are expected to rise, once again confirming (as if confirmation was necessary) that inflation continues to rise to higher and higher ground. Not as high as the CPI, because the PCE deflators tend to be less volatile in both directions. Still, 6.0% is way too far above the Fed’s 2% target to ignore. But as mentioned above, they’re planning on tightening anyway so I’m not sure this will move the dial very much in any case.

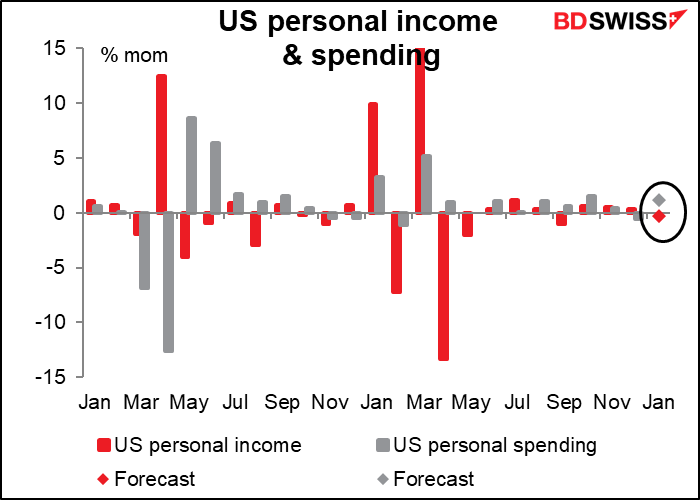

Meanwhile, personal incomes are expected to be down slightly (-0.3%) as the enhanced Child Tax Credit expired. Also people don’t make a big fuss about the average weekly hours figure in the monthly employment report but that’s very important for incomes – a couple of thousand more people working is nice, but when there’s already 150mn people working, a few minutes more or less on their average workweek is a Very Big Deal in their aggregate income. Average weekly hours fell in January to 34.5 from 34.7, or -0.6%. A 0.6% fall in average hours worked means a 0.6% fall in incomes for people who are paid hourly.

Despite the fall in incomes, personal spending is expected to be up 1.2% mom. Sounds like my family. I suppose this forecast stems from the excellent January retail sales figures, which were up 3.8% mom in January.

I would imagine that the rise in spending would be the more important of the two figures and therefore the rise in spending would be positive for the dollar.

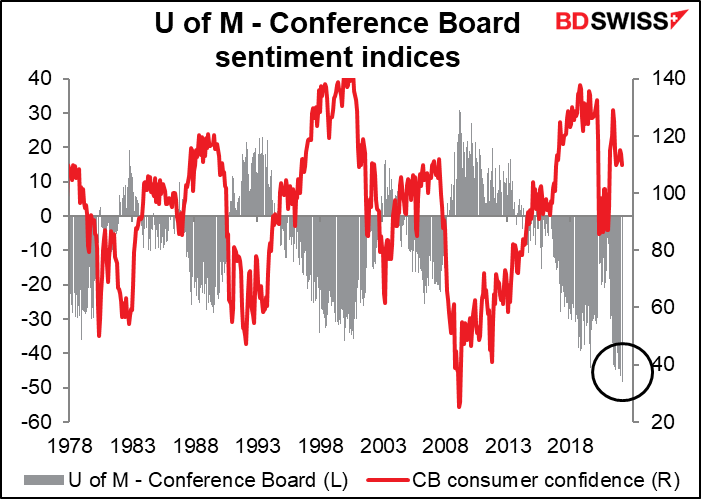

We also get the Conference Board consumer confidence figure on Tuesday. A record gap has opened up between the Conference Board estimate of consumer confidence and the U of Michigan consumer sentiment index. The Conference Board index is expected to fall to 110.0 from 113.8, but this isn’t as big as the 5.5-point decline in the U of M index during the month, meaning that the gap is expected to hit a new record.

The Conference Board’s questions place a greater emphasis on employment and labor market conditions, which are excellent right now, while the U of M’s survey emphasizes individual household finances, which are being pinched by inflation and the falling stock market. That’s probably why the gap has arisen.

In any case, a decline in either index is hardly to be applauded so this is likely to be negative for the dollar.

US durable goods orders are also coming out on Friday.

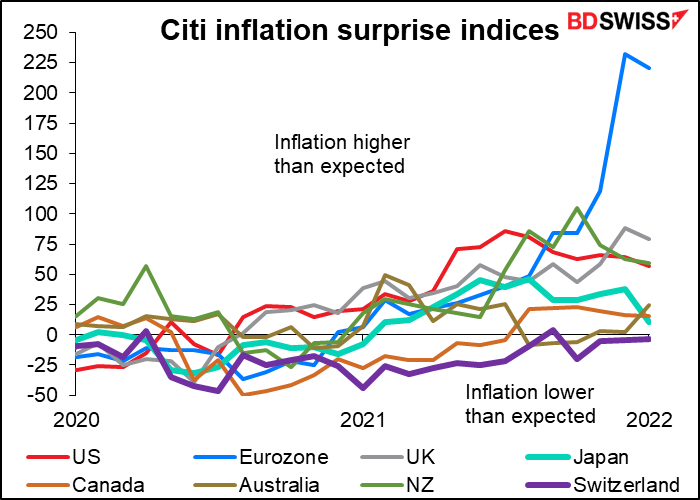

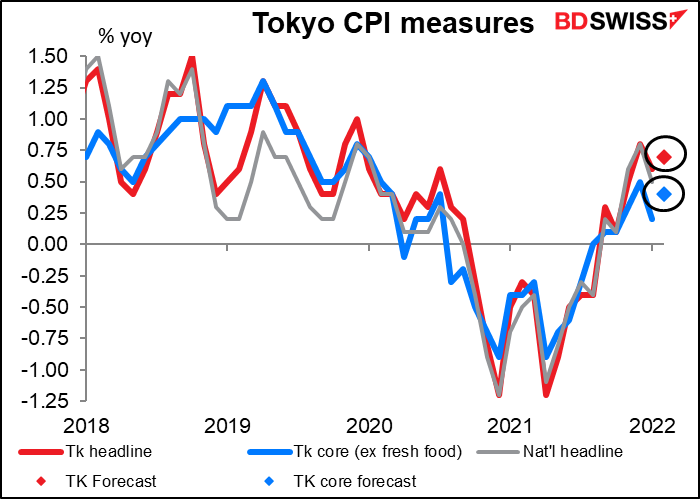

There are several important Japan indicators coming out during the week: Tokyo CPI on Friday and retail sales and industrial production the following Monday. We just had the national CPI out this past week and it surprised on the downside – one of the few inflation figures globally to do so. The Citi inflation surprise indices, which haven’t been updated for February yet, show Japan and Switzerland at the bottom of the pack in terms of how inflation is coming in relative to expectations. Most everywhere else it’s expected to rise and even then it’s beating expectations. In Japan it was expected to fall and in the event fell more than expected.

In this case the Tokyo CPI is expected to rise slightly – the headline figure is forecast to be +0.7% yoy up from 0.6%. This is still very disappointing and would probably be negative for JPY.

Among the more obscure indicators that I’m really excited about, Australia’s Q4 wage costs is going to be the big thrill of the week! That’s because the Reserve Bank of Australia (RBA) has singled out wages as the biggest issue preventing them from hiking. At its last meeting it opined that wages growth “remains modest and it is likely to be some time yet before aggregate wages growth is at a rate consistent with inflation being sustainably at target.” Wednesday’s number is expected to be +2.4% yoy. In the past that’s been consistent with inflation of around 1.5% yoy – 2.0% yoy, so a little below their 2%-3% target range. Wages growth would probably have to hit 2.5% yoy or above for the RBA to feel confident that inflation is “sustainably” within its target range. But at least it’s a start. AUD+