Weekly Outlook

To "V" or not to "V"

OK, I admit, the headline should read “To “V” or to “W”, but how could I resist?

So far, it looks like a “V” shaped recovery. We’ve had several comments from several central banks that the worst is over and maybe it wasn’t as bad as expected. “Leading indicators have generally picked up recently, suggesting the worst of the global economic contraction has now passed,” the Reserve Bank of Australia said this week. “Conditions have…stabilised recently and the downturn has been less severe than earlier expected.”

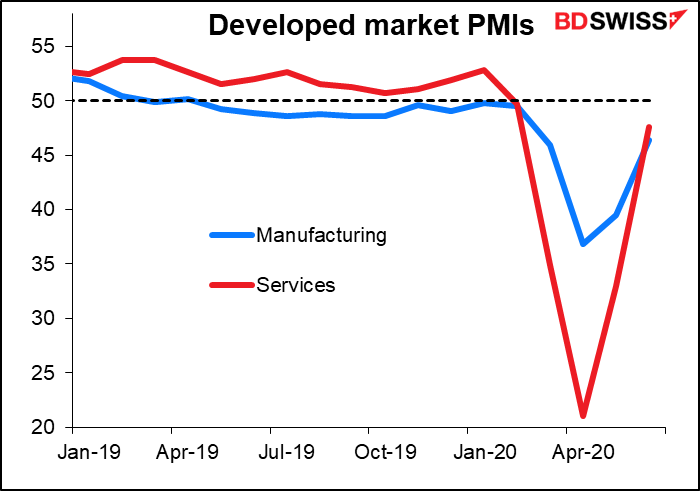

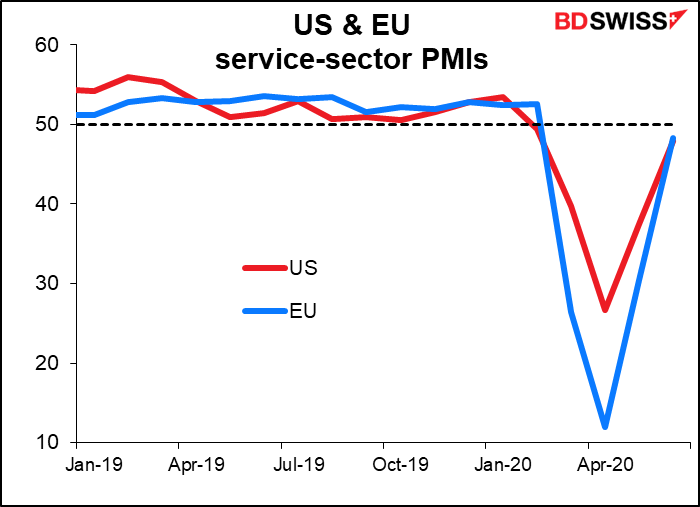

There are many such signs. The primary one is the sharp recovery in the service-sector purchasing managers’ index (PMI) globally. (I’m showing the developed market PMIs because we focus on the G10 currencies, but the story is the same for the global PMIs.)

The US and Europe are almost back to the 50 “boom or bust” line. That would signal an end to the contraction.

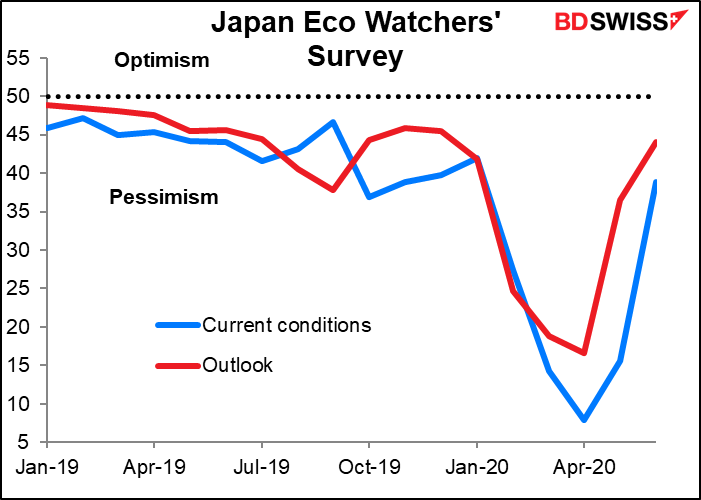

The Japan Eco Watchers’ Survey, a survey of grass-roots workers who are close to the consumer (barbers, tax drivers, waiters etc). is back to where it was last November and December, before all this hit. And the outlook is the highest it’s been this year.

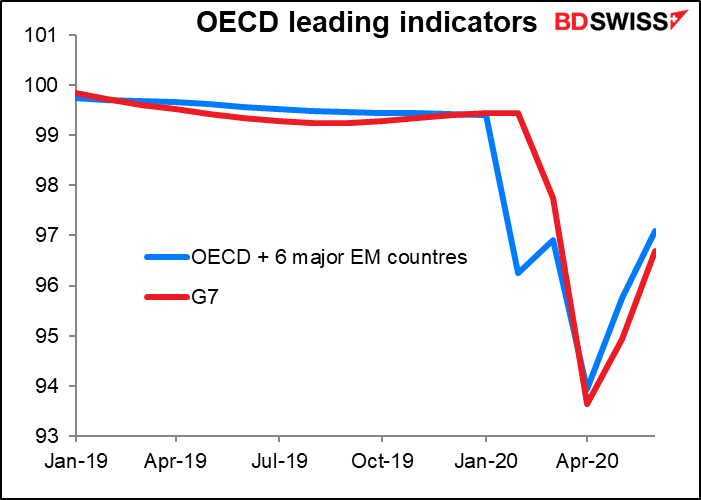

But not everything is there yet. The Organization for Economic Cooperation and Development (OECD) leading economic indicators tell a similar story, but not as far along. This “V” could be just the first half of a “W” – we’ll have to see.

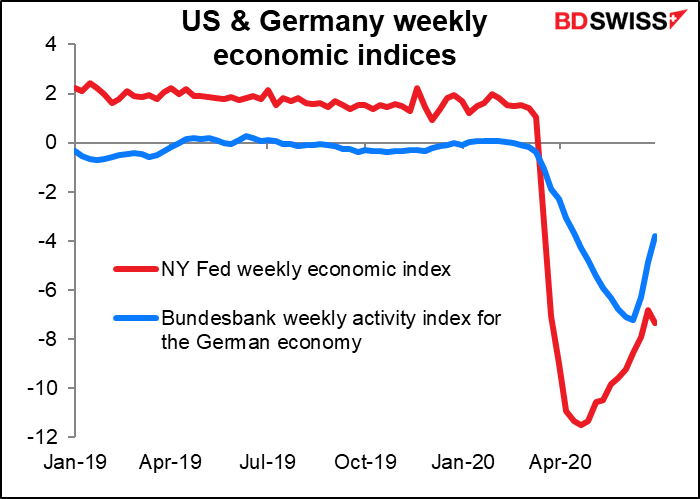

Same with the NY Fed and Bundesbank’s weekly economic indices, designed to track GDP growth but using short-term data. They only show half of a “V” so far.

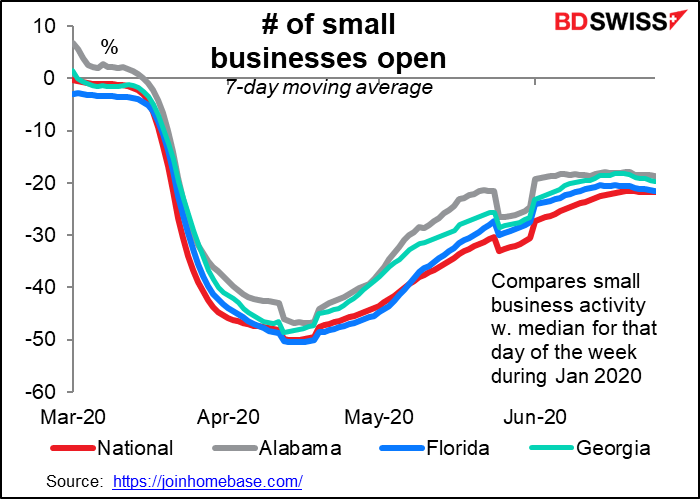

In an interview Tuesday with the FT, Atlanta Fed President Bostic (non-voter) said that high-frequency data had shown a “leveling off” of economic activity both in terms of business openings and mobility. While he was quite circumspect, as central bankers usually are, he’s probably worried that the “V”-shaped recovery in his region – which includes hard-hit Florida – could be more like a “W.”

The Atlanta Fed territory covers the Sixth Federal Reserve District, which includes Alabama, Florida, and Georgia, and portions of Louisiana, Mississippi, and Tennessee.

The Homebase app small businesses data are only available to the non-paying public with a lag, but the available data – up to 25 June – do indeed show that the three states were starting to see a decline in the number of small businesses that were open, in line with the rest of the country. The trend was especially noticeable in Florida.

Below is the Apple mobility data for requests for driving instructions in those three states compared to the data for the US as a whole. Florida hasn’t yet returned to normal and indeed is starting to turn down again.

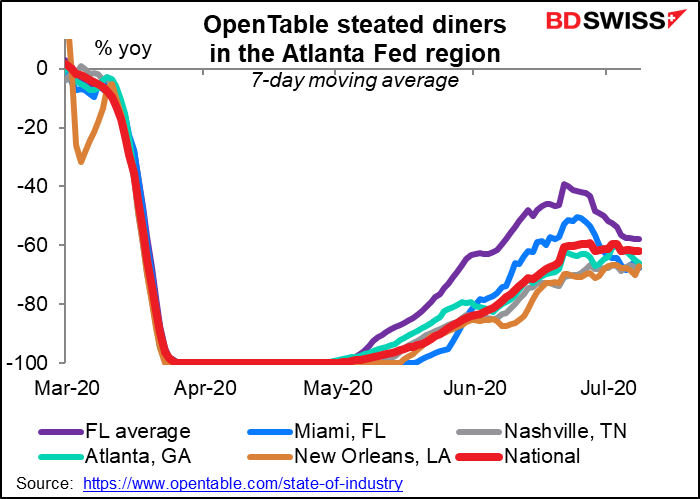

That’s certainly the case when we look at people going out to eat. The country as a whole has seen a “leveling off,” while in Mr. Bostic’s neck of the woods, there’s been a distinct downturn, particularly in Florida.

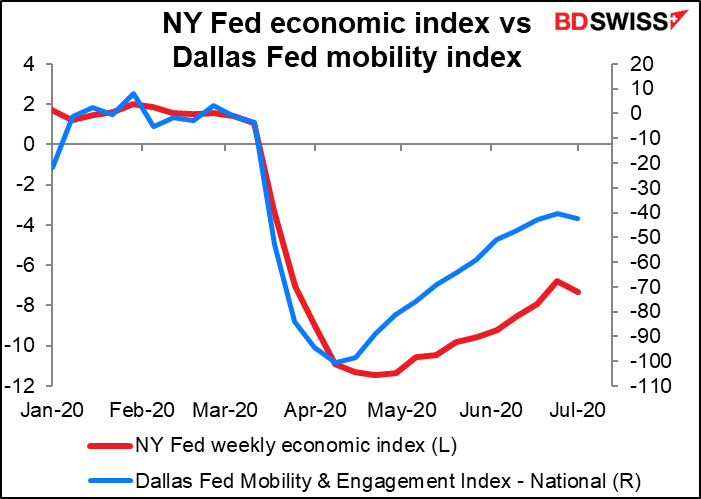

The relationship between mobility and economic activity is fairly clear. The Dallas Fed Mobility and Engagement Index, a national index of a range of spacial behaviors on mobile devices, has led the NY Fed Weekly Economic Index fairly closely. Mobility is starting to turn down, and with it, economic activity.

Even Cleveland Fed President Loretta Mester, one of the more hawkish people on the Federal Open Market Committee (FOMC), is worried. “We’ve seen some of the very frequent data suggest there has been a cooling-off because of the new data (about the virus) coming in so, I think there has been a sense of caution,” she told Bloomberg this week. “I don’t think any of us thought it would necessarily be a smooth path to increasing activity, but the numbers (of virus cases) are troubling,” she said.

Indeed they are. There are now only five states or territories in the US that are seeing fewer cases than they had a week ago (using a 7-day moving average), and the decline in those cases is barely enough to register on the graph. The number of cases is rising everywhere else. “These are not good statistics,” observed Mester.

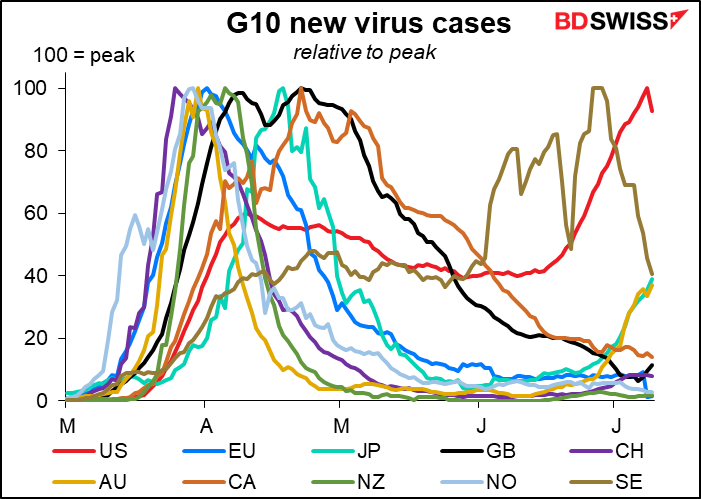

Globally, they are not good statistics either. The US remains the biggest outlier as cases in Sweden subside, but Japan and Australia are seeing troubling rises and an upturn is starting in the UK as well.

So which will it be: “V,” “W,” or maybe my favorite, the Japanese hiragana letter shi, which is writtenし – down, up and then stops. Or perhaps a so そ down, up again, then back down…

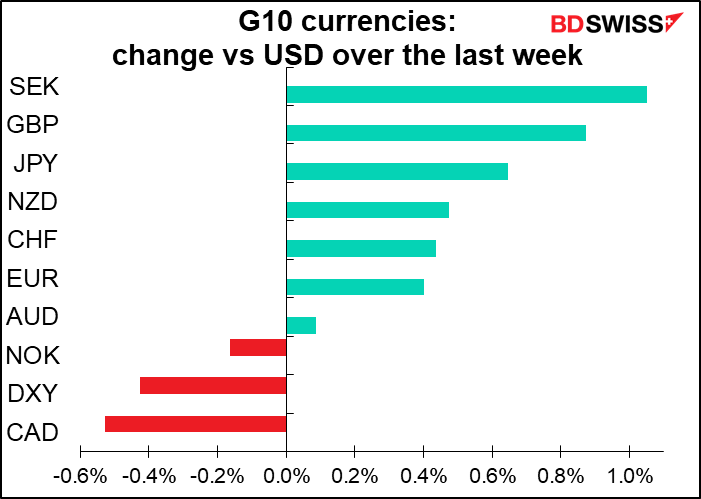

The point of all of this is that with interest rates at both ends of the yield curve converging across currencies and central banks on hold indefinitely, the main focus in the markets is growth. Those countries that can grow will see their currencies appreciate. Those that fall back into recession are likely to see their currencies depreciate. That means the path of the virus will determine the path of the currencies (as has been the case all along).

The one exception to that rule though seems to be the dollar: if the “second wave” becomes a general global problem, then the USD is likely to benefit from its role as the international safe haven – the “international dollar,” not the “domestic dollar.”

Next week: BoJ, BoC, ECB, EU Summit

There are three major central bank meetings during the coming week: the Bank of Japan (BoJ) and Bank of Canada (BoC) on Wednesday and the European Central Bank (ECB) on Thursday. None of them is expected to change rates or indeed to do much of anything. Central banks in general are on hold, waiting to see how the virus develops and what their governments do before they decide whether to crank up the printing presses a notch.

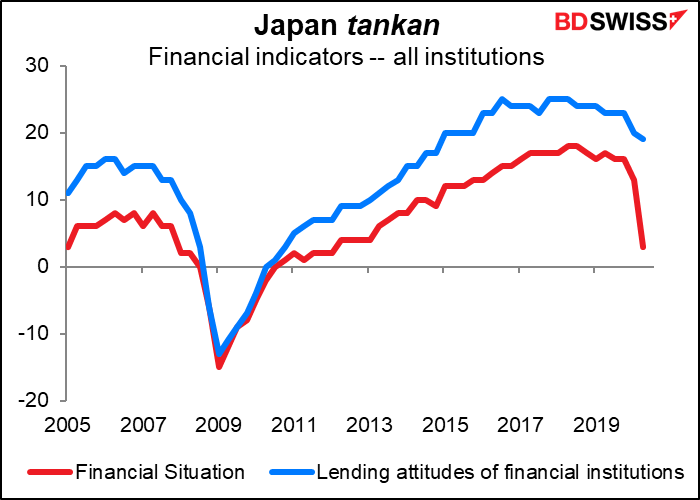

Given the signs of a nascent recovery, the BoJ is likely to maintain its current policy stance. As mentioned above, the Eco Watcher’s survey is back to where it was in November and December, before all of this hit. This suggests that the hard-hit service sector is recovering. Manufacturing will probably have to wait until world trade picks up, which is beyond the purview of the BoJ. Meanwhile, in the recent BoJ Short-Term Survey of Economic Conditions (Tankan), the financial situation and the lending attitudes of banks diffusion indices declines but remained positive, indicating that the financial support the BoJ and the government are providing to the banking system and to companies is working as intended. There’s therefore little need for the BoJ to tinker with its lending programs and other support measures.

The BoJ will also release its quarterly Outlook Report at the time. It’s likely to downgrade its outlook for overseas economies following the downward revision in the IMF’s World Economic Outlook, but after the large downward revisions back in April, any changes to the domestic view should be minimal – in fact, they could even be positive, seeing as several other central banks have highlighted that “things could’ve been worse.” But expect some words of caution about the outlook.

About the only point of interest will be whether they once again mention their concern about “the possibility that the momentum toward achieving the price stability target will be lost,” a boilerplate phrase that disappeared in April along with the usual assessment of the inflation target. Now that the initial flurry of activity is over, will they go back to worrying about inflation, or have they finally given up beating that dead horse? There may also be some discussion of the Bank’s USD fund-supplying operations, courtesy of the US Fed. Now that conditions in the money markets have calmed down somewhat, they may want to scale those back.

ECB: no change likely

Ditto for the ECB. At the last meeting in June, they expanded the Pandemic Emergency Purchase Programme (PEPP) and extended it into next year as well as implementing the large-scale Targeted Long-Term Refinancing Operation (TLTRO) auction. They also recently satisfied the German Constitutional Court’s discomfort with their Public Sector Purchase Programme (PSPP). That’s enough action for the time being. Nor will there be any forecast update to spur any changes in policy this time. Finally, the ball is in the governments’ court as they debate what to do about the European Commission’s proposed €750bn ‘Next Generation EU’ plan.

As a result, I would expect the Governing Council to take stock of the latest economic developments and reiterate its willingness to do more if necessary.

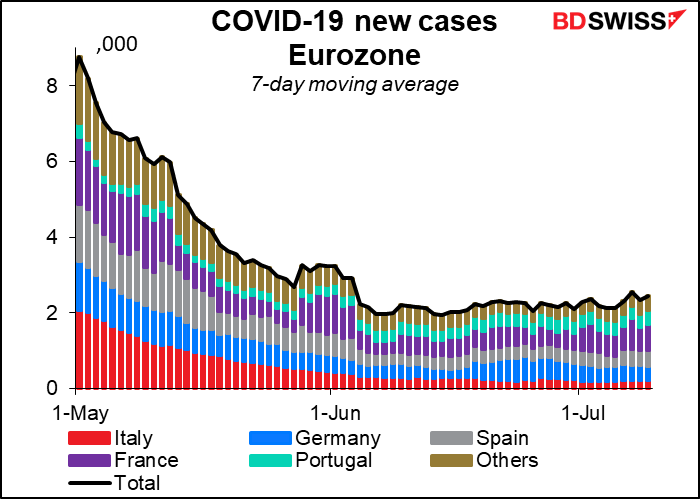

The only point of contention I can see is that some of the more hawkish Governing Council members have said that if the recovery proves stronger than expected, the ECB might decide not to use all the resources in the PEPP. However, with the EU yet to decide on the recovery fund and virus cases starting to inch up as countries start to emerge from lockdown, I think the recovery is far from assured yet. That debate can wait for a few more meetings.

If there are no new programs to debate and decide at this meeting, the Council could get back to the business of their strategy review, a goal that was put on hold because of the virus.

Bank of Canada: On Hold too

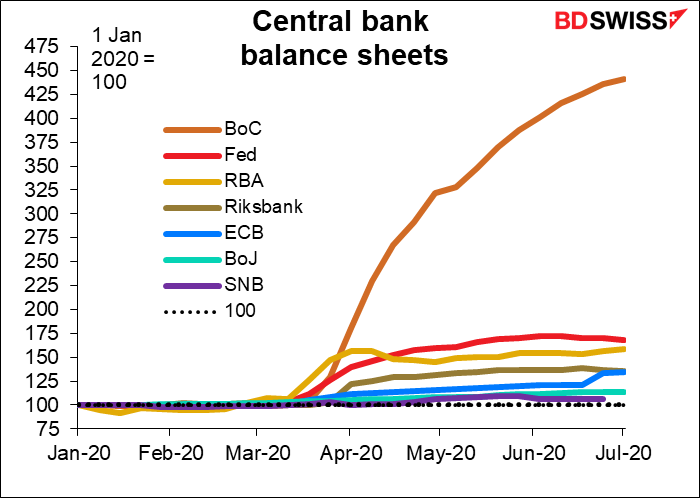

The BoC has been the most aggressive central bank in terms of expanding its balance sheet – not in absolute terms, but relative to its size at the beginning of the year. There’s no comparison with the other central banks.

The expansion has tapered off recently however, indicating that they believe they’ve achieved much of their goals. Indeed this was the message at their June meeting, when they decided to reduce the frequency of some of their emergency market operations. “As market function improves and containment restrictions ease, the Bank’s focus will shift to supporting the resumption of growth in output and employment,” they said at their last meeting. There could be some further shift in their programs in this direction. The other interesting point will be to see if they still expect growth to resume in Q3.

EU Summit: more talk, no action

The extraordinary EU Summit on Friday and Saturday will be the leaders’ first in-person meeting for some time. The main topic of conversation of course will be the European Commission’s proposal for a EUR 750bn “Next Generation EU” fund, comprised of EUR 500bn in grants & EUR 250bn in loans. There are four major points of disagreement: the overall size of the fund, the split between grants & loans, the contribution of each member to the budget, and the rebates that some members get. Four countries, the so-called “Frugal Four,” particularly object to grants (rather than loans), while some countries from eastern Europe object to the fact that the main recipients of the funds would be the richer countries such as Italy and Spain. There’s plenty to discuss and haggle about.

I expect them to discuss the mix of grants and loans – the “Frugal Four” don’t seem to object to loans that much – and perhaps they will revise the rebates that some countries get for their contributions to the EU budget to ally the concerns of the eastern countries. But no decisions are likely this time. The EU negotiations remind me of a sumo match: the fighters meet, they stare at each other for a while, then retreat back to their corners, rinse their mouths out, throw some salt around and come back for another brief staring contest. This goes on and on until time runs out, whereupon they collide.

All 27 EU members have to agree to the recovery fund and the EU’s next seven-year budget framework for 2021 to 2027. With so much money at stake, it will take more time to bridge the differences. I think the most that’s likely to come out of this meeting is probably some signs of goodwill and some agreement on the next steps. I wouldn’t expect the issues to be resolved until later in the year. I don’t think anyone is looking for an agreement at this meeting and so failure to agree should not be negative for the currency. On the other hand, an agreement doesn’t have to be complete for the market to have a positive reaction to it. Agreement on some issues would probably be seen as progress and therefore positive for EUR. The earlier they come to an agreement, the better for the euro – what the market wants to see is growth, and this fund is necessary to ensure growth in the Eurozone. We saw for example how a larger-than-expected budget deficit announcement for Canada this past week helped to push CAD higher

Other indicators etc.

In addition to these events, there will be many economic indicators worth watching.

In the US, we get consumer prices on Tuesday, Empire State manufacturing index and the Fed’s Beige Book on Wednesday, retail sales and Philly Fed indices on Thursday and U of Michigan consumer sentiment index and housing starts on Friday, not to mention the usual jobless claims on Thursday. Retail sales for June will probably be the most important of these – the market expects a further rebound in sales. The Empire State and Philly Fed indices are for July and so will also be closely watched.

The US earnings season will also start next week.

Eurozone industrial production for May on Tuesday will be the only major EU indicator.

Britain has a number of interesting data points coming out, including short-term indicator day on Tuesday (monthly GDP, industrial & manufacturing production, and trade balance, all for May), CPI on Wednesday, and unemployment on Thursday. GDP is expected to bounce back +5.3% mom from April, when it was down a whopping -20.4% mom. The Brexit talks move to Brussels next week.

Elsewhere, China releases its trade balance on Tuesday and GDP, retail sales, industrial production and fixed asset investment on Thursday. Q2 GDP is expected to be up +9.6% qoq, almost erasing the -9.8% qoq fall in Q1 It’s even forecast to be up modestly on a yoy basis (+2.5%), a good recovery after the -6.8% yoy fall in Q1.