Weekly Outlook

Weekly Market Overview: Higher volatility ahead, Will the US job market disappoint the Fed?

This week is going to be one of the busiest weeks in 2024, but what happened in the last week? Last week was another good one in the USD index 0.46%, 0.79% & Nasdaq 0.52% but silver did not follow the trend of gold & fell by -0.68%. In the meantime, crude oil prices tumbled by more than -4% on Monday for both WTI & Brent crude oil.

Oil proved to everyone that geopolitical tensions are not enough to keep the prices higher. Weaker demand outlook from China, World’s second biggest oil consumer & World’s biggest oil importer matters more. It is correct that Israel didn’t target the Iranian oil sites on Saturday, and only the military targets, but the major oil production fields in the Arabian Gulf remained safe & far from the real war that’s still going on for more than a year in the Levant. What’s next for oil? The answer will depend on more economic data this week, manufacturing PMI numbers from China will have a major impact, weaker numbers are likely to keep the pressure on oil for now. Technically speaking, we keep an eye on $66PB in WTI, that’s going to be an important support level.

Chart shows that weaker PMI numbers from China in 2024 have positive correlation with WTI crude oil that fell by almost -5% YTD. Chart: Tradingview

The US 10Y bond yields increased last week above 4.2%, the highest since late July 2024, however the implications could be misleading. As we know, higher yields will result in cheaper bond prices, in other words, the demand for safe-haven bonds fell. That’s correct, but the reason may not indicate to higher -risk appetite or an improved economic outlook! Markets started re-pricing the timing of the next rate cut by the Fed; interest rates have the biggest impact on the bonds. The 5-year chart shows a positive correlation between the US 10Y bond yields & Fed interest rates (higher rates & yields), however this correlation tends to be negative in YTD with higher yields by 10.8% & weaker rates by almost -9%.

Tradingview chart shows the positive correlation between US government bonds 10Y yields and Federal Reserve Interest rate with higher yields & rates. In the meantime, the higher the yields, the cheaper the bond prices are going to be, so is that an opportunity? We think the markets still ignore the underlying risks, which means that the cheaper bond prices offer an option for long to med-term investors.

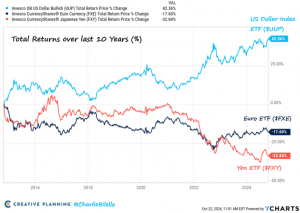

Combining higher interest rates in the US & growth rate in GDP over the past ten years, USD is in a better position than EUR & Yen. The US Dollar remains among the strongest global currencies & increased in value relative to the Euro & Yen over the past decade. Very simple explanation: why you wanna buy a currency that’s giving you as a trader or /and investor weaker yields & rate? Very simple explanation to USD strength & demand outlook.

Chart: Charlie Bilello – YCHART

Keep an eye on the US nonfarm payrolls on Friday, US GDP growth in Q3 (Wednesday) and US PCE numbers on Thursday. The Fed will remain data-dependent which means that the USD index – DXY will remain highly correlated to the US economic data, and exposed to short-lived technical correction (if any)