Weekly Outlook

Weekly Market Overview: Trump’s Trade & the Challenges Ahead

Last week was one of the best weeks in the US equities since the beginning of 2024, strong gains in Nasdaq 6%, Dow Jones 5.4%, SPX 5.2%, and the greenback index that increased by another 1% to 105.40, the highest since early July 2024, everyone is asking, is it really because of Trump’s landslide victory? To answer the question, the traders & investors must understand what Trump is planning first, and then how does the outlook look like? President-elect Trump always said that he will change the whole economic atmosphere in America with lower corporate taxes, less regulations, more spending and Trump’s own national perception of protecting the US industries & manufacturing. It really makes sense that the risk appetite increased, fear index lost more than 30% in a week and equities’ euphoria flourished. Being a candidate is likely to be different from being a president at the White House, but Trump was & still a businessman, he knows how to make delas & persuades both the allies & opponents, what matters is the risk management.

Treaders are likely to keep an eye on the US inflation (CPI numbers) on Wednesday where the estimates showed that the US inflation might increase to 2.6% last October. Federal Reserve cut the interest rates to 4.75% last week, highly expected & priced in, however the Fed will remain data-dependent which means that the higher the inflation, the higher the rates will remain for longer. How about not cutting the rates in the first half of 2025, is that possible? It is possible if US economy remains resilient with solid job market & inflation remains sticky which is the most likely. Chart: BlackRock

In the meantime, gold showed bearish performance for the last two weeks, fell by more than -2% in the last week, still on a monthly gain by almost 1%. What happened in gold recently was due to three major factors.

1st – Strong USD index that increased by 2% in a month, more than 1.3% in the last week.

2nd – China’s stimulus measures that disappointed the markets’ participants. China’s CPI contracted by -0.3% MoM in October, and PPI fell by -2.9% in October, worse than before.

3rd – Higher US 10Y bond yields that gained 0.24% in a month. Higher real yields will remain gold’s most challenging factor in the short – term.

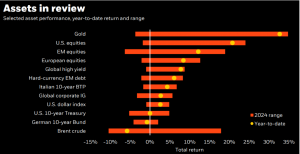

There is a question here, did the bullish trend in gold stop? The answer is no. Gold is still up by 30% in 2024, still in a better performance than many other assets including US, EM & European equities. Remember that Trump’s protectionism is likely to make the US inflation even higher, so be prepared. Graph: BlackRock Institute

Chart below shows that the yields on 10Y bonds in the US gained 10% YTD, which means that the US bond price fell due to weaker demand & continuous supply. At the same time, both silver & DXY gained by 33% & 3% respectively in 2024, so how will the traders allocate the assets? What these numbers are showing & confirming is that the diversification matters, while the US bonds kept falling, USD & precious metals gained. Since the global financial crisis in 2008, the correlation among the assets changed profoundly, and the distortion of the assets’ correlation materialized & is likely to continue as well. Chart: Tradingview