Weekly Outlook

Weekly Market Overview: Will the new- elected US president ignite a new trade war?

This week is going to be the most important week ever for years to come, not only in 2024, US presidential election on Tuesday, Federal Reserve & BoE rate decisions on Thursday , not to forget the ongoing China’s ruling party meetings between 4th to 8th November /2024 where everyone is asking: is China going to launch an economic bazooka with trillions of Yuan , supporting the economy & gaining the confidence of the investors ,domestically & globally.

As the numbers below show, last week was the second consecutive weekly gains in oil market, both crude oil benchmarks closed higher by almost 5% after OPEC+ agreed to delay its December oil production increase by one month, but that question here: what is the real risk?

Such a decision was positive for oil prices, but we think it is likely to be short-lived, simply because the markets realized that this decision showed that the demand outlook is not really promising, while China, World’s second biggest oil consumer is trying to support the slowing economy, not to forget the political factor from America if Harris wins with Democratic party’s dedication to green economy & less reliance on fossil fuel.

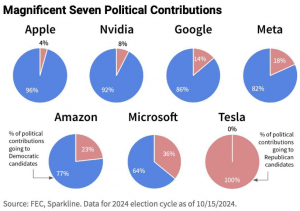

In the meantime, what are the US companies that contribute the most in this election? No more comments, picture shows below that all major US tech gigantic firms fully support Harris – Democratic Party and only Tesla – Elon Musk fully supports Trump. What this picture reveals is that the political influence in America comes from the tech firm that shape people’s life, decisions, public opinion & policies as well. The tech firms bet that Harris looks like less risky that Trump who wants to impose more tariffs, protections & highly probable trade war with China & other trading allies & partners, however that’s risky bet as the new-elected president may change the entire policies not to forget that Trump wants lower corporates’ tax, while Harris proposed higher taxes on wealthy people. Trump before wanted weaker USD which means that the clash with the Fed may intensify if he becomes the president.

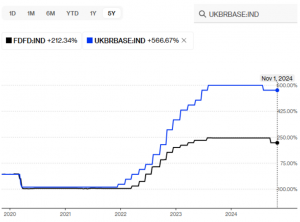

Who was better for the markets, Donald Trump between 2016 to 2020 or Joe Biden from 2020 to 2024?

Chart shows- Tradingview Chart, SPX gained by almost 65% between 2017 to the end of 2020 (Trump’s presidency, with SPX from 2273 to 2760), while SPX increased by 51% between 2021 until today, from 3790 to 5728, but is that enough? The answer is absolutely not.

Its correct that Trump wants weaker USD & lower tax on corporates which is positive for markets, but the trade war (if happens), more tariffs & aggressive immigration policies are unlikely to have positive impact on the investors’ sentiments. Protectionism will result in higher inflation which means that the rates will remain higher for longer and that will lead to stagflation in America.

In the times of the ongoing war & geopolitical tensions, the demand for high-sophisticated defense industries never slowed, that’s what the performance of many global defense manufacturers showed. YTD, Lockheed Martin increased by 20%, RTX ORD 40%, Northrop 7.8% and BAE systems 13.7%. Keep in mind that investing in defense may involve development & production of weaponry and support military operations to a certain extent, so business ethics matter for many.

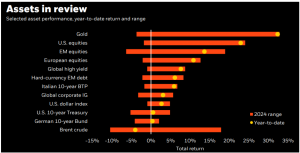

As for the assets, gold is still up by almost 32% YTD, overcoming other major assets including US equities 25%, European equities 13% and USD index 2.5%. There is an ongoing question among the investors & speculators, is the rally in gold going to continue? The answer is not easy, while gold showed strong resilience in the face of strong & higher US rates (still at 5% now), the underlying risks remain serious, that include higher rates for longer & higher bond yields as well. China is another risk where the Chinese government fights to bolster the growth. In the meantime, the fundamentals in gold remain intact, trend remains bullish for now.

Numbers & graphs: BlackRock

After Tuesday, the attention will start shifting to another big day on Thursday where both the Fed & BoE will have rate decision & press conference. The interest rates in the UK & US remained the highest among the advanced economies at 5%, while reducing the rates by 0.25% was highly expected & priced in, forward guidance matters. The Fed could be faster than BoE in reducing the rates more often, adding another cut by -0.25% before the end of 2024. What matters to us is the outlook for the inflation & growth perspective in 2025.

What are the factors that will push for weaker rates? Is it because of weaker growth, political intervention, currencies war, trade deals, that’s what matters to us, more than the rate cut itself. In the last cycle of rate hikes, BoE started hiking the rates before the Fed, BoE started in December 2021, the Fed in February 2022, and when the rate cut happened few months before, the Fed was more aggressive by cutting the rates 0.5%, BoE 0.25%.

Chart: Bloomberg