Weekly Outlook

U.S. Consumer Confidence Improved, Australia’s Inflation Picked Up, Core PCE Price Index Lower than Expected, PMIs, ECB and BOC Cuts, U.S. and Canada’s Labor Market Data Ahead

PREVIOUS WEEK’S EVENTS (Week 27 – 31.05.2024)

U.S. Economy

U.S. consumer confidence unexpectedly improved in May after deteriorating for three straight months amid optimism about the labour market, but worries about inflation persisted and many households expected higher interest rates over the next year.

The Conference Board said that its consumer confidence index increased to 102.0 this month from an upwardly revised 97.5 in April.

Consumers’ inflation and interest rate views were formed by price pressures in the first quarter that kept inflation high. The Fed has kept its policy rate in the 5.25%-5.50% range since July and it is expected to keep it unchanged until September.

Downward revisions to consumer spending and a key measure of inflation ticked down. GDP (Gross domestic product) grew at a 1.3% annualised rate from January through March, down from the advance estimate of 1.6% and notably slower than the 3.4% pace in the final three months of 2023. The first-quarter growth downgrade suggests the U.S. central bank’s aim of gradually cooling the economy through high interest rates is having an impact, although it remains uncertain whether the weakening trend in inflation will continue.

______________________________________________________________________

Inflation

Australia’s CPI

Australian consumer price inflation unexpectedly picked up to a five-month high in April due in part to increases in petrol, health and holiday costs, bolstering expectations that interest rates would not be lowered soon.

The Australian (CPI) rose at an annual pace of 3.6% in April, up from 3.5% in March and above market forecasts of 3.4%. Moreover, a closely watched measure of core inflation, the trimmed mean, also accelerated to an annual 4.1%, from 4.0%. The CPI excluding volatile items and holiday travel stayed at an annual 4.1%.

The RBA expects headline inflation to pick up to 3.8% by June this year.

U.S. PCE Price Index

The U.S. inflation tracked sideways in April. Price increases could last longer than expected, the Fed suggested. However, the personal consumption expenditures (PCE) price index increased 0.3% last month.

The PCE price index rose 2.7% year on year, after advancing 2.7% in March. Core PCE, subtracting food and energy prices, rose 0.2% month to month, less than the forecast repeat of March’s 0.3% rise. In the 12 months to April, the core index rose 2.8%, the same as expected and as last month’s rise.

______________________________________________________________________

Sources:

https://www.reuters.com/markets/australia-consumer-inflation-surprises-high-side-april-2024-05-29/

https://www.reuters.com/markets/us/us-economic-growth-revised-lower-first-quarter-2024-05-30/

https://www.reuters.com/markets/us/us-consumer-confidence-unexpectedly-improves-may-2024-05-28/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 27 – 31.05.2024)

Server Time / Timezone EEST (UTC+02:00)

Currency Markets Impact:

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

Dollar Index (US_DX)

Since the 28th of May the dollar started to strengthen significantly after the release of the improved consumer confidence figures. On the 29th the Richmond Manufacturing figure helped the USD to gain more strength with its improved figure as well. After that, the economic data were not in favour of the dollar. The second-estimate GDP was reported to have grown 1.3% in the first quarter, below the first-estimate of 1.6%. On the 30th of May, the dollar started to weaken. Further weakening continued with the release of the core PCE price index figure that was reported lower than expected causing dollar depreciation. However, despite the news the dollar is hard to bring down.

This week will be interesting and dollar appreciation is expected instead. Will this week be the week that the dollar index takes off considering a triangle formation breach, the Central Banks Rate cuts, the Fed still faces high inflation, and NFP figures are expected to be reported higher.

EURUSD

EURUSD

Despite the fact that the ECB is expected to cut interest rates this week the EUR does not seem to be affected greatly. The pair’s movement is driven by the USD apparently as we compare this chart with the dollar index chart. Since the 30th, the EURUSD moved to the upside as the dollar suffered depreciation. It could be the case that this week we will see the dollar strengthening, considering the interest rate cut events from non-Fed central Banks and a stronger NFP report on Friday 7th of June.

USDJPY

USDJPY

The pair was moving upwards until the 30th of May. As the dollar started to depreciate heavily, the USDJPY moved to the downside aggressively however the pair reversed to the upside quite strongly due to JPY depreciation that helped it to remain high. Despite the dollar depreciation that took place on the 31st, the USDJPY pair remained close to the 30-period MA indicating that the JPY is suffering occasional weakness. A sudden dollar strengthening will potentially cause the USDJPY to jump significantly and remain high for longer.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD

After a period of consolidation during the weekend when the price experienced low volatility, Bitcoin saw a jump on the 27th of May reaching 70,6K but soon reversed heavily to the downside. After finding support at near 67,500 USD it retraced to the 30-period MA and remained close, settling near the 68K USD level. Despite some high volatility on the 30th of May, the price still remained close to that level.

On the 31st of May, Bitcoin dropped after the U.S. PCE Price Index figure release reaching near the support at 65,500 USD before retracing to the 30-period MA. After a period of consolidation taking place over the weekend, the price broke the resistance and movies currently to the upside. It stalled at the resistance near 69K USD for now. The next level is at 69,500 USD.

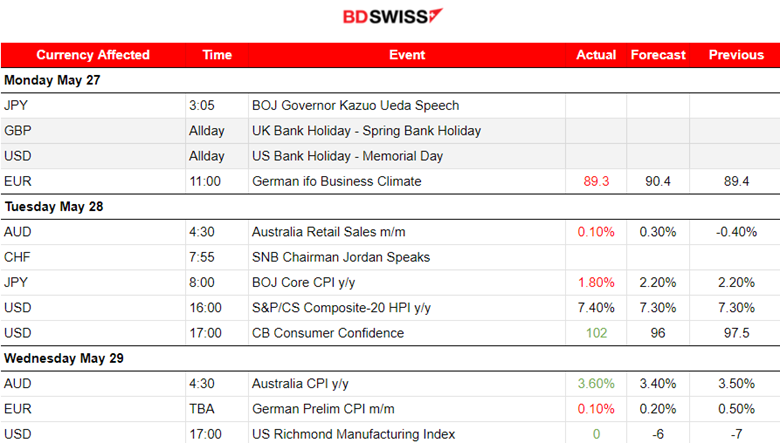

NEXT WEEK’S EVENTS (Week 03 – 07.06.2024)

NEXT WEEK’S EVENTS (Week 03 – 07.06.2024)

Coming up:

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

OPEC+ is in the financial media’s focus, highlighting the probability of an extension of the voluntary cuts for the third quarter of the year, however, we have seen a remarkable drop in price since the 29th of this month.

That clear downtrend could end soon. We are 4 dollars down from that peak and even though we have 1 or 2 dollars downward potential, considering Crude oil’s volatility this year, it might be the time for a turn to the upside. The RSI is clearly showing a slowdown (bullish divergence). The OPEC+ meeting on Sunday was probably deterministic in regards to the direction of Crude oil’s price. Since OPEC+ decided to extend oil production cuts into 2025 the price will have a pressure to stay high.

Source:

Gold (XAUUSD)

Gold (XAUUSD)

On the 30th of May the price continued to the downside, testing the 2,320 USD/oz as mentioned in our previous analysis, however, it was unsuccessful. 2,340 USD/oz served as the mean price until the 31st of May with the price deviating around 20 dollars from that mean. The price broke the support at near 2,320 USD today and with a potential to move further downwards. However, it stalled after the breakout, indicating that there are upward pressures that keep the support strong yet.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500)

Price Movement

The wedge was broken on the 28th and the index moved lower to the support around 5,280 USD before reversing to the 30-period MA. A downward path continued on the 29th of May and with no signs of slowdown it continued all the way down until the 30th of May. The RSI was indicating a bullish divergence (higher lows) Price: lower lows, as mentioned in our previous analysis.

A jump occurred eventually on the 31st of May which was a huge reversal, crossing the 30-period MA on its way up potentially ending the downtrend. This was the confirmation of the bullish divergence. The index is near the upper band of the 50- period Bollinger Bands indicating resistance for moving further to the upside. Retracement to the 61.8 Fibo level (back to the 61.8% of the total movement to the upside) is more probable, with target Level near 5,265 USD. Less probable alternative scenario could be the breakout of the 5,300 USD resistance pushing the index more to the upside with target level near 5,330 USD.

______________________________________________________________