Weekly Outlook

U.S. Retail Sales Up, USD Strong, U.K. Inflation Lower and Cooling Labor Market, Falling U.S. Indices, PMIs Ahead

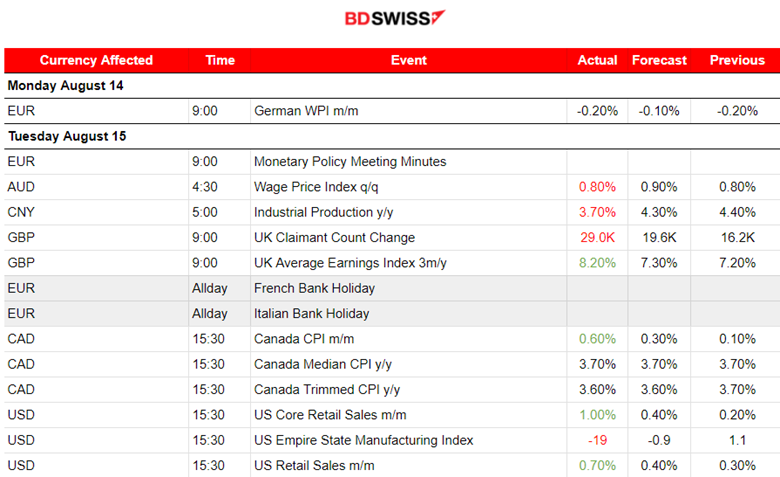

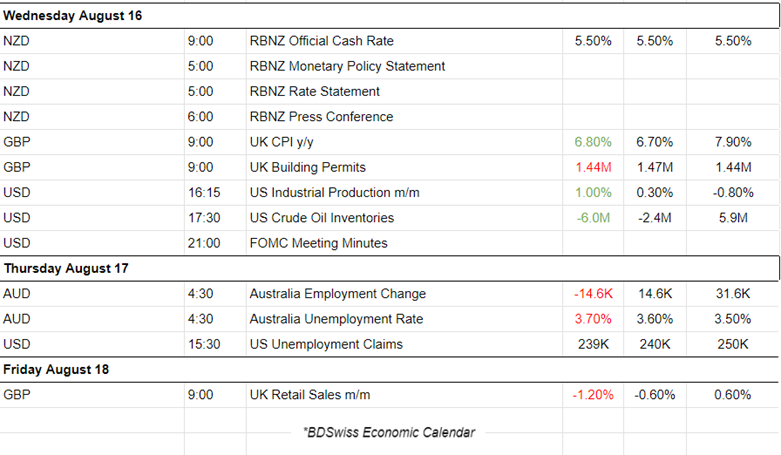

PREVIOUS WEEK’S EVENTS (Week 14 Aug – 18 Aug 2023)

Announcements:

U.S. Economy

The reports last week showed that U.S. retail sales increased more than expected in July, suggesting that the economy continued to expand early in the third quarter despite the Federal Reserve’s aggressive interest rate hikes.

Some economists do not think that the Fed is over with inflation after considering these data. However, this suggestion of strong spending eliminates more and more recession fears also considering the U.S. healthy labour market.

The number of Americans filing new claims for unemployment benefits fell last week, to about 11K, which is not considered very high. However, it shows that the labour market is hot and refuses to get much affected by the recent Fed policy.

The minutes of the Fed’s July 25-26 meeting were published on Wednesday, noting that further progress toward balancing demand and supply in the labour market was needed, expecting that additional softening in labour market conditions would occur as time passes.

Most economists believe the rate hiking cycle is likely over, given the recent moderation in inflation.

U.K. Economy

The number of people claiming unemployment benefits in the U.K. have increased, according to the latest Claimant Count report. These are fresh signs of cooling in the jobs market, with also the unemployment rate unexpectedly rising to 4.2% from 4.0%, the highest since the three months to October 2021 and climbing more quickly than the central bank has forecast.

Annual pay growth, including bonuses, also accelerated, hitting 8.2%, the fastest outside the coronavirus pandemic period.

According to the U.K. retail sales data, sales have fallen by 1.2% in July 2023, following a rise of 0.6% in June 2023 (revised from an increase of 0.7%). This was a bigger-than-expected decline in sales in July.

All of the above are signs that rate hikes have a strong effect on the economy. However, inflation is not dramatically falling.

_____________________________________________________________________________________________

Inflation

Canada:

The CPI changes for Canada showed that the annual inflation rate surged more than expected in July to 3.3%. The average of two of the Bank of Canada’s core measures of underlying inflation, CPI-median and CPI-trim, came in at 3.65% compared with 3.70% in June.

This causes an increase in the likelihood of another interest rate hike. Many economists are sharing this view.

U.K.: The CPI data caused volatility for the GBP pairs as the annual inflation rate for the U.K. was reported lower but higher than expected. The figure is not lowering significantly, and so the worries about persistently high inflation in the U.K. grew further. The annual consumer price inflation rate was reported at 6.8%, down from June’s 7.9%, as the Office for National Statistics said. Core inflation, which excludes energy and food prices, remained at 6.9%, unchanged from June.

The strength in core inflation is bad news. The market expects rate hikes to continue. With wage growth and services inflation both stronger, the Bank has a long way to go.

_____________________________________________________________________________________________

Interest Rates:

RBNZ: The Official Cash Rate (OCR) was held steady at 5.5% by the Reserve Bank of New Zealand (RBNZ). The OCR needs to stay at restrictive levels, they said, to ensure annual consumer price inflation returns to the 1% to 3% target range.

The cash rate would need to remain at around its current level of 5.5% to meet its inflation and employment objectives. The RBNZ has a 40% chance of a further 25 basis point hike to 5.75% in 2024, according to the monetary policy review (MPR). The rate hikes have sharply slowed the economy in a technical recession following two quarters of negative growth.

New Zealand’s annual inflation is currently 6.0%, with expectations to return to the central bank’s 1% to 3% target by the second half of 2024.

____________________________________________________________________________________________

Source: https://www.reuters.com/markets/nz-central-bank-leaves-cash-rate-hold-55-expected-2023-08-16/

https://www.reuters.com/world/uk/uk-inflation-rate-slows-68-july-2023-08-16/

https://www.reuters.com/world/uk/uk-basic-wage-growth-hits-record-high-2023-08-15/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 14 Aug – 18 Aug 2023)

_____________________________________________________________________________________________

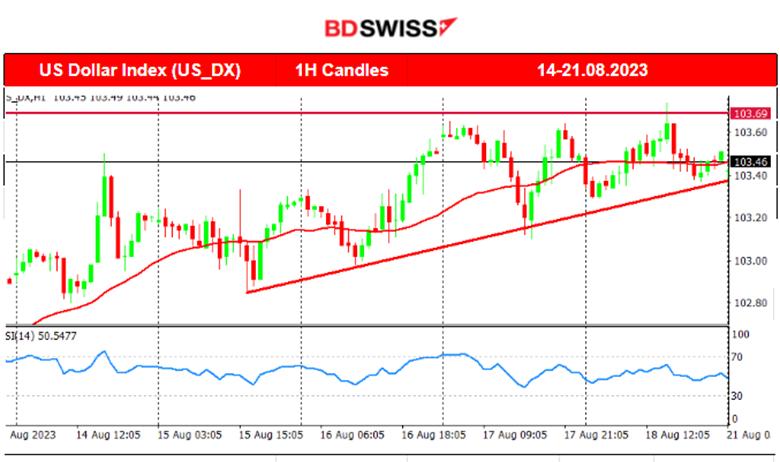

FOREX MARKETS MONITOR

DXY (US Dollar Index)

The Dollar experienced strength again last week overall. As we approach the end of the week, we see USD strengthening since the U.S.-related data releases showed figures favouring USD appreciation. The 18th of August shows signs of consolidation and a triangle formation. The downward band is visible by the red upward line, while on the upside, we see an important resistance level near 104. Important announcements this week will probably have a major effect on the USD, thus, it will probably move rapidly in one direction after breaking those bands.

EURUSD

Obviously, the USD is driving the pair path, As the USD strengthens, the pair moves more to the downside. The EURUSD was experiencing volatility with a downward direction overall last week. It remained below the 30-period MA on its way down; however, recently, we see it moving sideways. It might be the end of the downward move for now—the price forms lower lows, and the RSI higher lows, indicating bullish divergence.

_____________________________________________________________________________________________

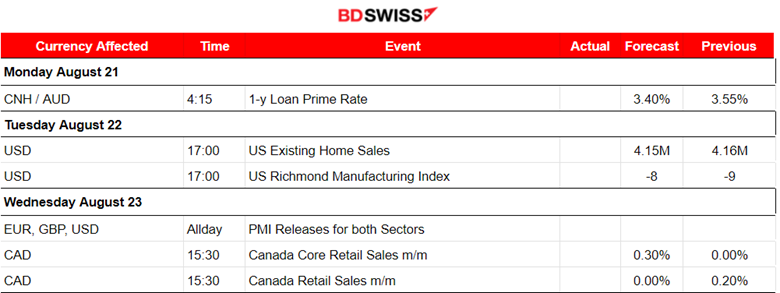

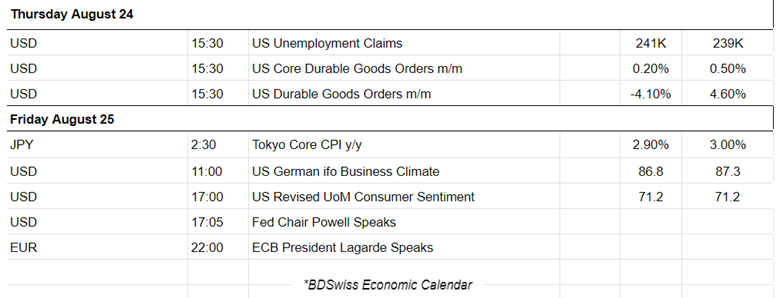

NEXT WEEK’S EVENTS (21 Aug – 25 Aug 2023)

Important PMI data for the Service and Manufacturing sector will enlighten the picture, especially for the U.S.

In addition, retail sales data for Canada this week and U.S. durable goods data release.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

The downward trend was short-term, and it seems that it ended somehow. However, the 30-period MA has only now shown a slowdown and volatility is still expected to be high. The price was moving around the mean sideways, indicating the downward movement’s end. It crossed the MA many times and remains on the upside. However, the RSI does not form a bullish divergence. It only confirms the movement. For the price to move upward significantly, it must break the level of 80.95 USD/b. This will give us a better signal in regard to future price direction.

Gold (XAUUSD)

As the USD gains strength, we see Gold moving lower and lower. A downtrend is apparent, the MA is obviously going down. It broke the 1900 USD/oz and even dropped until 1896 USD/oz before reversing quickly on the 15th of August. As the USD strengthened, Gold dropped further to the strong support of 1890 USD/oz, which broke, and the price eventually moved even lower. Gold price broke further support levels on the 17th of August, reaching even the level of 1885 USD/oz. No signs of reversing are apparent as the price still remains under the 30-period MA.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

The Fitch and Moody’s Ratings hit the U.S. stock market recently, causing it to crash intraday several times. The downturn continues as the market continues to underperform, breaking important support levels. The index remains below the 30-period MA, moving steadily downwards. However, it might be a seasonal effect. After August, the price path could see drastic changes until the end of the year.

______________________________________________________________