Weekly Outlook

We know the theory, lets’ see the action

This past week was mostly about the European Central Bank, with a sideshow in Britain and something from the Bank of Canada for those who trade CAD. In the coming week though we have a full schedule: meetings of three major central banks, US retail sales and the first two of the monthly Fed surveys, UK employment, inflation and retail sales, and a new Prime Minister in Japan…there’s a lot to watch.

First let’s discuss the three upcoming central bank meetings: the US Federal Open Market Committee (FOMC) meeting on Wednesday and the Bank of Japan (BoJ) and Bank of England (BoE) on Thursday.

The Fed is the main point of interest. Last month, Fed Chair Powell revealed the new Statement on Longer-Run Goals and Monetary Policy Strategy, the result of a two-year review of the Fed’s approach to monetary policy. We now know what their new framework is. The question then is: how do they translate that new theoretical framework into practice? What’s going to change?

Cleveland Fed President Loretta Mester (V) last week said, “It’s important that the statement that comes out of the meeting be consistent with the new strategy document.” But how? Even she admitted that the markets fully understand the Fed’s stance and so there isn’t much more that needs to be done in the way of clarification or explanation.

The main pressure points are 1) the Fed’s forward guidance, 2) their rationale for their bond purchases, 3) the maturity profile of their bond purchases, and 4) guidance about the likely amount of purchases in the future. For example, since March the Fed has said it would keep rates near zero until the Committee is “confident that the economy has weathered recent events and is on track to achieve” its goals. That’s rather vague – what does “weathered” mean, what does “on track” mean?

But Fed Chair Powell has said many times that the “The path forward for the economy is extraordinarily uncertain and will depend in large part on our success in keeping the virus in check.” With all its hundreds of PhDs, the Fed nonetheless has a lousy record for forecasting the economy. How can they be expected to forecast the pandemic?’

At some point they will probably have to refine their forward guidance and be more specific about what conditions would justify continuing with low rates and what would justify raising them; whether they’re buying bonds to improve market functioning or to support the economy; whether they’re going to start buying longer-dated bonds to hold down the long end (“Operation Twist”); and whether they’re ever going to have an equivalent of the “dot plot” that lays out expectations for their asset purchases. At some point, yes. But indications from officials recently indicate that there’s no consensus on these points yet and no urgency to reach a consensus. As long as the virus holds illimitable dominion over all, monetary policy will have to remain vague.

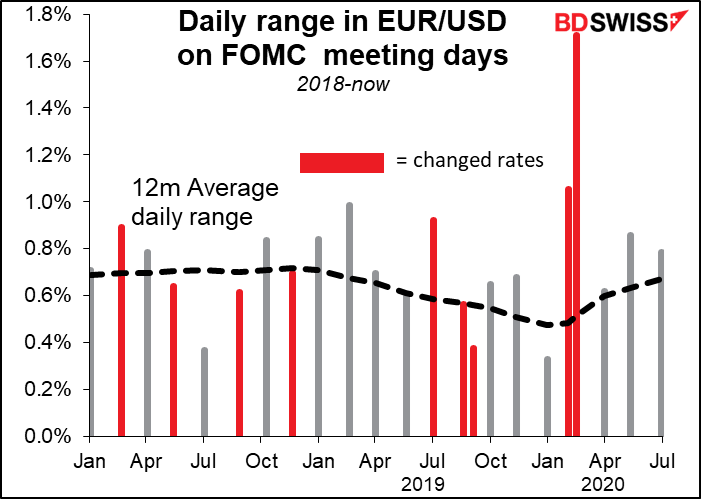

Net net, people will be looking for some change in the statement and some change in the Summary of Economic Projections (SEP), but there might not be much if any.

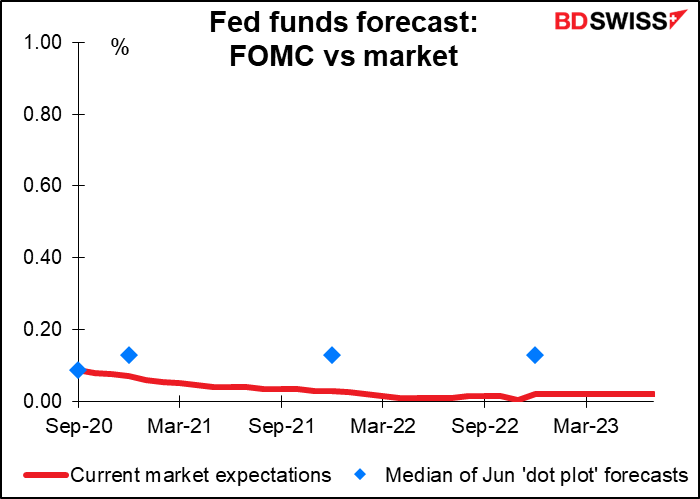

Speaking of the SEP, it will include the first forecasts for 2023. If the “dot plot” shows that they expect rates to remain at zero then too, it would be a kind of forward guidance. But that would just confirm what the market already expects. The new framework wouldn’t change anything.

So long as it’s “steady as she goes,” the new framework really won’t make much difference. “As we get to that period when it’s clear to everyone that we’re transitioning out of an emergency setting into a more stable setting, that’s when I think the kind of forward guidance and clarity…will become more important,” said Atlanta Fed President Bostic (NV). “I don’t think we’re there right now.” Mester agreed. “It’s those times when expectations — the public’s expectations and market expectations — could change and they could get out of line with policymakers’ expectations. And that’s where I think the framework will really be helpful, in the sense it gives us a way to really explain to the public: “No, remember, here’s what we said.”

Bank of England: “when,” not “whether;” but not now

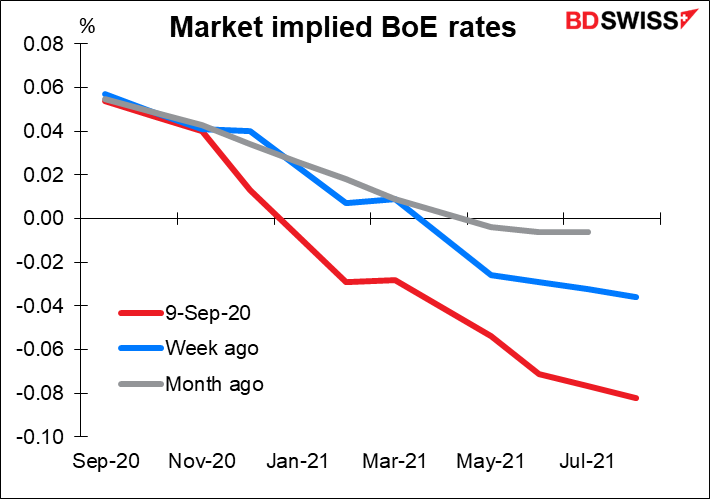

With the Bank of England (BoE), it’s more a matter of “when,” not “whether” or “what.” Market expectations are for further easing. The market is pricing in a Bank Rate of -0.10% by next June, vs a target rate of +0.10% today. Most of the recent comments by BoE officials have been to reassure the markets that “we are not out of firepower by any means,” as BoE Gov. Bailey said at the Jackson Hole virtual symposium.

That doesn’t mean anything specific for this meeting, however. With no update on the forecasts, no press conference scheduled, with Brexit talks looking like the parrot sketch from Monty Python (the UK position is that the Withdrawal Agreement is “just resting”) and with the next Bank of England meeting scheduled for 15 November, well after the 15-16 October EU Council meeting that’s the effective deadline for reaching an agreement, I can’t imagine that the Bank would take any decisions at this time. Furthermore, with July GDP up 6.6% mom and industrial production gaining, they may be getting a bit more optimistic about the economy (although the expected plunge in inflation for August, to be announced a few hours before they meet, might cause some consternation – see below).

I expect another unanimous decision to keep policy unchanged and an update on how the economy is going relative to the optimistic projections set out in the August Monetary Policy Report (MPR). Other than that, not much. The excitement is likely to come in November, when the Brexit endgame is known and the next MPR brings revised forecasts. A number of forecasters are expecting some move then or in December.

Meanwhile, the sale of the parrot Brexit talks will continue next week with more meetings in Brussels. The EU has given PM Johnson until the end of the month to drop legislation changing parts of the Withdrawal Agreement and threatened legal action if he doesn’t. I think it’s possible that the Conservatives back down on this, even though they pledged to keep the United Kingdom united. Not only has the law come in for severe criticism from Johnson’s own Conservative Party, but US House Speaker Pelosi said there was “absolutely no chance” of a US-UK trade deal passing Congress if the UK government decides to override the Withdrawal Agreement. And with good reason; what value would there be in signing an agreement with a government that has a track record of unilaterally abrogating agreements?

I should point out, this issue should come as no surprise to anyone. The Northern Irish border was always the insoluble problem with Brexit. I thought PM Johnson solved it by lying to the British people (he promised to maintain the integrity of the UK market and then caved in to EU demands), but apparently he solved it by lying to the EU (appearing to cave in to EU demands but with his fingers crossed). There never was any solution that would satisfy both sides. They should have known that before they even brought up the idea of leaving the EU.

Bank of Japan: Speaking of dead parrots…

The BoJ meeting will probably be a ho-hum affair. They won’t publish an Outlook Report, so no update to the forecasts. The meeting will take place just a few days after the new LDP presidential election, which is in effect the vote for the new Prime Minister. The Policy Board will want to see what new plans or ideas, if any, the new PM has before deciding on any policy changes. Besides, there’s been no change in the pandemic, no change in inflation, and no change in inflation expectations to warrant a move. BoJ Gov. Kuroda will probably stress at the press conference that policy won’t change just because the PM changes, as Deputy Gov. Wakatabe made clear in his speech on 2 Sep: “Quite irrespective of the choice of the next PM, my view on what the ideal policy might be at this time is that the existing policy stance is indeed the correct one.” I expect the statement following the meeting to be little changed and for the meeting to have little impact on JPY.

Monday’s election for the leader of the ruling Liberal Democratic Party (LDP) has about as much suspense as the BoJ meeting. It’s pretty much a foregone conclusion that the LDP will elect Chief Cabinet Secretary Yoshihide Suga to succeed retiring PMI Abe as president of the LDP (and therefore as Prime Minister). As Abe’s right-hand man for many years, he’s pledged to keep to the same track as Abe.

His comments though portend an even more expansive monetary policy, if that’s possible. As I mentioned in Monday’s daily (FT Article Roils GBP; LDP Leadership Battle Begins w. Suga in the lead = JPY-) Suga not only has an aggressive view on monetary policy but also doesn’t hedge it with the usual caveats that monetary policy is the purview of the BoJ, etc etc. I think his election is a long-term negative for the yen, although not immediately, because of course monetary policy is the purview of the BoJ and Gov. Kuroda isn’t going anywhere until April 2023. But it could also be a short-term negative for the yen if, oddly enough, the stock market takes heart from his plans and pledges. That could spark a “risk-on” mood in Japan that would usually lead to a weaker yen.

Indicators: US retail sales, the first Fed indices, and a slew of UK reports

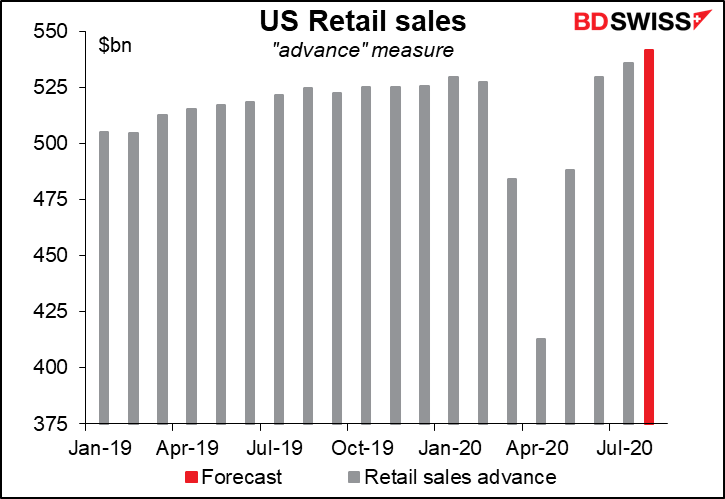

The main indicator of the week is the US retail sales on Wednesday. It’s expected to be up 1.0% mom, a slowdown from +1.2% in the previous month. A slowdown in the rate of recovery of consumption is worrisome, but then again it’s not clear whether it was caused by a lack of demand or constraints on consumption as many places dealt with a resurge in the virus. And in any case, it would put sales 2.4% above the pre-pandemic level, which is fairly healthy. Assuming people are just happy to see any increase, I think signs that the recovery is continuing could be positive for the dollar.

The Empire State manufacturing index on Tuesday is expected to be up a little, while the Philadelphia Fed business survey on Thursday is expected to be down a little, with the net impression at the end of the day that there’s not much change – that the economy continues to expand slowly.

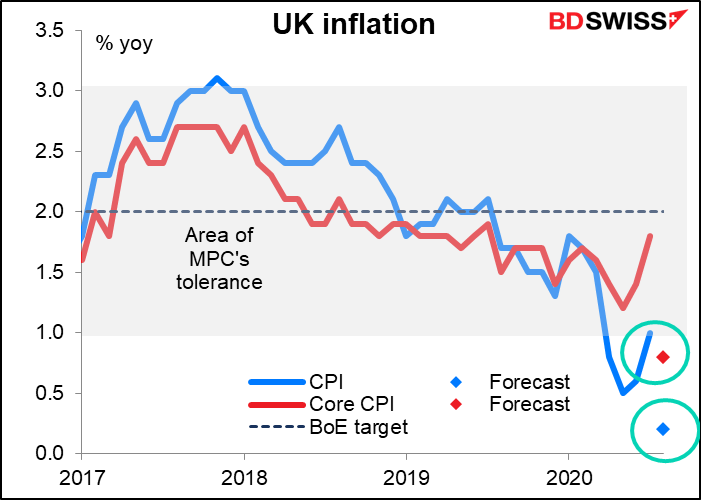

In addition to the Bank of England meeting, Britain sees the employment data on Tuesday, consumer prices on Wednesday, and retail sales on Friday. Within this, the inflation data is probably the most important, followed by the employment data. People still watch the jobless claims although economists don’t forecast it. Unemployment is forecast to rise only modestly to 4.0% from 3.9%. The expected plunge in inflation in August, to only 0.2% yoy on a headline basis and 0.8% yoy on a core basis, could be troublesome for the Bank of England.

Separately, China will announce its retail sales, industrial production and fixed-asset investment (FAI) on Tuesday. It’s almost back to normal. The market is expecting growth in industrial production to accelerate to 5.2% yoy, which is not that far off the average growth rate of 5.5% yoy for the second half of last year. Meanwhile retail sales are expected to finally return to the year-earlier level, as is FAI (almost). Signs that things are back to normal in China could be good for risk sentiment and help boost AUD and NZD.