Market Analysis Review

Japan’s core inflation rose to 2.10%, Canada’s inflation surprised with a jump to 2.80%, Drop in U.S. consumer confidence, Bitcoin recovers

Previous Trading Day’s Events (25.06.2024)

“No bones about it, this is not what the Bank of Canada wanted to see at this point, and clearly shaves the odds of a follow-up July rate cut,” said Douglas Porter, chief economist at BMO Capital Markets, adding that the next rate cut is likely to be in September.

“We suspect an abundance of caution will see the next move land in September, matching the timing of the first rate cut from the Federal Reserve,” said Karl Schamotta, chief market strategist at Corpay.

The drop in confidence was concentrated in the 35-54 age group. Confidence improved among consumers under 35 and those 55 years and older.

“The mild decrease in confidence isn’t consequential and we think there are sufficient tailwinds to keep consumers spending,” said Oren Klachkin, financial market economist at Nationwide. “The economy is on a glide path to normalised conditions.”

Source: https://www.reuters.com/markets/us/us-consumer-confidence-ebbs-slightly-june-2024-06-25/

______________________________________________________________________

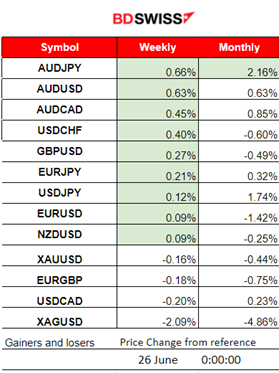

Winners vs Losers

AUD wins this week with all pairs reaching the top. AUDJPY thrives for the week and month with 0.66% and 2.16% gains respectively.

______________________________________________________________________

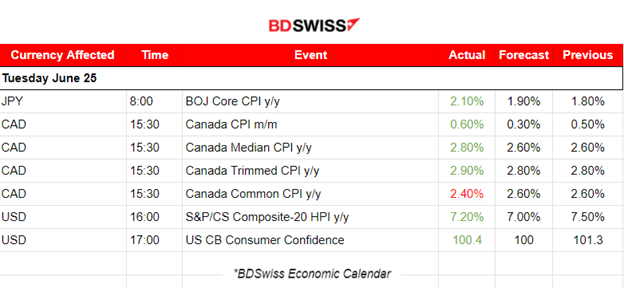

News Reports Monitor – Previous Trading Day (25.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

In Japan, the annual Core CPI figure was reported higher than expected, at 2.10%. At the time of the release at 8:00, the JPY strengthened only slightly. Earlier, at 3:30 though the JPY appreciated greatly at 3:45. The USDJPY dropped nearly 44 pips before retracement took place. That raises the possibility that it was a BOJ intervention to strengthen the JPY since it started to weaken greatly again after the last intervention.

- Morning – Day Session (European and N. American Session)

At 15:30, the inflation data for Canada were reported, shaking the markets. The monthly and yearly Inflation came higher than expected. The CAD pairs experienced an intraday shock with an initial CAD appreciation that soon reversed to depreciation. USDCAD dropped initially near 50 pips and reversed almost immediately back to the 30-period MA just only to continue its sideways path.

Consumer confidence in the U.S. dropped slightly in June but was reported higher than expected. The latest consumer confidence index dipped to a reading of 100.4 in June from 101.3 in May. The U.S. presidential election takes place in a few months and obviously, that plays a role. The USD pairs were not affected much by the report release.

General Verdict:

__________________________________________________________________

FOREX MARKETS MONITOR

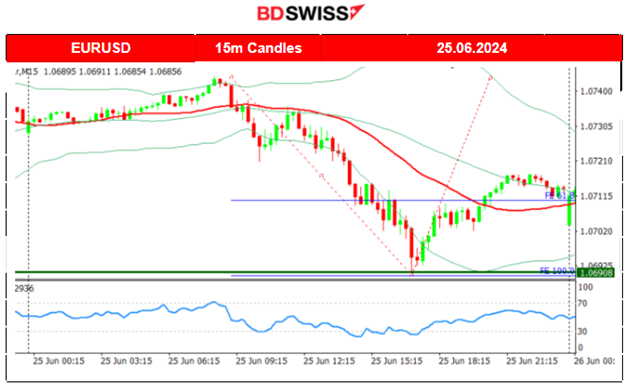

EURUSD (25.06.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair moved downwards steadily after the start of the European session and crossed the 30-period MA on its way down. The USD strengthening was the main driver of the drop that lasted until the pair found support near the 1.069. Retracement followed with EURUSD returning to the MA and continuing sideways until the end of the trading session.

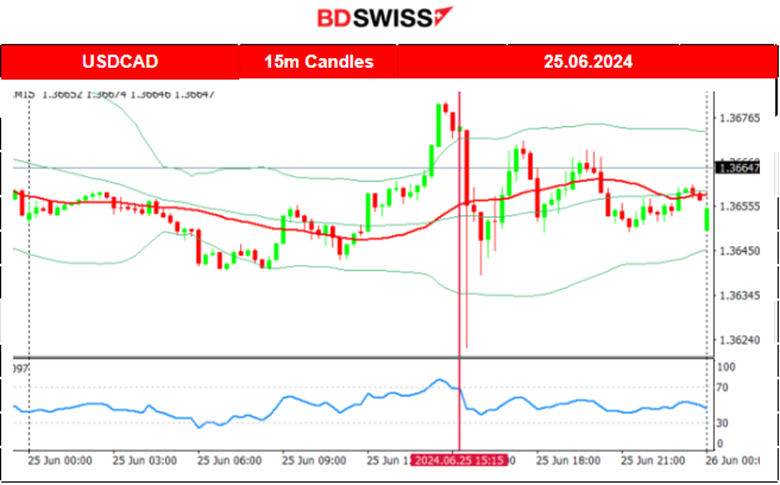

USDCAD (25.06.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was moving sideways and around the 30-period MA, until the start of the European session when volatility started to pick up. Before the important news regarding inflation in Canada, the pair moved to the upside rapidly, finding resistance at near 1.368. At the time of the inflation data releases the CAD appreciated initially causing the pair to drop heavily, crossing the MA on its way down. It reversed however almost immediately back to the MA, leaving a candle shadow behind. The pair continued with a sideways path around the MA with volatility levels getting lower and lower until the end of the trading day.

___________________________________________________________________

CRYPTO MARKETS MONITOR

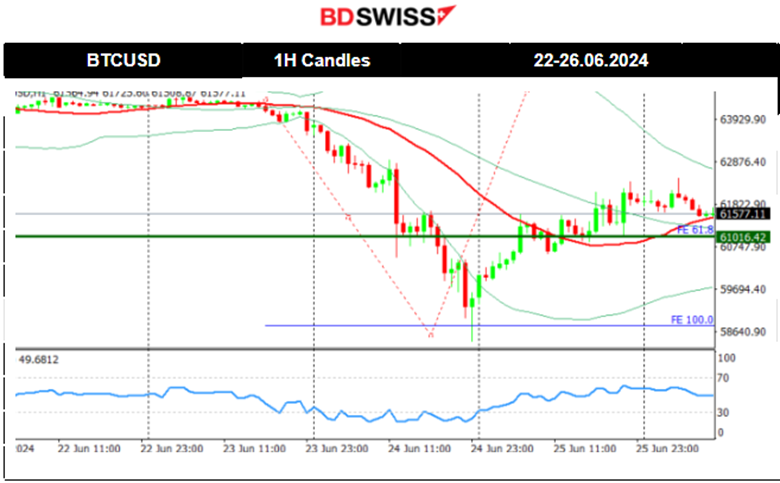

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 20th the price moved to the upside breaking the upper band of a triangle formation and stalled at 65,500 USD. That changed on the 21st when the price moved lower quite aggressively, reaching the support at 63,430 USD before retracing and settling to 64K USD. During the weekend, volatility lowered but yesterday, 24th of June, Monday, Bitcoin plunged to 58,400 before retracing to the 61.8 Fibo level and settling near the 30-period MA, very close to 61K USD for now.

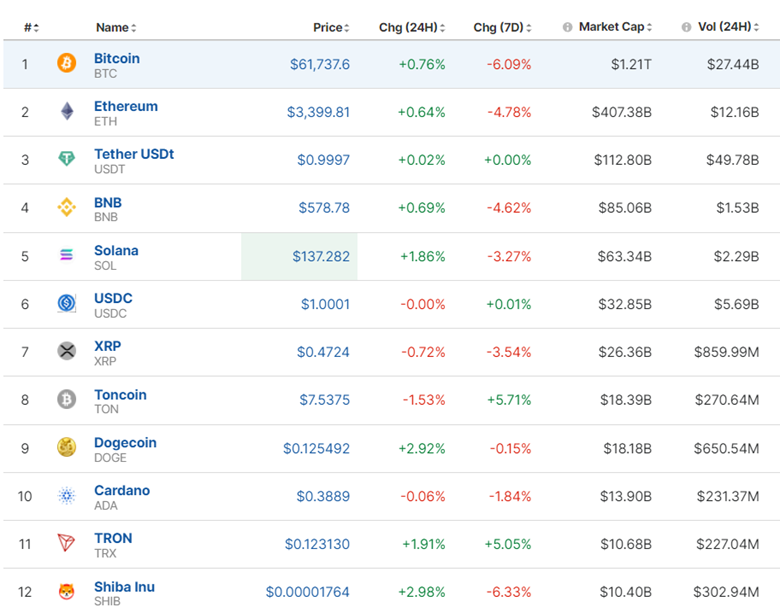

Crypto sorted by Highest Market Cap:

The Crypto Market is still suffering. Bitcoin keeps dropping and breaking important support levels. Volatility is currently high, with many Cryptos recovering significantly, correcting from the recent continuous drops in value.

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 20th, the wedge was broken to the downside and the index dropped rapidly to the support near 5,456 USD. Retracement followed. The 30-period MA confirmed a turning point to the downside and a downward trend formed. The price was following a downward wedge actually as it seems. Interest rates in the U.S. are expected to remain high and stocks see a drawdown while the rising price of oil increases costs further. As mentioned in our previous analysis, the RSI provided bullish signals and the index after unsuccessfully testing the support near 5,453 USD, eventually moved higher.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price eventually broke the 81 USD/b level on the 20th and it remains high. On the 21st the price experienced a drop after 18:00 by 1.30 USD/b but during the next couple of days, it reversed to the upside. The resistance area remains strong at 81.7 USd/b. It is clear from the chart that the 80 USD/b acts as a support now. Currently, despite the volatility, there is a sideways movement with high deviations from the mean. However, there was no breakout yet of the important support and resistance areas that were mentioned.

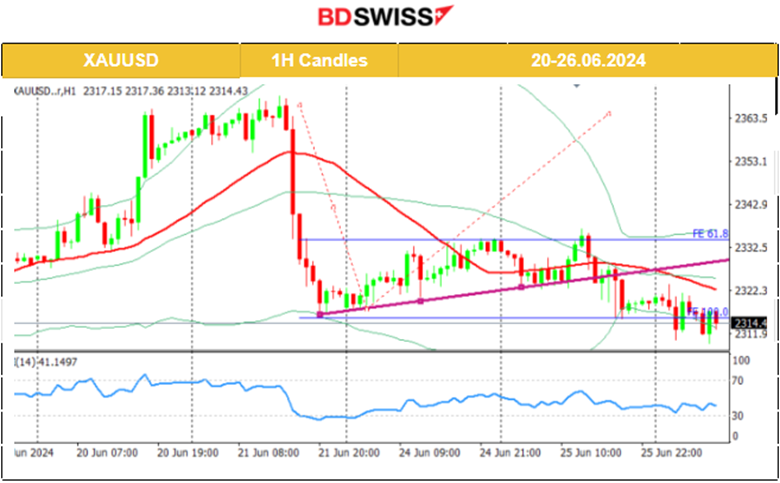

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The resistance broke on the 20th of June with Metals in general experiencing a rise in prices despite the dollar strengthening. The 2,350 USD/oz was reached as per our previous analysis with gold not losing momentum and reaching even higher at nearly 2,365 USD/oz on the 20th. A triangle formation was visible with the RSI showing bearish signals. That triangle was broken to the downside on the 21st a few minutes before the release of the U.S. PMIs. Gold dived nearly 50 USD before retracing to the 61.8 Fibo level and returning back to the 30-period MA. On the 25th, the price dropped after breaking a triangle formation and moved lower, remaining below the 30-period MA. Support remains strong and after several unsuccessful tests, we could see the price move upwards again.

______________________________________________________________

News Reports Monitor – Today Trading Day (26.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

In Australia, inflation was reported higher than expected. The monthly CPI indicator rose 4.0% in the 12 months to May, up from a 3.6% rise in the 12 months to April. The RBA has kept interest rates elevated but inflation refuses to cool down causing the AUD to appreciate. At the time of the release, the AUD jumped more than 30 pips and retracement has not taken place yet.

- Morning – Day Session (European and N. American Session)

The New Home Sales figure, the annualised number of new single-family homes that were sold during the previous month, is going to be released at 17:00. Economists mark this figure as important for the day since there is absence of other releases. It might be the case that the USD pairs will be affected much by the release. Home sales indicate an increase in consumption due to the fact that with new homes people have to buy other complementary assets as well such as furniture, or do decorations, renovations etc.

General Verdict:

______________________________________________________________