Market Analysis Review

The U.S. dollar weakened, Commodities moved higher, U.S. indices are stable at lower levels, Bitcoin suffers, JPY probably reached the peak of weakening, BOJ possible intervention

Previous Trading Day’s Events (24.06.2024)

______________________________________________________________________

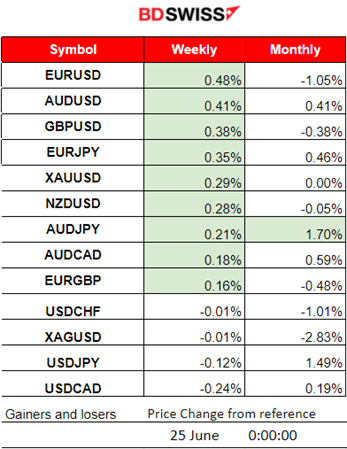

Winners vs Losers

EURUSD takes the lead this week as USD depreciated significantly, currently gaining 0.48%. The leader this month is AUDJPY with 1.70% gains as the AUD remains strong and the JPY weakened notably lately.

______________________________________________________________________

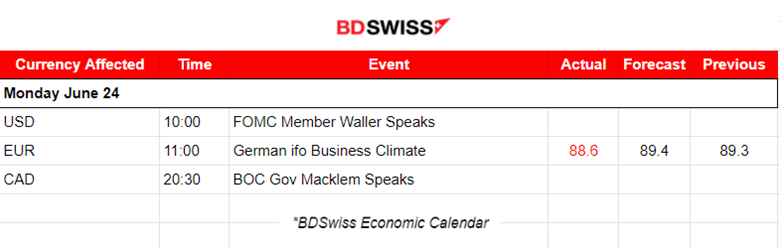

News Reports Monitor – Previous Trading Day (24.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements. No special scheduled figure releases.

- Morning – Day Session (European and N. American Session)

No important news announcements. No special scheduled figure releases.

General Verdict:

__________________________________________________________________

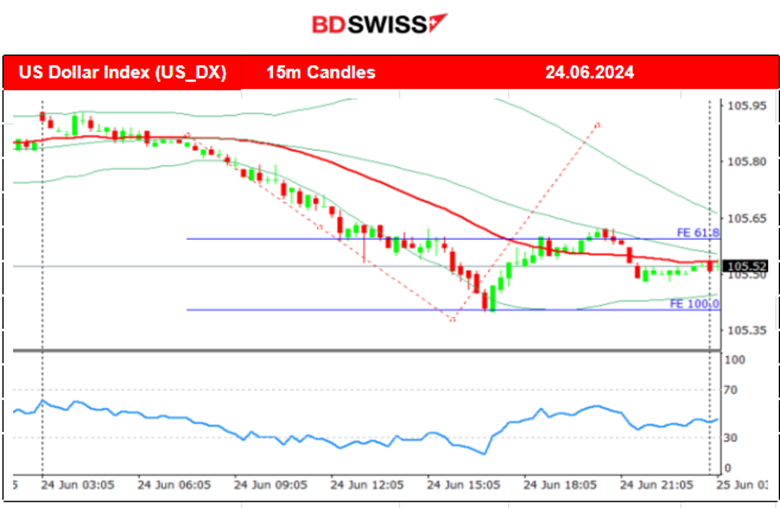

FOREX MARKETS MONITOR

EURUSD (24.06.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair started to move early to the upside yesterday but volatility increased dramatically after the start of the European session. The pair moved steadily upwards due to USD steady depreciation during that period. It found resistance near 1.07450 before it eventually retraced to the 30-period MA and moved sideways until the end of the trading session.

___________________________________________________________________

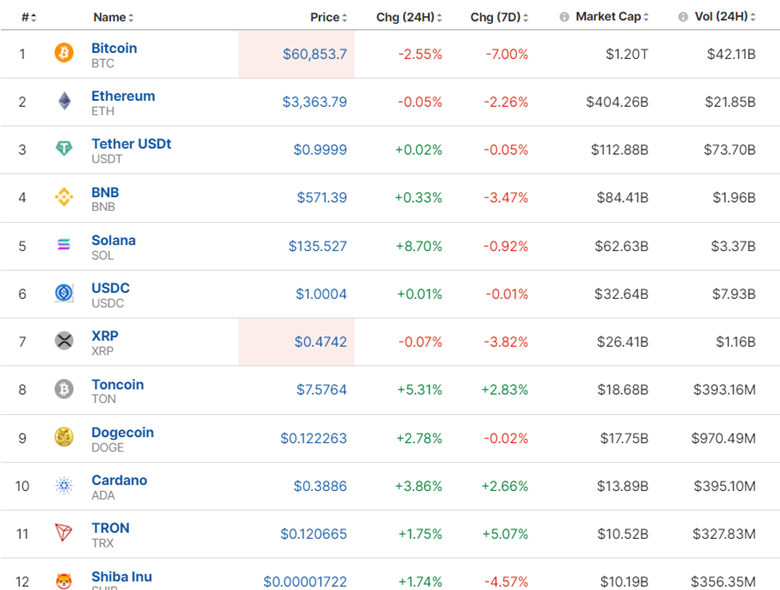

CRYPTO MARKETS MONITOR

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 20th the price moved to the upside breaking the upper band of a triangle formation and stalled at 65,500 USD. That changed on the 21st when the price moved lower quite aggressively, reaching the support at 63,430 USD before retracing and settling to 64K USD. During the weekend, volatility lowered but yesterday, 24th of June, Monday, Bitcoin plunged to 58,400 before retracing to the 61.8 Fibo level and settling near the 30-period MA near the level of 61K USD for now.

Crypto sorted by Highest Market Cap:

The Crypto Market is still suffering. Bitcoin keeps dropping and breaking important support levels. Volatility is currently high, with many Cryptos recovering significantly today, which is why we have seen gains over the past 24 hours. Overall, however, it is a huge drop in Crypto value. Tron seems to be doing well despite this, with nearly 5% gains in the last 7 days.

https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 20th, the wedge was broken to the downside and the index dropped rapidly to the support near 5,456 USD. Retracement followed. The 30-period MA confirmed a turning point to the downside and a downward trend formed. It seems that the price is on a downward wedge for now. Interest rates in the U.S. are expected to remain high and stocks see a drawdown while the rising price of oil increases costs further. Even though the RSI shows bullish signals, a sideways movement is expected this week, considering that the support areas remain strong.

______________________________________________________________________

COMMODITIES MARKETS MONITOR

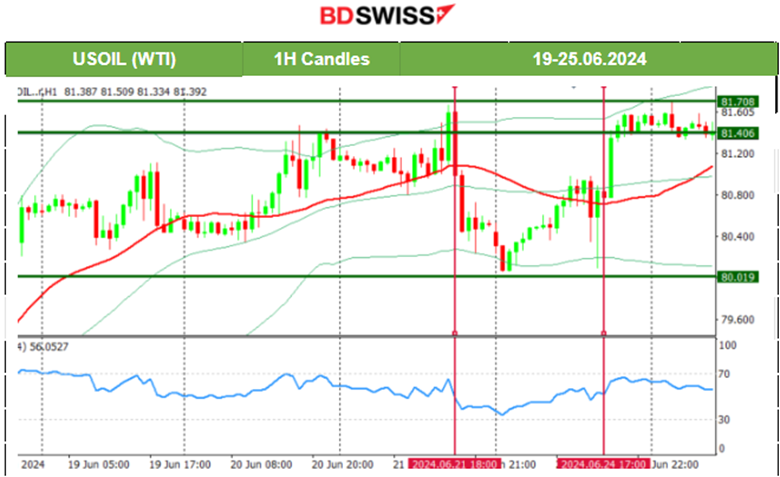

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The price eventually broke the 81 USD/b level on the 20th and it remains high. On the 21st the price experienced a drop after 18:00 by 1.30 USD/b but during the next couple of days, it reversed to the upside. Will the resistance hold today? The resistance area remains strong at 81.7 USd/b. It might test it today and the breakout could lead to 83 USD/b. It is clear from the chart that the 80 USD/b acts as a support now. During the Canada inflation data releases at 15:30, the price of Crude oil could see some volatility potentially causing support/resistance level breakouts.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The resistance broke on the 20th of June with Metals in general experiencing a rise in prices despite the dollar strengthening. The 2,350 USD/oz was reached as per our previous analysis with gold not losing momentum and reaching even higher at nearly 2,365 USD/oz on the 20th. A triangle formation was visible with the RSI showing bearish signals. That triangle was broken to the downside on the 21st a few minutes before the release of the U.S. PMIs. Gold dived nearly 50 USD before retracing to the 61.8 Fibo level and returning back to the 30-period MA.

______________________________________________________________

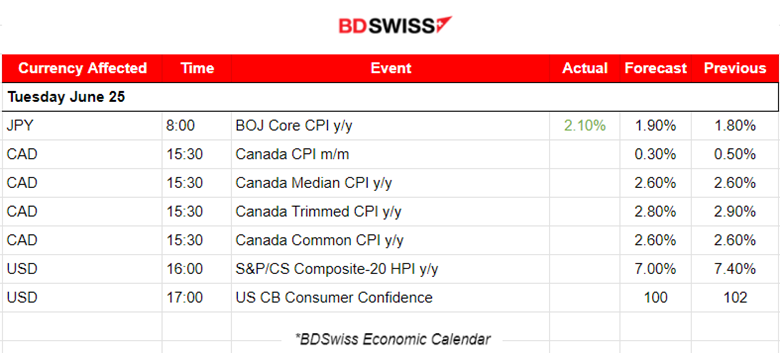

News Reports Monitor – Today Trading Day (25.06.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

In Japan, the annual Core CPI figure was reported higher than expected, at 2.10%. At the time of the release at 8:00, the JPY strengthened only slightly. Earlier, at 3:30 though the JPY appreciated greatly at 3:45. The USDJPY dropped nearly 44 pips before retracement took place. That raises the possibility that it was a BOJ intervention to strengthen the JPY since it started to weaken greatly again after the last intervention.

- Morning – Day Session (European and N. American Session)

Important figures to be released at 15:30, the inflation data for Canada. The report is expected to shake the markets since the economic price data following the first interest rate cut from the BOC. Interesting the fact that analysts expect a lower monthly inflation figure since interest rates are still too high and that view would be considered optimistic actually. CAD pairs though are going to be affected by an intraday shock probably regardless of the outcome generating trading opportunities.

Consumer confidence is quite important lately since inflation is not lowering for the U.S. and delays in cuts are in place. It is expected that the figure will be reported lower. Confidence rose last time after three straight declines but consumers seem to worry about the future. USD pairs could see more volatility after the release.

General Verdict:

______________________________________________________________