Market Analysis Review

Daily Market Report: Expert Technical & Fundamental Insights – 04.11.2024

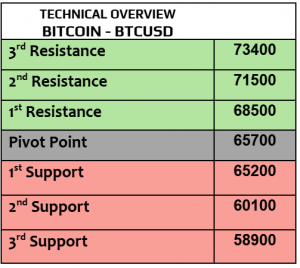

EURUSD

EURUSD resumed the trading on Monday after USD index fell by -0.60%, EURUSD gained & traded at $1.0900, the highest in two weeks. The annual inflation in EZ increased by 2% in October, higher than September of 1.7%, however it is unlikely to change ECB forward guidance. In the meantime, EURUSD is still up by 0.75% on weekly basis, waiting for a big week ahead with US Presidential election on Tuesday. Manufacturing PMI numbers from Germany, EZ, Spain & France will be due later today, not to forget the investor confidence index as well.

Price action kept advancing, heading higher to $1.0950 then $1.10 (pivot). Daily chart gives stronger momentum than the hourly one for further advance. Daily RSI is at 34 (support).

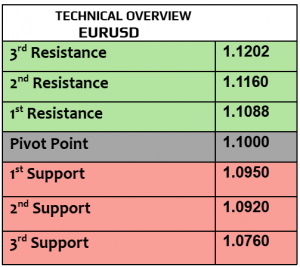

USDJPY

As USD index remained under pressure one day before the US presidential election, USDJPY fell to 151.86 today, losing almost -1% in a week. While the markets are still expecting that BoJ could raise the rates to 0.5%, however the market’s participants are likely to remain highly focused on the US election outcome, not much focusing on the fundamentals.

1H trend index remains bearish but beware of the change in markets’ sentiments. Keep in mind the following levels, 151.60 & 151.10 (support), 152.70 & 153 (resistance) . This currency pair is still in positive technical channel. Daily chart supports further USD weakness.

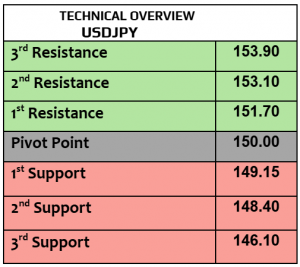

GBPUSD

How was the weekly performance in GBPUSD? Even if this currency pair gained in the last week, these gains were less than the gains of EUR & Yen vs USD, GBPUSD traded higher today at $1.2986. After the US presidential election on Tuesday, the focus will start shifting to BoE’s next week rate decision, is BoE going to reduce the rates? No major economic data from the UK for today.

Important support at $1.2940, if broken then the next one will be $1.2880. Daily chart is targeting $1.3050, which is doable considering the velocity of the price action.

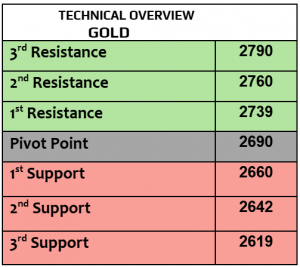

Gold

Gold remained little changed on weekly basis, traded higher today at $2742 per ounce. This week is going to be one of the most important weeks for many months ahead with the US presidential election (Tuesday) and Fed rate decision (Thursday). Reducing the rates by the Fed by 0.25% (if happens) was already priced in, however the outcome of the US presidential election matters more for now. Trump’s proposed policies are likely to make USD weaker.

There was profit taking in the last two sessions, but the trend index is bullish again, heading higher to $2755. $2733 is short-term support.

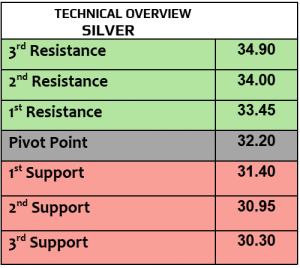

Silver

Silver traded higher today at $32.63 per ounce after falling by more than -3% in a week, but why did the loss happen? it was a mix of profit-taking, doubts about China’s expected stimulus measures & mixed global manufacturing PMI. Rate decision by the Fed on Thursday and China’s ruling party meeting between 4 – 8 November are silver’s biggest catalysts.

Mixed sentiments prevailed. $32.30 is support, with weaker volatility in 1H chart. In the meantime, price action is bullish, heading higher to $33.

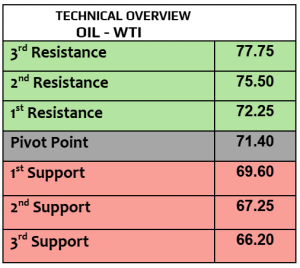

Oil – WTI

Two consecutive weeks of gains in oil prices, WTI traded higher again today at $70.72PB, Brent advanced as well to $74.36PB. OPEC+ decided to delay December plans for production increase by one month, the second delay, however the reality is that such a decision reflected the fragile demand outlook, that’s why the gains could be short-lived. Crude oil prices increased by almost 5% in a week.

The good thing is that WTI kept advancing, trying to break the pivot to higher level. $71.60 is the next target (probable). $70.30 is support. Momentum indicator is positive now at 1.2 and may support further advance but slow one.

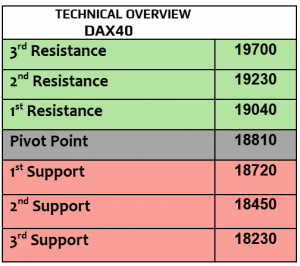

DAX

DAX futures slightly increased today, traded higher at 19276 after falling by more than -1.3% in a week. DAX gained on Friday by almost 0.9%, supported by 1.7% in Siemens, 2% BASF & 3% in Puma. Germany manufacturing PMI numbers & German Buba President speech will be due later today.

1H price action is heading higher strongly, targeting 19370 after the second major resistance was executed. Daily chart supports further advance.

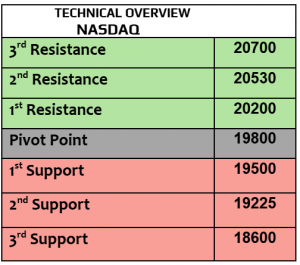

Nasdaq

US stock indexes fell last week, Dow Jones -1%, SPX -1.4% and Nasdaq by -1.1%. What happened in the last few days was mainly due to US nonfarm payrolls on Friday that increased by only 12K, strongly weaker than before, and the preparations for the US presidential election on Tuesday which will be crucial for the US economy & equities as both candidates Trump & Harris have different economic views & plans. More earnings from the US corporates are due this week, and US factory orders in September will be released later today.

Price action is heading higher & targeting again 20600. 19900 & 19200 are support levels. Technical diagram is still heading higher.

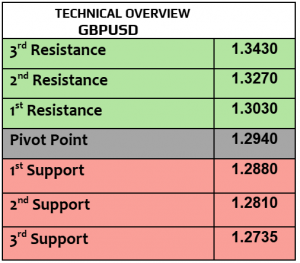

BTCUSD

Bitcoin fell by only -1.1% in week, traded slightly higher today at $69081 & waiting for big Tuesday, is Trump going to be the winner? If yes, then BTC is likely to gain another momentum as Trump announced his full support to crypto & digital assets. Eth was up today by 0.70% and Solana was little changed $162.35 after losing by almost -10% in week.

1H RSI is heading higher, supported by bullish index 15M. $69770 is the next target, $68200 is support. Higher volatility ahead and may become aggressive.