Market Analysis Review

Daily Market Report: Expert Technical & Fundamental Insights – 06.11.2024

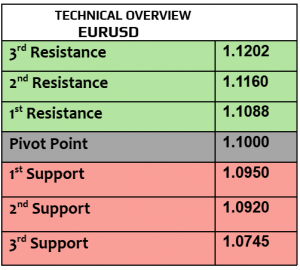

EURUSD

Strong volatility gained momentum today before the final results of the US presidential elections where EURUSD fell sharply by more than -1.3% to $1.0788, the lowest in two weeks. The drop in EURUSD was mainly due to USD index strength that gained by more than 1.2%, traded at 104.65 the highest since last July after the first numbers showed that Trump took the lead over Harris. PMI numbers in services from EZ, Germany, Spain, Italy & France will be due later today.

Last major support was executed. After being oversold, the speculators jumped in again & started buying, targeting $1.0825 then $1.0840.

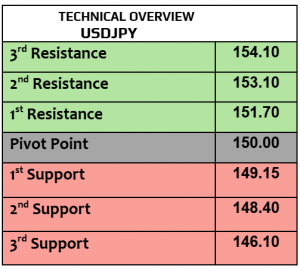

USDJPY

Rally in USD index continued this morning, USDJPY rallied by more than 1.3% to 153.50, the highest in four months after the US bond yields increased above 4.4% on 10Y bonds. While it is still early to judge the final results of the US election, if the US bond yields remain elevated then USDJPY could maintain the gains. Japan’s household spending will be due later today.

After hitting an overbought level, correction started from 154, targeting 152.90 then 152.20. Momentum remained bullish but price action may support such a correction.

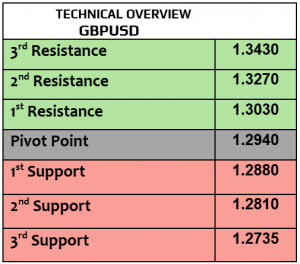

GBPUSD

Following the same markets’ sentiments this morning, GBPUSD fell by almost -1% to $1.2917 as USD index maintained its bullish bets. Traders are likely to start shifting the attention later today from America to BoE rate decision on Thursday, where it is likely to cut the rates by 0.25%. Keep an eye on the USD performance as the UK calendar has no major releases for today.

Unlike other advanced currency pairs, GBPUSD didn’t break any major technical levels. Correction started from an oversold level, heading higher to $1.2960 then $1.2995.

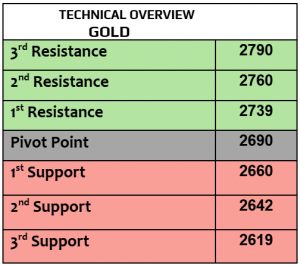

Gold

Gold was one of the few assets that remained somehow stable this morning, trading at $2740 per ounce, has not fallen strongly like other commodities such as silver & crude oil, even if USD index was & still strong today. The markets realized that it is still early to talk about any major change in the US economic policies while the Fed is likely to cut the rates by 0.25% in the next meeting on Thursday.

There was profit taking in the last few sessions, daily trend index is bullish again, heading higher to $2755 . $2733 is short-term support (executed) then $2720.

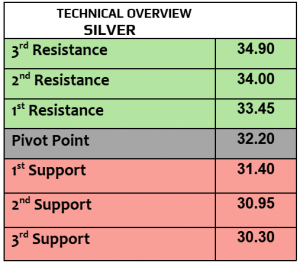

Silver

Will China’s trade balance save silver from today’s loss by more than -1.6%? Silver fell & traded lower at $32.18 per ounce today, the lowest in two weeks after the risk appetite gained momentum. It will be better for the traders to avoid the markets’ buzz & focus on the fundamentals, mainly from China as the US elections’ euphoria could be short-lived.

While price action is still supporting further weakness to $31.50, rebound may happen due to traders’ repetitive behavior & targeting $32.90. Volatility is likely to remain strong for the rest of the day.

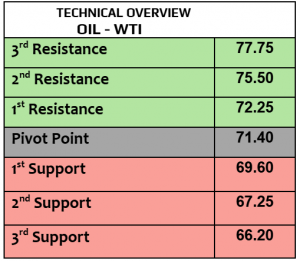

Oil – WTI

Crude oil prices fell today by more than -1.4%, WTI $70.94PB, Brent $74.40PB, after the US crude oil inventories increased by more than 3.1 million barrels last week according to API. It is important to say that Trump (if he wins) may support the oil industry in America, but that means more oil production which could send the prices even lower (if happens). EIA will release the weekly crude inventories later today.

Momentum remained negative, supporting further drop to $70.40 then $69.40 . $72.60 is resistance.

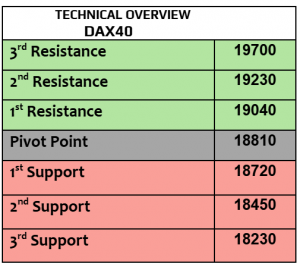

DAX

After closing higher by 0.7% on Tuesday, DAX futures traded weaker today & fell by -0.70% as the traders kept closely watching the US presidential elections voting & early results. EZ in general may not fully support the economic policies of Trump if Trump becomes the next US president, that’s why the markets don’t like the uncertainty. EZ PMI in services & PPI will be due later today.

19000 is an important support, if broken then 18700. Price action is still somehow bullish now (1H chart), still heading higher to 19320.

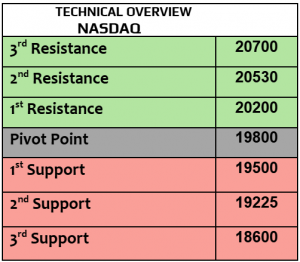

Nasdaq

Who is going to be the markets’ favorite president? US stock futures traded strongly higher today after closing higher again on Tuesday, Dow Jones 1%, SPX 1.2% and Nasdaq increased by 1.4%. According to the first results this morning, Trump took the lead, however it is still early to know the winner. The calendar from the US has only one event for today, US presidential election. What matters now is which party will take the majority in the US congress; divided congress may have negative impact on the markets’ sentiments.

1H RSI is overbought now; however, price action is very bullish. Beware of the correction to 20200 due to traders’ behavior.

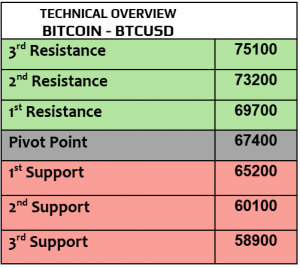

BTCUSD

Bitcoin’s traders & supporters started celebrating Trump’s victory even before the final results as BTCUSD rallied by more than 7.5% this morning & traded at a new record-high $75K after the first results from America showed that Trump took the lead over Harris. Other major cryptocurrencies followed, ETH 6.7%, Cardano 7.5% and Solana 11%. Volatility is likely to remain aggressive, while the traders must manage the risk exposure as the final results of the US elections have not yet disclosed.

Markets’ rally continues even if the indicator is overbought. Traders’ sentiments don’t support the correction now.